Uncategorized

A new AI “superhero” has been introduced Claude.AI is a new analysis tool being called a “game changer” This innovation represents a new partner in effectively preventing fraud For nearly a decade, we’ve heard about the potential of artificial intelligence for the bank industry and how it is a “game-changer.” For checks processing and fraud…

Read MoreEven as digital payments gain popularity, paper checks remain prevalent Businesses and customers alike still regularly use checks Fraudsters exploit the anonymity of depositing checks through ATMs or mobile devices, which adds complexity to tracking We have previously noted that the rise in check fraud can be traced back to the deployment of EMV chips…

Read MoreFarmers have, by necessity, a unique relationship with paper checks They also wait days, if not weeks, for paper checks to clear End-user education is a crucial approach In a new blog post and video, PYMNTS points out that “the only thing bigger than the agriculture sector’s contribution to daily sustenance could be its reliance…

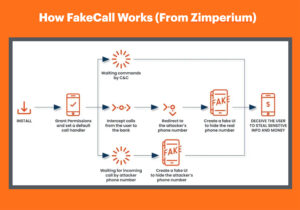

Read MoreNew malware designed for Android phone users Fakecall software redirects calls to scammers Download apps only from official stores — do not allow installations from unknown sources During the pandemic, we saw a shift of banking customers — who, at the time, could not or would not go to their local branch — utilizing…

Read MoreFraud continues to rise Fraudsters are now utilizing AI to strengthen scams The battle between AI-powered fraud and AI-powered fraud detection is only just beginning Recently, OrboGraph’s Marketing Manager and Fraud Detection Specialist, James Bi, had an interesting conversation with an industry expert on mRDC and Check Fraud. The expert noted that “Fraudsters are one…

Read MoreCFPB has finalized a transformative open banking rule under the Dodd-Frank Act The rule allows consumers to control their financial data and share it with third-party service providers Compliance will roll out in phases based on institution size As we noted previously, Open Banking is a hot topic for financial institutions. It allows consumers to share…

Read MoreThe rise of new payment methods has not eliminated check usage Checks present a security risk to both consumers and financial institutions Are check payments more secure than digital payments? Over the past several months, it’s been suggested by industry experts and technology vendors that the “checks are dead” sentiment has lead to the surge…

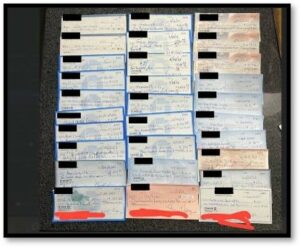

Read MoreTelegram is a bountiful resource for check scammers 20,000 checks were catalogued, sourced from nearly 2,000 different US banks and credit unions Government checks make up 22.6% of the total In order to commit check fraud, the first step for a fraudster is simple: obtaining a legitimate check. Sure, a fraudster can purchase blank check…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MorePaper checks have not disappeared There is an element of nostalgia in check usage Removing $1 trillion in checks is highly unlikely For those in the industry, the notion that checks are going away has all but dissipated. Mainstream media has recently tried to capitalize on the sentiment, but they continue to rely on high-level…

Read More