Fiserv & Mercator Advisory Group Address Check Deposit Risk Mitigation on PaymentsJournal Podcast

- Check fraud is rising

- Remote deposits are more popular and create more fraud opportunities

- Tools are available to effectively fight check fraud

The PaymentsJournal Podcast invited guests Bev Nichols, Product Director of Deposit Solutions at Fiserv, and Sarah Grotta, Director of Debit and Alternative Products Advisory Service at Mercator Advisory Group, to discuss the state of check fraud and it's prevention, particularly as check deposit behavior shifts from in-branch to remote channels.

Source: PaymentsJournal Postcast

The greater adoption of digital deposit -- often the only deposit method available during the pandemic -- encouraged check fraud schemes to evolve and adapt.

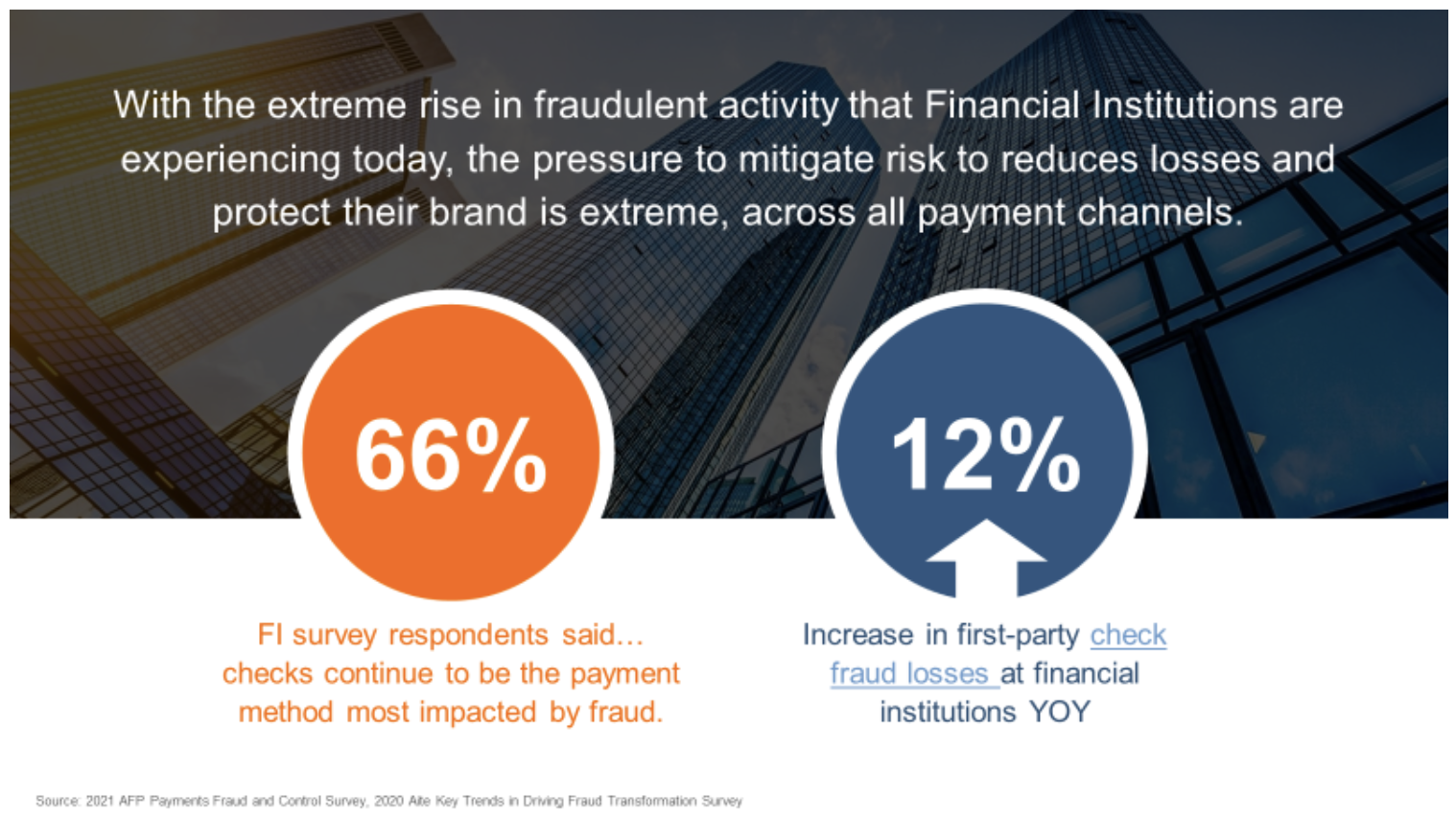

“[Mobile deposit] has now basically become a standard,” said Nichols, “but as we [made that transition], we came across risk challenges.” The AFP report showed that 66% of respondents believe checks to be one of the most susceptible methods of payments fraud.

Staying Aware of Checks & Their Prevalence

“We often forget just how often we do write checks,” added Grotta. “FIs are investing in their digital transformation, but there hasn’t necessarily been enough investment in activities to support checks.”

The fact is -- as PaymentsJournal reports -- consumers and businesses are still writing billions of checks equaling trillions of dollars annually. Banks, credit unions, and their clients and members need fraud prevention that extends beyond manual efforts from overextended FI staff.

How to combat rising fraud?

“Investing in check fraud detection systems isn’t necessarily the sexiest investment [FIs] could make,” suggested Grotta, “but at the same time, some of the automated systems can actually find fraudulent checks that humans just aren’t able to see.” Risk-mitigation technology not only helps combat check fraud, but it also protects the reputation of financial institutions.

Bev Nichols pointed out four methods for combatting fraud:

Establishing intelligent deposit limits for deposit accounts can reduce risk for your financial institution, while rewarding good accountholders with higher deposit limits. By using historical data from your account processing system to calculate risk scores for every account and determining automated deposit limit values, FIs can achieve consistency across depositors and offer higher limits to the most valued accountholders while managing risk and ensuring compliance.

Deploy risk analysis and scoring methods with software tools to identify and stop advanced check alterations, forgeries, counterfeits, out-of-pattern transactions, and kiting activities. With automated workflows to capture suspicious items and use of historical images, FIs can improve efficiency by reducing false positives and false negatives across multiple transaction types and channels.

Recognize check fraud activity with an analysis and forecasting engine that uses neural network algorithms to recognize patterns of suspicious activity, such as deposit fraud and check kiting. Through machine learning and use of historical transaction data from your core banking system, a benchmark is established for each account type and used to identify suspicious activity.

Analyze deposited checks to stop fraudulent deposits before they hit the bottom line. With a robust database comprising account and item-level information from thousands of contributing financial institutions, and years of historical data from consumers, processors, and third-party sources, FIs can make faster and more accurate decisions about whether to accept a deposited check or place a hold on the deposit.

For small and medium businesses, these steps are particularly important. Interrupted check payments can prove dire for them.

“A better system with greater throughput provides better protection not just to the financial institution, but also to the small businesses themselves,” noted Grotta. “Helping to approve good checks and providing access to funds more quickly have got to be a great service to small businesses and their all-important cash flow.”

Access Tools NOW to Prevent Fraud LATER

Even though the volume and sophistication levels of fraud are increasing, Financial Institutions also have access to more advanced technology and procedures to combat this trend. “Look for tools that capture fraudulent activity from various sources across your institution,” explained Nichols. “Don’t forget, there are two parties to every transaction.”

As noted by Bev Nichols in the section above, the best solution is taking a blended approach, layering transactional-analytics and image forensics that leverage artificial intelligence and deep learning with rules creation (including deposit limits and thresholds) and data analytics from multiple sources.

The key for this approach? Work with a technology vendor whose core platform can integrate all these results into a single review platform that allows fraud analysts to review suspicious activities and stop fraud payments and actions in their tracks.

There is no single solution on the market that can detect all fraud from every payment channel. However, many technology vendors are developing fraud capabilities that are easily integrated with other platforms through APIs, creating the fraud solution that works best for your organization.