Be Aware: Fraudsters Are Opening LLCs to Commit Check Fraud

- Fraudsters have graduated beyond mere check washing

- An LLC "business" can be inexpensively opened and used for fraud

- Transactional analytics and image forensic AI systems are crucial to meet this challenge

We all are aware of check washing/alterations and how effective this method is for stealing funds. However, the success rate is not guaranteed, particularly when it comes to business checks. More and more businesses are adopting payee positive pay solutions to fight back against fraudsters, making it more difficult for them to be successful. Fraudsters changing the payee to either their name or a false identity, or adding a name at the end of the payee, are being flagged at higher rates as the system will compare the payee name with the issuer file.

However, fraudsters are highly adaptive and have already found a way around this technology.

Opening Up Legitimate Businesses

Dr. David Maimon notes in a LinkedIn Post that fraudsters are now opening up LLCs to commit fraud.

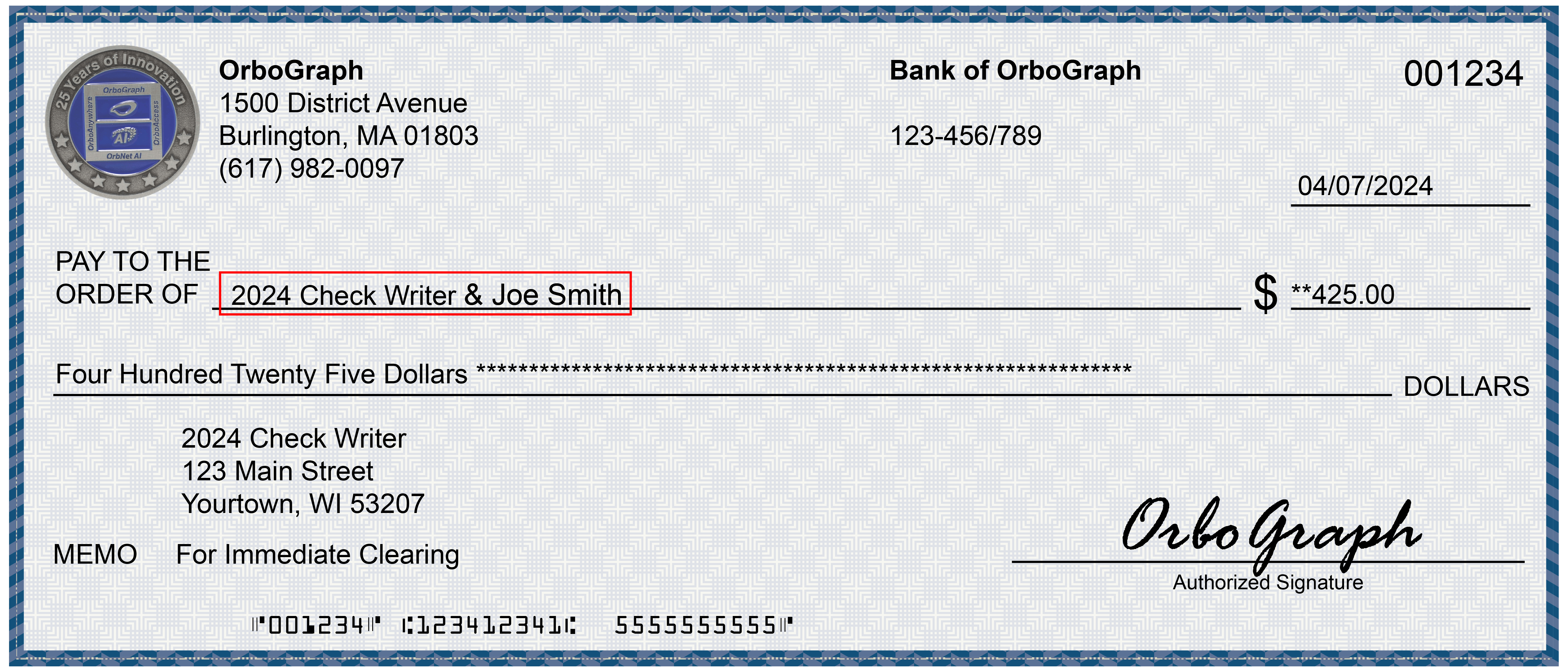

Fraudsters are aware that states like Montana allow an LLC to open with just a small fee ($35). Here is how the scheme works:

- Fraudster acquire stolen business check

- Fraudster opens an LLC in a state like Montana, choosing a name similar or even identical to the payee name

- Fraudster opens a business banking account under the newly established company name

- Fraudster deposits check into the banking account

This method allows the fraudster to circumvent the payee positive pay system, as the payee now appears to the be the same as the deposited account. In fact, the business and FI will most likely not be aware that the intended receiver has not received the check until the receiver reaches out to the business. The investigations require additional time as well -- months in some cases. This will allow the fraudsters plenty of time to deposit the check and make off with the cash.

To detect this fraud, FIs need to deploy specific analyses like "new account" and "state-of-deposit" that are included in transactional analytics and image forensic AI systems. Both analyzers provides a risk score that can identify if the check has been false deposited -- adding protection against this new fraud scheme.