Mobile Banking

Last month at the RDC Forum: Atlanta, an event hosted by RemoteDepositCapture.com, a new unified platform for processing check and ACH transactions was discussed by a Fed spokesman. It’s expected to make its debut at the central bank later this year. The changes are a modernization of the Fed’s own internal systems, and appears to hold…

Read MoreRecently we looked at whether or not the bank teller and associated “human touch” was disappearing from the banking experience (Verdict: happily, bank tellers are not yet “endangered species.”) In this interesting take from India, the writer, a sociologist, wonders whether the very same tech that makes transactions quick and easy – – mobile apps,…

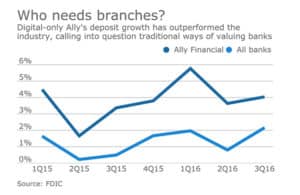

Read MoreAmerican Banker provides their view toward futuristic ideas with 10 Big Ideas for Banking in 2017. It’s a combo of both cool and crazy concepts; each of the 10 predictions/ideas link to a more comprehensive look at the topic in question (also in a fun slideshow format). “Redefine a bank’s worth for the digital age,” for example, links…

Read MoreWithin the first months of 2017, there will be a number of important market studies released related to check volumes via FED research, fraud losses (ABA Deposit Account paper), and retail banking (BAI). As OrboGraph looks to the future in check payment innovation, we believe the following trends will feed market innovations. Check volume declines…

Read MoreAndrew Davies, Vice President of Global Market Strategy, Financial Crime Risk Management at Fiserv, makes several great points about how quicker transactions – and the customer expectations attached to that speed – can be dangerous in terms of exposing fraud and theft opportunities. (Read it HERE.) Mr. Davies describes a “perfect storm of factors,” broadly consisting of: Greater demands…

Read MoreBAI.org offers valuable insight into consumers’ adoption of digital interaction with their financial institutions via a document entitled “Digital Banking and Analytics: Enhancing Customer Experience and Efficiency.” The downloadable PDF provides great information about current and future use of digital interactive technology among bank customers, as well as a cogent overview of future expectations that the industry…

Read MoreNew technologies by the FINTECH community continue to grab the spotlight in the market. FINTECH is pushing hard on digital payment varieties and all kinds of scenarios to make P2P, B2B, and P2B via mobile devices and new card/chips options, taking volume from the branches. Banks are looking for ways to better serve millennials, too.…

Read MoreRecipients of the 2016 FinTech Forward awards discuss how evolving technology will reshape banking in the next five years. Some of the key takeaways: Data, data, data. Huge value in data analytics for those who efficiently gather it. It will be crucial to respond to the shift occurring in the next five years toward “banking where and…

Read MoreWe’re excited to see that, of the Top 5 Tech Innovations Your Bank Can’t Ignored, we can actually contribute significantly to three of them! Let’s call them the “Key 3”: Continue to embrace Check 21 Leverage electronic workflows Automated tellers Part of the shared theme of the Key 3 is that the branch bank is far from obsolete. Online…

Read MoreThe same report that finds 57% of organizations intend to use same-day ACH for last-minute payments also finds that business-to-business payments by paper check actually increased slightly from 2013, breaking the previous downward trend in check use. In fact, 86 percent have finally integrated their check payments systems with their accounting systems. There are still major…

Read More