How to Execute a POC for Image Analysis

- FI’s are concerned about increases in check fraud losses

- Image analysis adds value to check fraud detection

- Running a Proof of Concept (POC) requires minimal resources

Check fraud is a hot topic. It’s a lopsided battle, in many cases as fraudsters are becoming more technologically advanced and utilizing new techniques to steal money using counterfeits, forgeries and alterations via a more diverse deposit channel. In the meantime, financial institutions are running legacy transaction detection systems installed 10+ years ago.

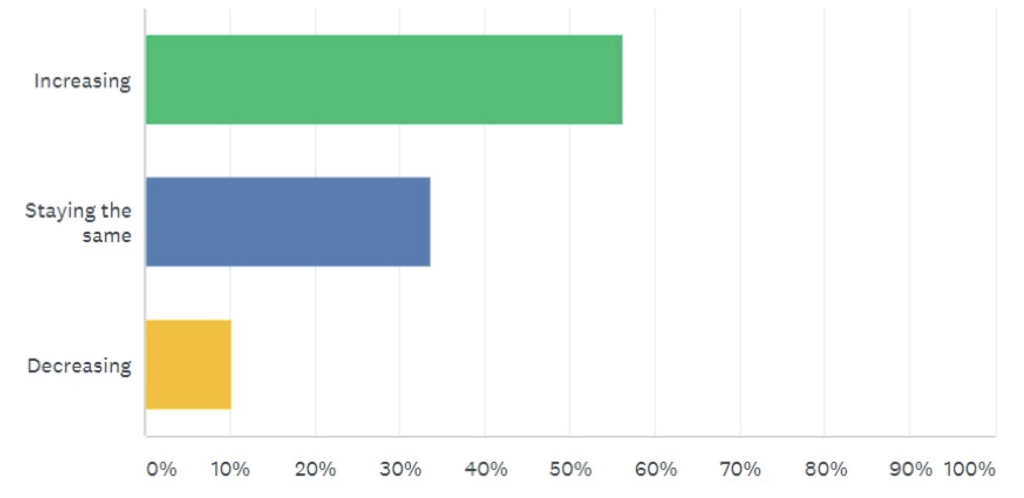

In a recent survey conducted by OrboGraph, (56%) of respondents reported that check fraud within their organizations were increasing. Based on continued discussions with FI’s on a direct basis, its getting worse!

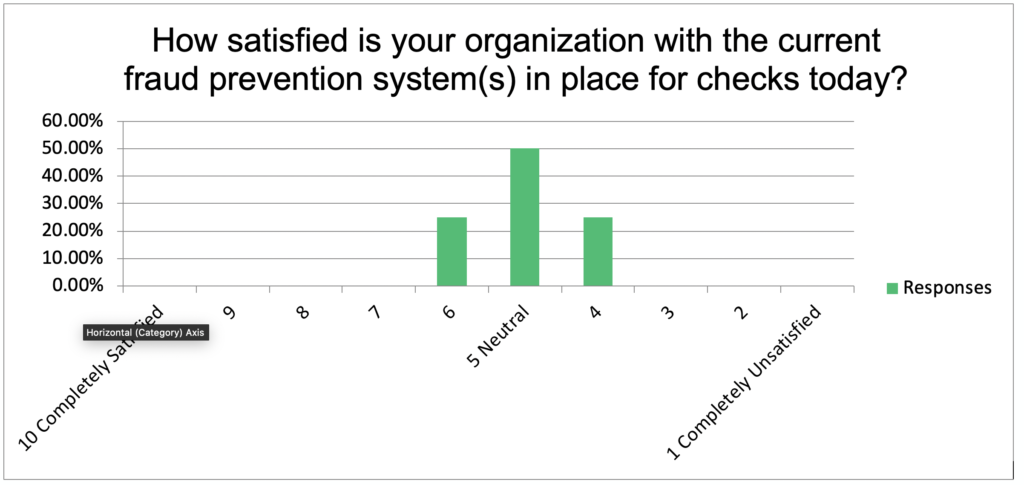

It’s no wonder why the majority of respondents reported that they were either neutral or leaning towards unsatisfied with their current Check Fraud Prevention systems that they have in place today.

When addressing check fraud, FI’s need to combine strong data analytics with image analysis (check stock validation (CSV), automated signature verification (ASV), and alteration detection) to provide the greatest coverage and protection from today’s dynamic environment.

Why is a POC Needed?

Many financial institutions evaluate the benefits of image analysis via the use of a Proof of Concept (POC). The main goal of a POC is to identify detection rates and incremental “lift” from CSV, ASV and alteration detection.

A simple image export of real account history (including check images) paired with fraud case examples provide the data necessary to complete a POC. Once the images are received, a POC can many test cases:

- Check Stock Verification – Counterfeit Detection

- Automated Signature Verification – Forgery Detection

- CAR vs LAR Verification – Amount Alteration Detection

- Image Analysis using ALR – Pre-authorized draft/Remotely Created Check Detection

- CAR/LAR Recognition – Inflated Amount Detection

- Transactional Analysis – Serial/Amount Out of Range Detection

- OCR Recognition – Payee Positive Pay for Alteration Detection

- Payee Recognition – Account Holder Name Matching (Deposit fraud)

It’s a robust list, but additional fraud use cases can also be tested.

POC Results: What to Expect

When OrboGraph completes a POC, we provide a very detailed review of the overall impact. A summary of each test performed is provided along with “raw” score results. This way, the FI has all the data points to review and can estimate the incremental “lift” above existing transaction systems.

If the POC is successful, then the next step would typically be to:

- Consider strategic implications to the FI

- Start your business case based on loss prevention and operational improvements

- Focus on most problematic use cases

- Evaluate scoring integration with review platform and data analytic system

Conclusion

A POC is a valuable tool to help analyze the functions of the software, and estimate the results for the business case justification. For more information on running a POC with OrboGraph, contact joe.gregory@Orbograph.com.