FrankonFraud: Ten – no, Eleven – Fraud Predictions for 2024

- Review of fraud in 2023 -- SARs forecasted to exceed 2022

- 11 fraud predictions for 2024

- Image forensic AI key technology for decreasing check fraud losses in 2024

Fraud in 2023 saw an increase in almost every possible channel. And, while we are able to look at past historical data for each payment channel, it's difficult for anyone to predict the future. However, Frank McKenna, author of the always informative FrankonFraud blog, has taken on the challenge with the help of fellow #FraudFighters Mary Ann Miller and Karrisse Hendrik and published their fraud predictions for 2024.

My fraud-fighting friends, Mary Ann Miller and Karrisse Hendrik, and I mind-meld each year to imagine the year ahead.

A flurry of text and Zoom calls goes on for weeks. Out of that process, we create ten predictions we think will come true in the next 12 months (or perhaps beyond).

Reviewing Fraud in 2023

Before diving into their predictions, it's useful to recall what occurred in 2023. The article reviews a number of key aspects from the past year, including:

- The rise of ChatGPT

- Fraudulent start-up companies -- also known as Founder Fraud

- First-party fraud

- Various scams

- Check fraud -- reported doubling since 2022

- Data breaches and ransomware

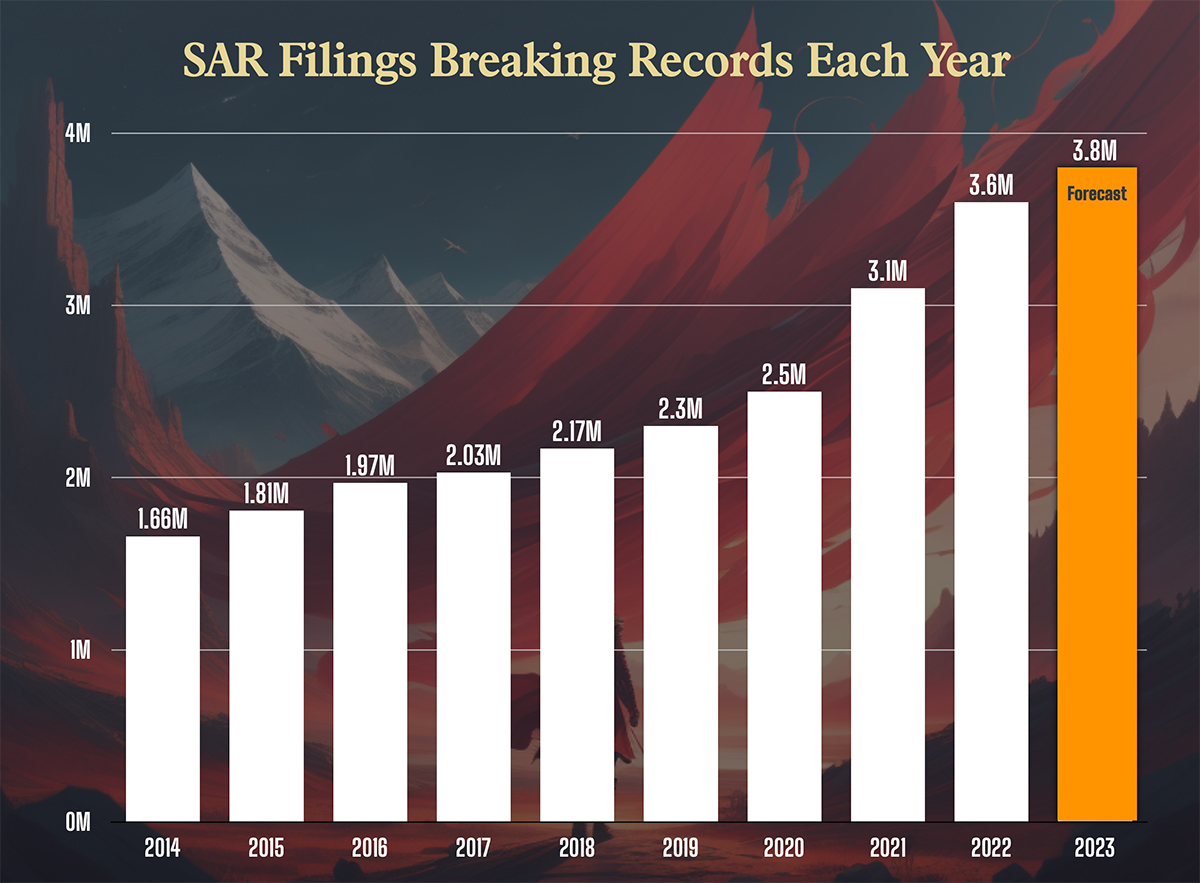

In addition, SARs are forecasted to break 2022's totals, with check fraud accounting for over 17% (est. 672,000).

Source: FrankonFraud Blog

Fraud Predications for 2024

So, what can we expect for 2024? Well, here are their predictions:

In 2024, a new wave of “Inny” perpetrated fraud will be realized at banks, lenders, telecom providers, online retailers, and shippers. The word “Inny” has been popularized on social media fraud forums to sell insider access to do everything... Read more →

When examining the predictions for check fraud in 2024, the team offers some practical advice for financial institutions:

- Text Validation – The Credit Card Approach

- Name Check Payee – Positive Identification To Accountholder

- Telegram and Dark Web Interdiction

- Leveraging FedNow Rails

And, while this is sound advice, they are missing the key element of integrating image forensic AI technologies to analyze the images of checks for counterfeits, forgeries, and alterations. This enables banks to compare a newly deposited check against previous cleared checks for any issues with check stock, signature, writing styles, and amount discrepancies that are common with stolen/counterfeit checks.

The technology is readily available to financial institutions to ensure that losses from check fraud decrease in 2024.