FED Study Shows Underutilized Mobile Capabilities, RDC Stays Strong

Consumer enrollment in mobile banking services is growing as more individuals rely on their mobile phones for access to financial services. While growing, the total enrollment and usage percentages for most organizations still falls short of potential.

The Federal Reserve Bank study, The Mobile Banking and Payment Practices of U.S. Financial Institutions report, provides results from 706 financial institutions in the Atlanta, Boston, Cleveland, Dallas, Kansas City, Minneapolis and Richmond Federal Reserve Districts, as well as historical comparisons to previous research by the Fed.

The report says that, while SIGN-UPS are on track, actual USAGE of both mobile banking and mobile payments “remains either rudimentary (only checking balances vs. more advanced functions) or lacking altogether (mobile payments at POS).”

When asked for reasons why mobile payment solutions were not already offered, security was at the top of the list.

The article’s author, Jim Marous (co-publisher of The Financial Brand and publisher of the Digital Banking Report), offers the following advice:

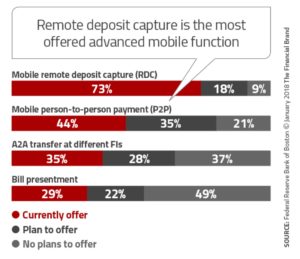

With the offering of basic mobile banking services achieved, banks and credit unions must focus on adoption and usage growth, using mobile banking as a relationship-building tool. This can be achieved through increased education and promotion of value-added tools and services that consumers want, including P2P payments, card controls, external A2A mobile transfers, as well as vastly increased mobile alerts and security features (biometrics).

On the positive side, Remote Deposit Capture is becoming ubiquitous – – and perhaps the lever for driving widespread adoption of mobile payments. New Reg CC rules activating in July of 2018 should eliminate some of the security concerns of consumers and banks with better definitions of warranties and indemnities. OrboAnywhere Validate technologies fit well with Reg CC and UCC requirements by validating the critical fields on Mobile and Corporate RDC items. Another major consideration is Restrictive Endorsements, which will have additional importance for reducing fraud.