OrboNation Blog

Enhanced scalability and targeted use cases add incremental justification to industry modernization efforts Billerica, MA, May 2, 2018 – OrboGraph, a premier developer and supplier of intelligent electronic/paper automation solutions in healthcare revenue cycle management (RCM), as well as recognition solutions, image validation and check fraud detection for the U.S. check processing market, announces the…

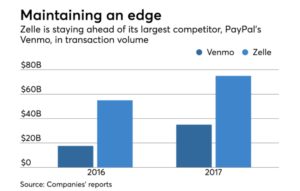

Read MoreThere is a trend in the wind, according to AmericanBanker.com: Over the past few days, midsize banks — such as Comerica, Commerce Bancshares and M&T Bank — have reported notable declines in total deposits, with M&T, in particular, reporting a 6% drop from a year earlier. Executives have offered a number of reasons why, saying…

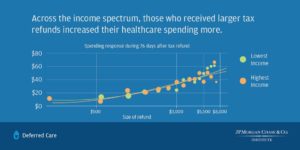

Read MoreA report from JP Morgan Chase Institute (JPMorgan is part of a new healthcare venture announced with Amazon and Berkshire Hathaway) notes that many Americans wait for their tax refund to make payments against medical bills. The report looked at 1.2 million American households in different income and demographic groups that received tax refunds in 2016,…

Read MoreOn April 12 & 17, 2018, OrboGraph’s own Joe Gregory, VP of Marketing, gave a 20-minute, “sneak preview” of the 2018 Healthcare and Check Payment Technology Conference. Topics included: The OrboGraph Experience Reasons why we selected Nashville and a quick view of the Union Station Hotel Introduction to our all-star line up of speakers Detailed…

Read MoreThe 2018 AFP Payments Fraud Survey, underwritten by J.P. Morgan, has some alarming fraud news for corporate clients and the treasury departments of financial institutions. Overall payments fraud reached a new peak in 2017, after experiencing a downswing earlier in the decade. A record 78% of all organizations were hit by payments fraud last year,…

Read MoreRepresented companies include: The Clearing House, Change Healthcare, IBM, CAQH and Deluxe Billerica, MA, April 16, 2018 – OrboGraph, a premier developer and supplier of intelligent electronic/paper automation solutions in healthcare revenue cycle management (RCM), as well as recognition solutions, image validation and check fraud detection for the U.S. check processing market, announces a star-studded…

Read MoreA newly released report reveals that cloud computing advances are a driving force for large enterprises — including, of course, those in the health care and retail banking segments — to modernize their application platforms in spite of large investments they may have made previously in legacy systems. Large enterprises have dedicated in-house IT resources,…

Read MoreRemoteDepositCapture.com creates one featured poll question per month on RDC-related topics. If you’re at all interested in check processing [who wouldn’t be, right?], then we invite you to visit their site and register your input. While you’re there, it’s well worth signing up for their newsletter so you can get poll results regularly. This month’s featured…

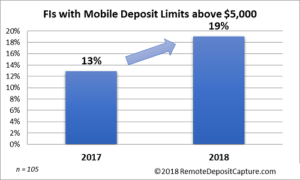

Read MoreA RemoteDepositCapture.com poll reveals that the limits banks and credit unions place on the size of consumer checks eligible for depositing via mobile RDC are rising steadily. In fact, the past year has seen the number of financial institutions with standard per-item deposit limits above $5,000 for consumer mobile deposit customers growing by nearly 50%, according to the…

Read MoreOn July 1st, 2018, Amendments to Federal Reserve Regulation CC take effect. Many financial institutions are taking a passive approach to these very important changes. Others are serious about making changes to their deposit agreements and are changing workflows to modernize their risk and fraud practices. What’s your position on these changes? The amendment creates…

Read More