Uncategorized

“In-person banking is fading away.” Wall Street’s biggest bank would beg to disagree. Bankingdive.com reports that banking giant JPMorgan Chase plans to expand its branch network significantly over the next few years, aiming to open over 500 new branches focused on underserved areas, according to a statement seen by Reuters and The Wall Street Journal. Some other banks…

Read MoreCheck fraud is not new — it boomed in the 1970s By 1977, banks responded with multiple anti-fraud tactics Are there lessons modern financial institutions can learn from the ’70s? FrankonFraud takes us back to the days of cable TV, eight-track tapes, and leisure suits – the 1970s. The 1970s were hard times in fraud.…

Read MoreAnother new report sees fraud growing Complexity of fraud has increased as well Cost has become the main obstacle in defending against fraud FeatureSpace — creator of Adaptive Behavioral Analytics, Automated Deep Behavioral Networks and ARIC Risk Hub, the most powerful and open technology to combat fraud and financial crime — just released a…

Read MoreAs a global leader in check fraud detection and prevention, we at OrboGraph understand the growing concerns credit unions have regarding check fraud. With various fraudulent schemes continually adapting, it’ss essential for credit unions to keep up with the latest techniques and measures in detecting and combating check fraud. As senior executives in the fraud…

Read MoreNot long after we saw Elon Musk’s X (ex-Twitter) make moves into payments, Visa has successfully completed its acquisition of Pismo, a global cloud-native issuer processing and core banking platform, for $1 billion in cash. Earlier reports said Visa was competing with at least one other firm to acquire Pismo. The collaboration aims to offer clients…

Read MoreBank check fraud continues to be a significant concern for financial institutions in an increasingly digital age. The resurgence of this threat underscores the importance for banks to re-examine their processes and strategies to more effectively protect themselves and their customers. As a global leader in the field of check fraud detection and prevention, we…

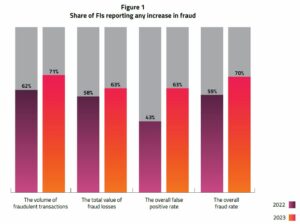

Read MoreFinancial organizations faced significant fraud losses in 2023 A majority of survey respondants report fraud attacks have increased or remained the same 23% of respondents saw a decrease in fraud attacks Alloy — a identity risk management platform for financial companies — has recently published its 2024 State of Fraud Benchmark Report, revealing meaningful losses…

Read MoreSome banks offer “extra protection” against fraud for a monthly fee Bank customers are responsible to report suspicious activity within a short period of time “This is not a fraud mitigation program; this is a screw the bank customer program” A recent report by Melissa Andrews was cited on LinkedIn by Frank Albergo, National President…

Read MoreThe new BAI Executive Report, entitled Safeguarding Against Fraud, offers a look at the current state of fraud and the ways financial institutions can protect themselves and their clients. One thing is for sure: It’s not getting any easier. Ever faster and smarter technology — like nearly instantaneous money transfers and the popularization of artificial…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read More