FeatureSpace Report: Check Fraud Increased 70% in 2023

- Another new report sees fraud growing

- Complexity of fraud has increased as well

- Cost has become the main obstacle in defending against fraud

FeatureSpace -- creator of Adaptive Behavioral Analytics, Automated Deep Behavioral Networks and ARIC Risk Hub, the most powerful and open technology to combat fraud and financial crime -- just released a report entitled The State of Fraud and Financial Crime in North America, which explores "volume, value and false positive benchmarks for financial institutions in North America, 2023."

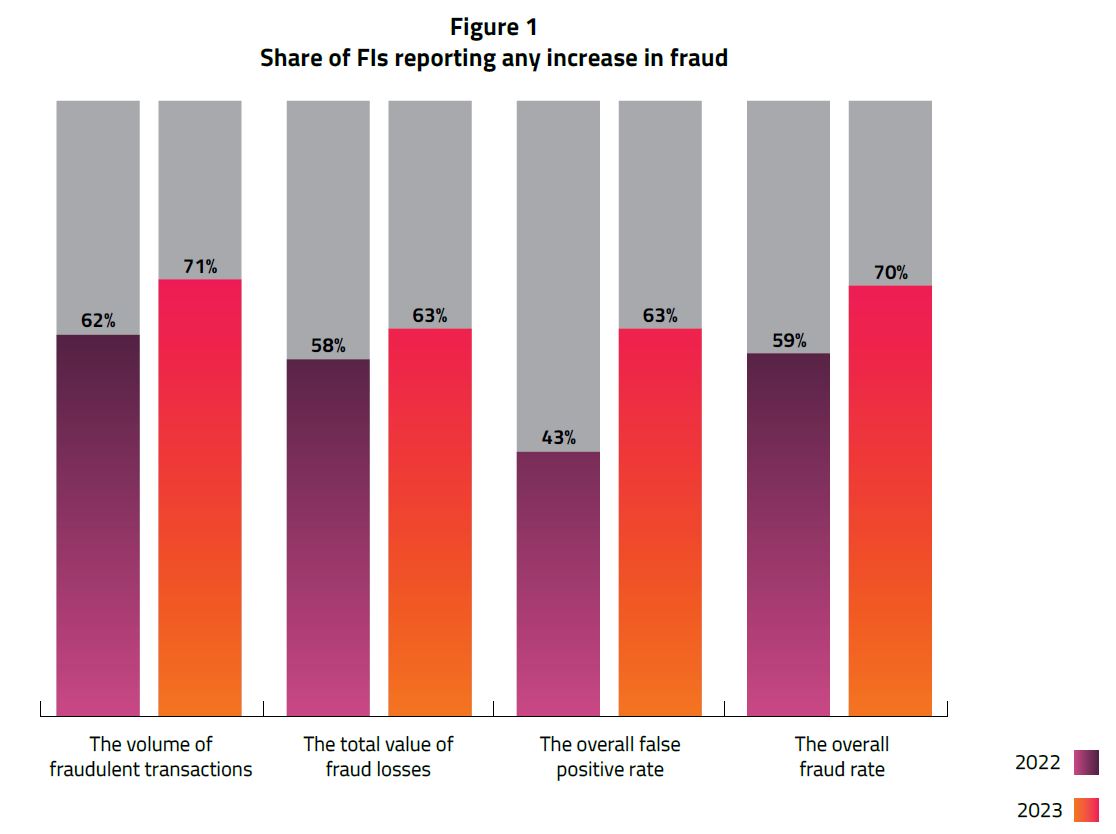

The findings from the report reveal that "70% of financial institutions (FIs) saw a rise in fraud rates over the past year, marking an 11% increase compared to the previous year."

Key Findings from the Report

Martina King, CEO at Featurespace, notes that FIs appear to approach fraud as a cost of doing business, rather than a problem that needs to be solved.

“The fact that fraud is considered commonplace points to the real challenges in our sector. We need to build a future together where the fraudsters are two steps behind the FIs, instead of two steps ahead.”

These are their key findings:

1. Increasing Fraud Rates: 70% of financial institutions (FIs) saw a rise in fraud rates over the past year, marking an 11% increase compared to the previous year.

2. The most at risk payment methods: Credit cards, debit cards, and checks remain the most susceptible to fraud.

3. Growing challenges for fraud managers: Both the frequency and complexity of fraud incidents have increased, posing greater challenges for fraud prevention professionals.

4. Use of multiple fraud prevention systems reduces losses: Rule-based algorithms, fraud prevention APIs, and processor-provided fraud scores are among the prevalent methods used.

5. Increased adoption of new solutions: FIs are more open to adopting new fraud prevention systems, with fewer requiring exhaustive proof before implementation.

6. Embracing Generative AI: While currently underutilized, there’s widespread recognition (98%) of the need for Generative AI to combat fraud.

7. Challenges with scams and authorized fraud: Detecting fraudulent activities, particularly scams and authorized forms of fraud, remains a significant challenge.

8. Rise in physical forgery and counterfeit activity: Frauds related to physical forgery and counterfeit activity have doubled, constituting 14% of fraudulent transactions, likely tied to check payment fraud.

9. Limited understanding of AI/ML delays adoption: About 70% of FIs are still learning about AI/ML solutions, causing delays in adoption of new technologies.

10. Cost overtakes regulatory constraints: The cost of implementation has become the primary barrier to innovation and adoption, surpassing regulatory issues.

Payments Fraud on the Rise

Their survey of 200 financial institutions in North America indicates an increase in fraud rates over the past year for 70% of institutions, with credit cards, debit cards, and checks the most susceptible payment methods. For checks specifically, 2023 saw an increase of 70% over the past year.

Both the frequency and complexity of fraud incidents have risen, posing growing challenges, while adoption of multiple fraud prevention systems was found to reduce losses. Tools like generative AI are also are shown to be effective, but simple lack of understanding -- along with cost and regulatory issues -- delays its widespread adoption. The report provides in-depth analysis and as well as recommendations on strategies for financial institutions to better address evolving fraud and criminal risks.

Compelling evidence also suggests that those currently implementing new fraud prevention strategies – rather than planning to do so in the next two years – are already reaping tangible, positive results. Respondents who reported reduced fraud losses over the past year are significantly more likely to be implementing new measures compared to those experiencing increased losses.

Fighting Back Against Fraud

The report notes that FIs using "more extensive range of anti-fraud measures" are the ones that are more likely to report a reduction in fraud. This make sense, particularly when it comes to check fraud

Traditionally, FIs utilized a combination of OCR technology, transactional analysis, and positive pay solutions as part of their fraud strategy. Unfortunately, FIs are realizing -- sometimes too late -- that these legacy technologies are not enough to fight back against the new sophisticated fraudster. There have been innovations across all legacy solutions, as well as new technological solutions that better protect the FI and their customers by detecting more fraudulent checks. These include:

OCR Image Analysis to Image Forensic AI -- Traditional image analysis systems utilizing algorithms have been replaced by image forensic AI based on deep learning models. This innovation is able to analyze the images of checks and detect more alterations, counterfeits, and forgeries.

Transactional Analysis to Behavioral Analytics -- Traditional transactional analysis reviews individual transactions of an account to detect fraudulent checks. This is being replaced with behavioral analytics, which analyzes the entire behavior of an account to detect anomalous behavior and transactions.

Positive Pay to Payee Positive Pay -- Traditional positive pay compares the serial number, account number, and amount to a issuer file from the business account holder. New advancements in recognition technology are now enabling banks to extract payee names more accurately -- including handwritten -- which can now be compared to the issuer file as well.

Consortium Data Including Check Images -- While not a new innovation, we are seeing a major uptick in FIs leveraging consortium data for check deposit fraud. This enables banks to access data from other FIs including checks/transaction data and account information. Several companies are now developing solutions that include check images as well.

Dark Web Monitoring -- This is the latest technology for fighting check fraud. Stolen checks are making their way onto the dark web and other encrypted messaging apps -- proliferating check fraud across the country. Dark web monitoring enables FIs to scour these channels to identify accounts that are compromised -- both stolen checks and account information -- and enables them to take action on the account before fraud losses.

Most industry experts are expecting check fraud to continue to increase in 2024 and beyond -- unless more FIs become more effective in stopping the fraudsters. With a plethora of technologies that can reduce losses, it is on FIs to deploy these technologies and decrease fraud success rates -- ultimately deterring the perpetrators.