Frank on Fraud: Check Scams On the Rise – – With Many Losses Unreported

- According to Frank on Fraud, there are 16 main types of check fraud

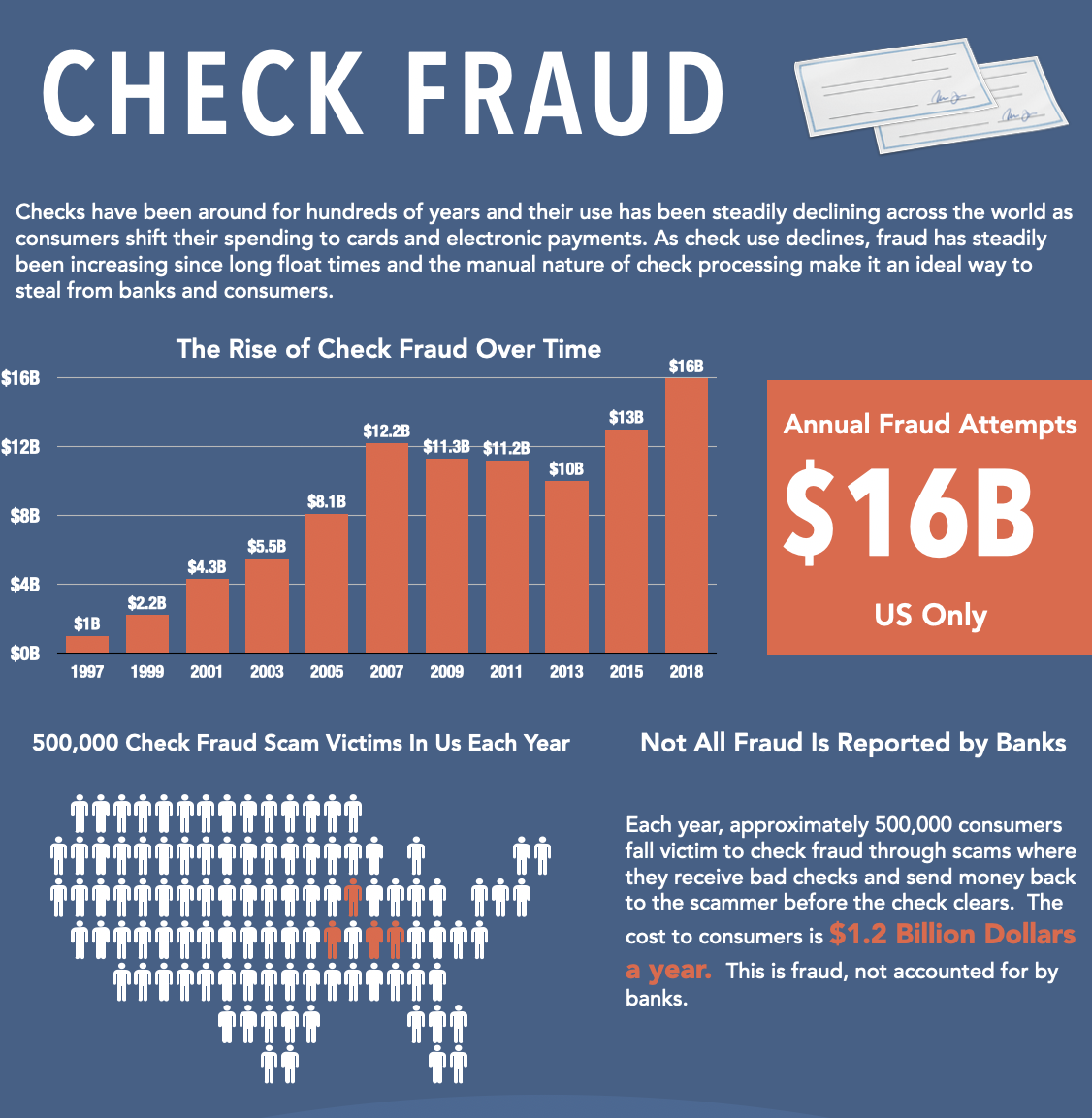

- On the surface, check fraud growth defies logic

- A huge amount of check fraud goes unreported - - up to $1.2 billion in losses per year, in fact

FRANK ON FRAUD is a terrific (and entertaining) blog by Frank McKenna, the Co-Founder and Chief Fraud Strategist for PointPredictive, a company that focuses on solving application fraud for the lending industry.

In a recent post, Mr. McKenna took a look at the different types of check fraud we face -- he identifies 16 different varieties -- as incidents continue to rise. He notes, for instance, that an American Bankers Association (ABA) survey recently reported that attempted check fraud ballooned to $15.8 billion in 2018, which is an almost 100% increase over the $8.5 billion that was attempted in 2016.

As Frank on Fraud notes:

Check fraud continues to grow over time which confounds logic. As it turns out though, the very thing that makes checks suck – they’re paper and take forever to clear – is exactly what makes them a choice for fraudsters and scammers.

They rely on those long float times to steal from everyday consumers that deposit bogus checks into their own accounts.

Indeed, every year approximately 500,000 consumers fall victim to check fraud where they receive bad checks and send money back to the scammer, thinking the check has "cleared" when it actually has not. The cost to consumers is $1.2 billion per year -- and it's a cost not reported by banks. (Download the full infographic at right by clicking here)

It is crucial for banks to continue to educate and bring awareness of the various fraud schemes to their customers. Furthermore, any time they are suspicious of fraudulent activity, they should get in contact with customer service immediately. A combination of customer awareness along with transactional and image analysis technologies deployed by the banks can effectively reduce fraud losses -- not only to banks, but to their customers.