Uncategorized

In the newest segment of their “I’ve Always Wondered” series, which addresses questions many of us have about the economy and spending habits, Marketplace tackles the question: “Why do we still use paper checks?” For insight, they consulted experts. There are a slew of reasons explaining our continued check use. Many check writers have had…

Read MoreCheck fraud doubled in 2022 Counterfeit checks are easy to create Checks are still widely used, giving fraudsters a big target ABA Risk and Compliance takes a look at check fraud, a persistent challenge for banks with reported cases doubling in 2022. The article highlights the three primary fraud techniques at work today: Counterfeit checks…

Read MoreCheck fraud is growing and becoming more sophisticated Technology is keeping up with fraudsters Careful implementation of anti-fraud tech is vital to staying ahead of fraud innovations Sherah S., Head of Legal, Risk, and Compliance at CheckAlt, recognizes that check fraud is growing more and more common and accessible to fraudsters. That doesn’t mean financial…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreCheck fraud is growing We are on track to see another increase in ’23 Fortunately, investing in newer tech to combat fraud is affordable Check fraud continues to be a growing and significant problem for US banks. S&P Global reports that, between 2018 and 2022, suspicious activity reports for check fraud at banks increased over…

Read MoreWhile the younger generation doesn’t use checks frequently, check use is still strong Fraudsters are robbing mailboxes – both private and US Postal Service “blue boxes” Check fraud can be accomplished with inexpensive tools, making it popular Jeffrey Weiner, Chairman and CEO at Marcum LLP, posted on LinkedIn about the growing “popularity” of check fraud…

Read MoreAs we are all aware, the pandemic has changed the behavior of consumers when it comes to depositing checks — they’ve adopted mRDC and ATMs as their main deposit channels. In turn, ATMs have evolved over the past few years, offering new services to accommodate this change in behavior. As the year winds down, ATM…

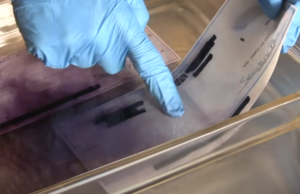

Read MoreGel pens are resistant to “washing” It’s often advised to write checks with gel pens to avoid fraud Fraudsters can create checks from scratch, so they no longer “wash” checks A few months back we reported on an experiment to see whether gel ink pens indeed resisted “check washing” as claimed by some pundits. The…

Read MoreCheck fraud continues to rise Scammers are now working with smaller dollar amounts The “Dark Web” provides an easly accessable marketplace for checks At BankInfo Security, Suparna Goswami spent some time talking to Rene Perez, director of financial crimes sales and financial crimes consultant for Jack Henry & Associates, to review the major fraud scams…

Read MoreMcKinsey and Company sat down with leaders on the front lines to talk about the need for — and advantages of — third parties to help financial institutions with data analytics, modernization of core technology, and extension of customer reach beyond traditional banking channels. Joining the discussion were: Diego Caicedo, the cofounder and CEO of…

Read More