Business Switching to Alternative Payment Methods are NOT the Answer to Check Fraud

- Businesses present a big target for check fraudsters

- Some assume alternative payment methods may be the answer

- Checks are too widely used for alternative methods to take hold

Fraudsters do not discriminate when it comes to who they victimize -- individuals, business, and even the US Treasury are targets. Unfortunately, victims typically have the mentality that "it could never happen to me," or "I am too smart to fall for it" -- leading to lackadaisical attitudes that open them up even more to fraud.

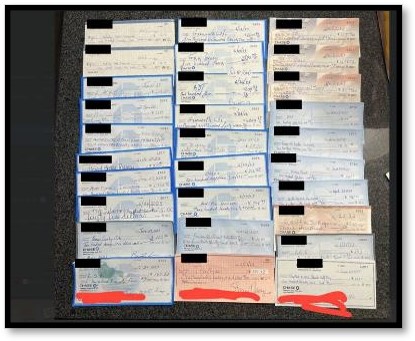

Businesses become an even greater target, as their checking accounts typically hold more funds than individuals. The evidence is proven by dark web research, where business checks are sold for higher prices than personal checks.

While fintechs like OrboGraph are equipping banks with technologies like payee positive pay and image forensic AI to help banks and small business detect check fraud, small businesses need to take the threat seriously -- being proactive vs. reactive. Small businesses like contractors, landlords, and professional service providers receive up to 25% of their revenue via check, making them prime targets.

Small Business Victims of Check Fraud

In a recent article from Forbes.com, author Rieva Lesonsky details a few examples of small businesses that fell victim to check fraud:

RenewalMD's chief operating officer Scott Regan recounts how his company's accounts payable process was in disarray, which lead to fraudsters from another state acquiring their routing and account numbers to create counterfeits. Mr. Regan notes: "Anybody can fake a check; it’s really easy.”

The article also covers the experience of Sunscape Eyewear, where checks never made it to their destinations.

Adam Rizza, the president of Sunscape Eyewear, a manufacturer and distributor of eyewear in Irvine, California, says that after paying vendors, sometimes “checks go missing, and suddenly someone recreates our checks and deposits them. Some of our vendors have had our checks stolen from their mailboxes. Those were duplicated and deposited into several different bank branches on the same day. It’s a hassle and takes time to call the bank to get it straightened out.”

Reducing Check Fraud Through Alternative Payments? Think Again.

The article reveals their solution to check fraud: using alternative payment methods.

Since check fraud is pervasive, small businesses must prioritize convenience, security, and efficiency by offering alternative payment and collection solutions to paper checks. Digital transactions provide faster processing, reduce the risk of fraud, and enhance customer satisfaction.

So, is it really that easy? The answer is a resounding NO.

As noted by the recent 2024 AFP® Payments Fraud and Control Survey Report, 70% of organizations have no immediate plans to discontinue their use of checks in the next two years. Additionally, PYMNTS.com reports that 75% of Companies Still Use Paper Checks Despite High Cost.

Alternative payment methods have their own drawbacks -- from the high processing fees of credit cards to unrecoverable funds and quick access to funds from wire transfers.

Banks need to continue investingt in check fraud detection technologies to protect their customers, while also providing them with educational materials to help them remain vigilant. Remember -- banks and their customers need to do their parts to protect themselves from fraud.