Did the Government Phase Out of Treasury Checks Slow Down Fraudsters?

- Treasury’s paper-check phaseout briefly slowed, but didn’t eliminate, Treasury check fraud

- Fraudsters quickly adapted schemes, restoring high volumes of illicit Treasury check activity

- Continuous, AI-driven image analysis is essential to counter rapidly evolving check fraud

On March 25, 2025, the current US administration signed an executive order entitled Modernizing Payments To and From America’s Bank Account -- with September 30, 2025 as the deadline for the issuance of paper checks for all government disbursements. The deadline has long past, and the US government has backtracked on this to ensure those who we know as "underbanked" or those who do not have access to online banking receive their payments.

One of the core reasons for elimination was the rampant fraud of Treasury checks. Unfortunately, a recent LinkedIn post from David Maimon underscores a hard truth: even high‑profile policy moves like Treasury’s decision to end paper checks only produced a brief pause in Treasury check fraud, not a structural fix.

What the Data Shows

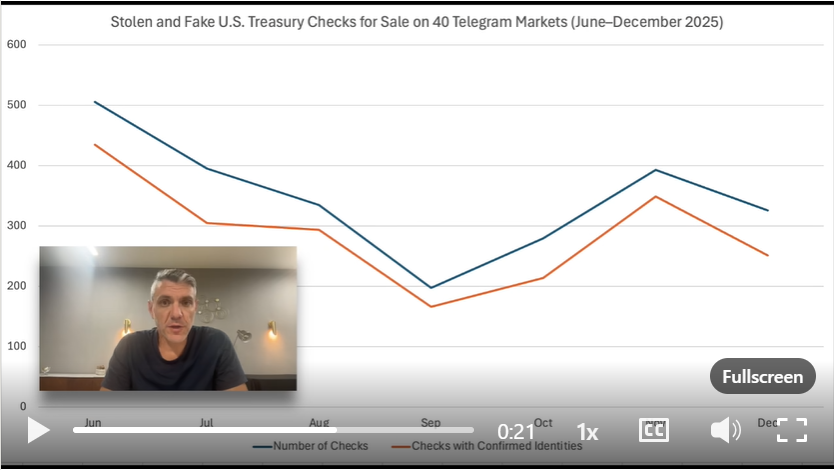

Dr. Maimon provides details of his team's research, show that listings of fraudulent Treasury checks initially fell from more than 500 checks across 40 markets in June 2025 to fewer than 200 by September. However, this was temporary and rebounded quickly as “fraud actors adapted” rather than disappeared. In fact, Dr. Maimon notes that the rebound was back to levels similar to before the announcement.

Even more troubling, Mr. Maimon notes that “across every month we analyzed, more than three-quarters of these checks exposed real, verifiable identities,” underscoring that stolen checks is part of the larger fraud ecosystem.

This includes identity theft -- as any check contains personal information such as legal name and address. With this information, and a bit of social engineering, fraudsters can cause more harm than simply stealing funds.

Can the US Government Assist in Curbing Check Fraud?

As we noted earlier this week, the US Government has yet to make an actual impact when it comes to curbing check fraud. In case you missed it, at a recent hearing, Congresswoman Ann Wagner of Missouri presses Federal Reserve Vice Chair for Supervision Michelle Bowman on the growing exploitation of the most vulnerable in society -- specifically points out check fraud. The overall theme is that the US Government is moving too slow to address the issue.

At the end of our post, we noted that while we can hope that regulators are able to stop the fraudsters in their tracks, it's not recommended that financial institutions rely on them. Remember, Treasury checks are not simply going away and financial institutions will still need to accept them. Additionally, US regulators have not provided any meaningful actions to stop fraudsters.

However, financial institutions have the right technologies -- such as image forensic AI -- to effectively detect counterfeits, forgeries, and alterations before funds are lost. By layering this with multiple technologies including transactional analysis, behavioral analytics, and consortium data, financial institutions possess the best method for solving the check fraud issue.