Faster Payments Fraud: Over Two Thirds of Victims Transfer Funds within 24 Hours

- Faster payments can actually increase fraud risk

- Banks must focus on education and building trust

- Instant payment apps bring new scam risks

Banks and financial experts often advocate for moving consumers to faster payment systems—such as real-time transfers or instant payments—to combat check fraud. The reasoning is that current data show faster payments like FedNow seeing much lower rates of fraud -- so experts proclaim them as more secure.

However, data from the 2025 PYMNTS Intelligence “Financial Scams and Consumer Trust” report commissioned by Block suggests that this strategy may be oversimplified—and possibly dangerous.

As PYMNTS notes, scams and fraud are rapidly evolving, with nearly 40% of U.S. households experiencing scams in just the past five years. Surprisingly, tech-savvy, younger, and affluent individuals are among the most frequent victims. Criminals are leveraging advances in technology, including AI, and capitalizing on real-time payment channels to exploit consumer trust.

Examining the Data

Scams and Tactics

The PYMNTS report finds that 81% of successful fraud cases involved scammers impersonating trusted contacts, and nearly two-thirds of victims sent money within just 24 hours of the first contact—a window made possible by faster payments.

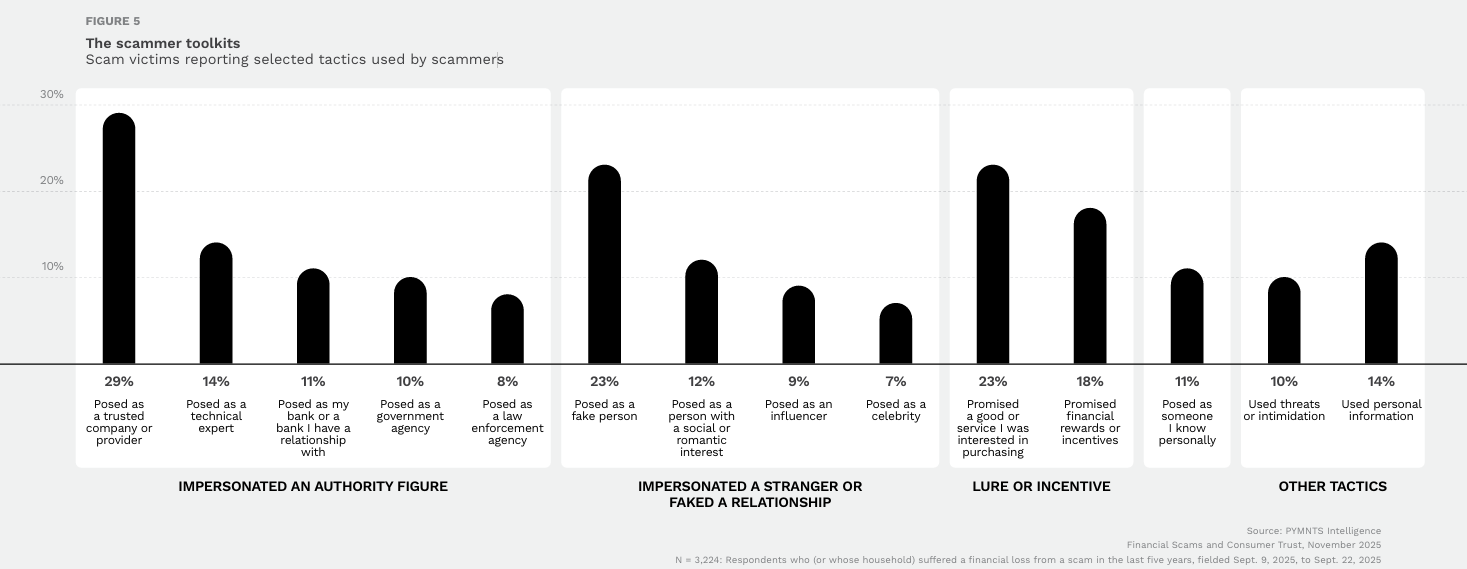

Scammers have a variety of tactics at their disposal. As shown by the graphs below, scammers will do almost anything to convince their target that they can be trusted, with 55% of incidents pretending to be a trusted authority.

Source: FINANCIAL SCAMS AND CONSUMER TRUST Report

Faster Payments = Faster Fraud

Rather than reducing fraud, speed can actually intensify risk. Instant communication and immediate payments empower scammers to pressure victims into action before they’ve had time to reflect or verify. The report notes that:

More than one in two victims send money within the first 24 hours of contact. Nearly one in four send money within the first 30 minutes.

Ultimately, faster payments mean fraudsters move faster, too. Speed eliminates crucial “friction”—the breaks and pauses that give consumers time to think and spot scams. While streamlining payments is a worthy goal, it should not come at the expense of security. Friction isn’t always bad; when used smartly, it can protect users from disaster.

Consumer Losses = Distrust with Their Financial Institution

Unfortunately, when a consumer takes a loss from fraud -- even if it's entirely the fault of the consumer -- they will most likely blame their financial institution for not protecting them better.

What is most important is that financial institutions report the scam immediately to them, as there is a higher chance of recovery. The report notes that 53% of victims recover most or all of their funds when reporting it to their financial institution. This compares to 40% for those who've reported elsewhere—such as to law enforcement or consumer protection agencies—and 12% who did not report at all.

For those who recoup most or some of their losses, there is a positive impact for financial institutions:

- 90% believe their financial institutions will help prevent them from being scammed again

- 83% have recovered smaller portions of their money

However, for those who are not able to recoup any funds, this is reduced to 70% -- showing how a bad recovery experience can erode consumer trust in banks.

Are Faster Payments a Safer Option Than Checks?

While the data may give that impression, a deeper dive produces a resounding NO. Faster payments enable quicker access to funds by fraudsters. Once those funds are released, financial institutions struggle to recoup the losses, often taking losses to return funds to their customers' accounts. These are typically smaller dollar amounts (under $1000), but add up quickly.

Check fraud detection is now more sophisticated than ever, as new innovations like AI are achieving 95% detection rates for On-Us and Deposit Fraud. These technologies, coupled with the financial institutions' funds availability policies, enable financial institutions to better protect themselves and their customers, ensuring that counterfeit, forged, and altered checks are flagged before funds are disbursed.

While faster payments are seen as the future of payments, leveraging them as a way to mitigate fraud from other channels is NOT the right path.