Gel Ink Pens: Effective Against Check Washing, NOT Counterfeiting

- Gel pens are resistant to "washing"

- It's often advised to write checks with gel pens to avoid fraud

- Fraudsters can create checks from scratch, so they no longer "wash" checks

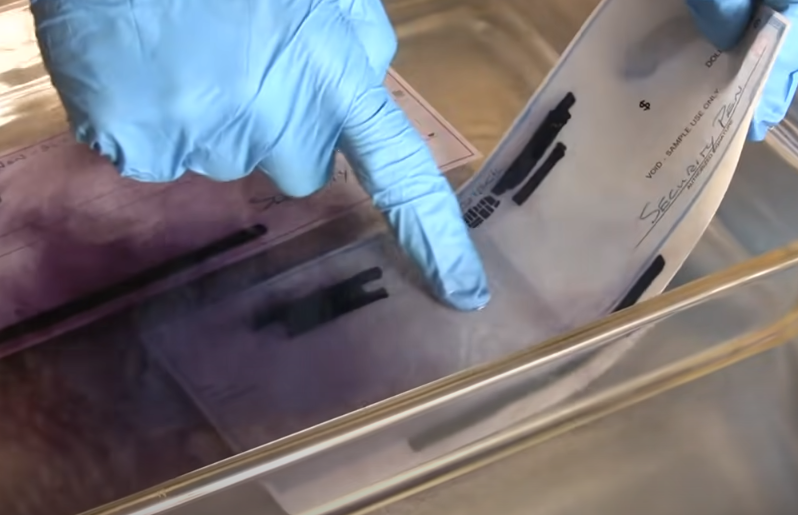

A few months back we reported on an experiment to see whether gel ink pens indeed resisted "check washing" as claimed by some pundits. The results were positive: The UniBall Signo 207 pen, in particular, was resistant to the chemicals generally used to "wash" and create bogus checks.

And, while being effective against dissolving from the chemical, the results came with a warning:

However, washing checks involves more than just the solution. The [YouTube] content creator failed to recognize that check washers do not stop at a simple soak -- fraudsters will utilize other materials such as toothbrushes to gently scrub the ink off. And, while it may slightly damage the background of the check, deposits via mRDC make it difficult for banks to identify the issue as the images of checks are converted to black and white for processing and review.

So, while gel pens made things a bit more difficult for the fraudster, they did not make fraud impossible. But, as we all know, fraudsters are known to adapt their tactics quickly.

Why Wash When You Can Counterfeit?

A report by KSDK News goes a step further, reporting that fraudsters are bypassing the "wash" method as higher tech is available to them.

Note: The article states that "No, writing checks with gel pens doesn't make it harder for criminals to 'wash' checks. Victims can blame advancements in technology for the failure of the deterrent." A correction has been sent by OrboGraph to clarify the differences between alterations, forgeries, and counterfeits.

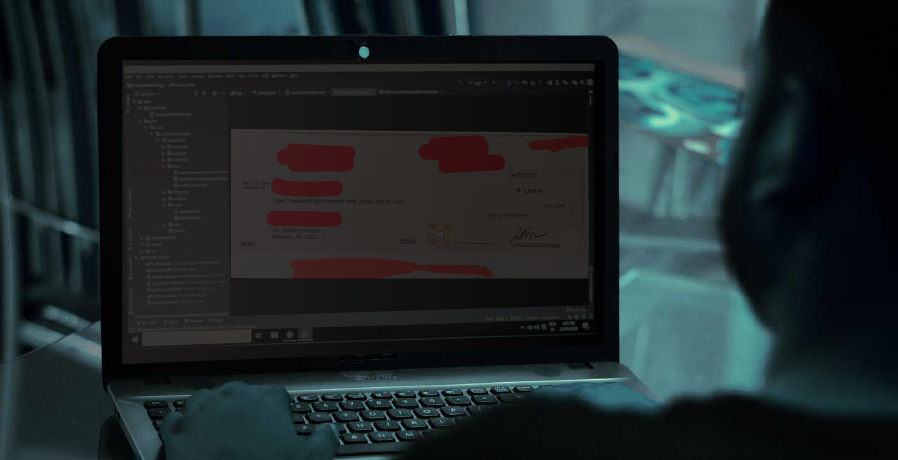

As outlined in the report, fraudsters are moving away from washing checks, and gravitating towards digital counterfeiting.

Dr. David Maimon of Georgia State University explains that fraudsters will now scan the signature from a stolen check, add it to checks created on a computer, and simply print check after check with a new check number at the top of each one. The software, a scanner, and a printer are all fraudsters need to accomplish this inexpensive method of counterfeiting checks.

Another benefit for fraudsters is the ability to create multiple checks. Washing a check typically leads to a single fraudulent transaction. However, when you have the check stock recreated, it's comparable to a person stealing a check book -- they can write unlimited number of checks for whatever amount. This can lead to major losses, including personal accounts being completely drained or overdrawn, to businesses unable to pay their vendors.

Banks must counter the tactics of fraudsters by deploying a multi-layered technology approach, leveraging complementing tech such as behavioral analytics, image forensic AI, consortium data, and dark web monitoring for check fraud detection. This will effectively protect the bank and their customers against fraud losses.