RDC & Mobile

Small banks are at a crossroads: adopt new technologies or face the possibility of shutting the doors. According to Americanbanker.com: For community banks in highly competitive markets, service with a personal touch can be a differentiator to win and keep customers. But when legacy technology hampers the customer experience, all the cups of coffee in…

Read MoreLet’s be frank: paper checks present a challenge to anyone in the accounts payable space. But let’s be equally realistic: checks continue to make up about half of the supplier payments volume. B2B payments disruptors now have a choice when designing and deploying technology: Will they use that tech to make paper checks less friction-filled, or entice…

Read MoreThere is a trend in the wind, according to AmericanBanker.com: Over the past few days, midsize banks — such as Comerica, Commerce Bancshares and M&T Bank — have reported notable declines in total deposits, with M&T, in particular, reporting a 6% drop from a year earlier. Executives have offered a number of reasons why, saying…

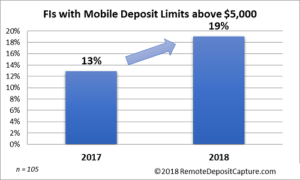

Read MoreA RemoteDepositCapture.com poll reveals that the limits banks and credit unions place on the size of consumer checks eligible for depositing via mobile RDC are rising steadily. In fact, the past year has seen the number of financial institutions with standard per-item deposit limits above $5,000 for consumer mobile deposit customers growing by nearly 50%, according to the…

Read MoreOn July 1st, 2018, Amendments to Federal Reserve Regulation CC take effect. Many financial institutions are taking a passive approach to these very important changes. Others are serious about making changes to their deposit agreements and are changing workflows to modernize their risk and fraud practices. What’s your position on these changes? The amendment creates…

Read MoreIs your financial institution ready for payment innovation? The Innovation Readiness Playbook from PYMNTS.COM surveyed US financial institutions and created a gem for strategic and tactical considerations. Like many surveys, you can take a positive or negative spin on the data and critique the questions. For example: Is this a wake-up call to mid-sized financial institutions that…

Read MoreThe “death” of the check is still way behind schedule, according to many organizations that predicted the end of paper checks many years ago. We keep reporting that checks are still popular when they were supposed to have been dwindling years ago. (That’s the boring part of the post) The latest installment in PYMNTS’ Kill…

Read MoreTHE TECHNOLOGY HEADLINES features an article examining OrboGraph’s utilization of AI technologies and the effect it’s had the check and healthcare lines of the business. With OrboGraph’s main focus on automating payments, the company looks at AI as a means to improve efficiencies into the entire payment mix and to facilitate electronification of payments, which ultimately…

Read MoreCornerstone Advisors recently released their 2017 Cornerstone Performance Report for Banks. On the heels of this report, Gonzo Banker website offers their insight into how banks’ operational performance has changed over the past 10 years based on the information contained in the report. There’s a long list of metrics that have changed dramatically, but they narrowed it to 10…

Read MoreA new year means new opportunities, and Aite Group’s Top 10 Trends Report tells us to be ready for changes in 2018! It looks to be an amazing year of challenges for retail banking payments as well as wholesale banking. Note: Both sites also feature a link to their Top 10 Trends in Financial Services, 2018 summary…

Read More