RDC & Mobile

OrboAnywhere offers banks straight-through processing automation as well as risk/fraud prevention Billerica, MA, December 11, 2017 – OrboGraph, a premier developer and supplier of intelligent electronic/paper automation leveraging recognition technologies, image validation and check fraud detection for the U.S. check processing and healthcare revenue cycle markets, was recently featured in the November edition of CIO Applications…

Read MoreFintechs and banks have been at odds with one another over customer information since the first moment that someone somewhere decided “fintech” was an actual word. American Banker reports that the icy relationship may be thawing. Fintechs have been arguing that they need to access bank customer account data to provide a variety of services,…

Read MoreThe adoption of online banking, now incorporating mobile, has become a staple for the industry over the past couple of years. However, the online experience can vary greatly based on what features are offered from each financial institution. One area which has not received its share of improvements are value-added features for check-type payments. The…

Read MoreHere’s a terrific podcast interview via BAI Banking Strategies that you should listen to during your commute. In it, Andres Wolberg-Stok, Citi FinTech’s global head of policy, talks about best practices and approaches to incorporating financial tech – FinTech – in financial organizations. An important point Wolberg-Stok makes early in the conversation is the fact that,…

Read MoreWe’ve heard stories of card skimmers at outdoor ATM machines and even gas pumps ripping off consumers’ card information, but, admit it – – you always trusted card machines that are inside of retail establishments just a bit more, right? Watch this clip and marvel at the fact that this caper is pulled off in…

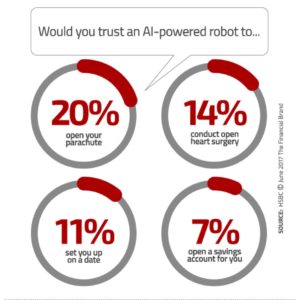

Read MoreArtificial Intelligence, chatbots and robo-advisors are coming. Here’s an interesting example of how perceptions can yield crazy statistical results. A “Trust in Technology” report published by HSBC found that consumers are leery of allowing chatbots and robo-advisors to help them open a savings account or provide mortgage advice – – but they would trust them more for heart surgery! In an article…

Read MorePymnts.com reports that electronic payments are rising, according to a Viewpost study. Small and large businesses are recognizing the advantages of electronic payments. But, for all the rah-rah about electronic payments seeping into the consciousness of American businesses, there are no victory dances quite yet: Every single one of the business owners surveyed by Viewpost…

Read MoreAJC.com recently reported the story of a group of fraudsters who used Instagram ads to solicit bank information for unsuspecting victims, who were robbed of substantial funds before the crime was discovered. During a scheme lasting at least 17 months, the FBI said, the trio posted advertisements on Instagram and other social media sites offering “fast…

Read MoreBillerica, MA, June 7, 2017 – OrboGraph, a premier developer and supplier of intelligent electronic/paper automation solutions in healthcare revenue cycle management (RCM), as well as recognition solutions, image validation and check fraud detection for the U.S. check processing market, recently presented its OrbyAwards for excellence and inducted eight recipients to the OrboGraph Hall of Fame…

Read MoreThe American Banker podcast is a pleasant way to spend your commute. Their latest segment features a conversation from our business partners FIS, Doug Brown, senior vice president. He examines a recent survey that shows 14% of small and medium-size businesses switched banks last year and 18% are considering switching this year. “Business owners gravitate toward things that make…

Read More