Examining a Real World Mail Theft/Stolen Check Scenario

- Postal theft warnings are now in mainstream media

- Sending checks via mail can be done safely by following certain guidelines

- Banks need to rise to the challenge as check usage is still common

While most in the banking industry are aware of the growing mail theft problem in the US targeting paper checks, many in the "public domain" remain in the dark. In a piece for Forbes.com, John Wasik expresses surprise that the desire for checks would actually lead to stealing from the post office:

I didn’t think thieves would be so brazen to steal mail. After all, it’s a federal crime. Yet an increasingly amount of theft is occurring where checks are stolen from mail.

Checks stolen from snail mail are not difficult to perpetrate. It’s easy to spot a standard envelope containing a check. Thieves then rip the check out of the envelope, change the payee to themselves or create new fake checks.

I know how they work since this happened to me while I was managing my father’s estate after he died several years ago. When my banker called me to ask if I had cashed a check in Maryland (where I don’t live and hadn’t been), I told him to call the police and close the account.

There was a happy ending in his case:

Fortunately, the banker’s quick action prevented the loss of money from my father’s account. I wasn’t responsible for the stolen check and I immediately reported it to my local police department. My bank immediately flagged the incident for their fraud division. I signed an affidavit attesting to the fraud for the bank and I was on my way.

Financial Institution Protecting Against Check Fraud

It's worth our time to examine the unpack the above scenario -- deriving a few assumptions -- to see how the financial institutions performed. What we know is that a check was stolen through the mail from Wasik's father estate account, cashed in Maryland, and the bank reached out to Mr. Wasik to verify the validity of the check.

The most likely scenario is that this check was deposited at a different financial institution. We know that per Reg CC, the Bank of First Deposit (BoFD) is responsible for verifying the validity of the check. It appears that the BoFD did not have the right technologies in place to verify the check as it was not flagged as fraud. In order to do this, the BoFD would have needed to utilize a combination of image forensic AI, validation checks, behavioral analytics, and leveraging consortium data.

Below is how the technologies work together:

- Image forensic AI will analyze the check image to detect indicators of altered check stocks and alterations to the payee and CAR/LAR fields.

- Validation checks will analyze the negotiability of the check image.

- Behavioral analytics will analyze the transactions of the account to see if this account could be a "drop account."

- Consortium data will test the validity of the checking from past transactions.

Since the check was cashed, the paying bank did a great job in flagging the item and following up with their customer. This could have been achieved with the usage of business rules (high dollar amount) or through a combination of behavioral analytics (identifying the check via anomalous behavior) or image forensic AI interrogating the image and identifying signals of alteration(s).

Awareness of Growing Mail Theft

The mail theft problem is, of course, no secret to regular readers of our blog. Mr. Wasik cites a report by the Financial Crimes Enforcement Network of the U.S. Treasury (FinCen) that we'd featured in an earlier post:

Despite the declining use of checks in the United States, criminals have been increasingly targeting the U.S. Mail since the COVID-19 pandemic to commit check fraud,. The US Postal Service (USPS) delivers nearly 130 billion pieces of U.S. Mail every year to over 160 million residential and business addresses across the United States. From March 2020 through February 2021, the USPIS received 299,020 mail theft complaints, which was an increase of 161% compared with the same period a year earlier.

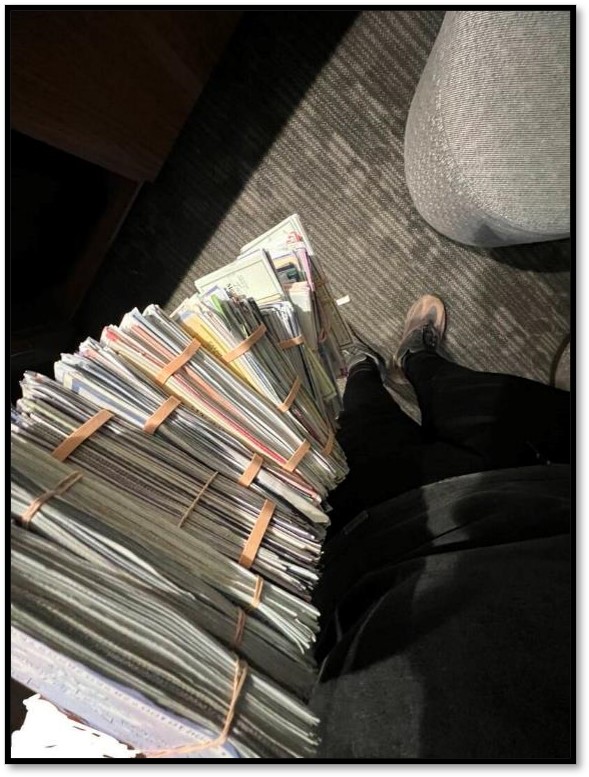

The above statistics include individual packages and letters. However, when it comes to stealing checks, criminals are looking for "mail thefts of high volume" according to an article from USA Today. In laymen terms, thay are looking to steal large of amounts of letters in a singular theft or robbery -- which amounts to more stolen checks at once. This has risen significantly from 2022 to the first half of 2023:

Mail thefts of high volume, including from blue collection boxes, rose from 38,500 in fiscal year 2022 to more than 25,000 in the first half of fiscal year 23, the Postal Service said.

And, while readers here are aware of the mail theft and check fraud crisis in the US, it's important that FIs take the steps needed to deploy complementing technologies that protect depositers, while also alerting its customer base to protect their mail and watch out for scams.