How to Stop Check Fraud at the Paying Bank

It’s no secret that check fraud is an issue plaguing the banking industry. Since the release of the 2019 ABA Deposit Account Fraud Survey, we’ve seen what appears to be a 3X spike in fraud attempts -- exacerbated by the COVID-19 pandemic. Couple that with prevention rates which many times falls significantly under 90% and you have a combination which is not sustainable for the financial industry.

Various credible sources have reported on this, including:

- Exploration of Check Fraud in 2020: Significant increase in On-us check fraud attempts and modest-to-significant increase for deposit check fraud attempts from 2018 to 2020.

- The 2022 NICE Actimize Fraud Insights Report: attempted fraud dollar value for checks increased 106% in 2021.

- 2021 AFP® Payments Fraud and Control Report: checks and ACH debits were the payment methods most impacted by fraud activity (66 percent and 37 percent, respectively) in 2021.

For a comprehensive list of primary and secondary research, industry trends, and 3rd party reports on check fraud, visit the #OrboIntelligence Check Fraud Resource Hub.

The Difference Between On-us and Deposit Fraud

Financial Institutions (FIs) can realize check fraud losses, referred to as charge-offs, in two primary ways: through either deposited items or inclearing items.

What’s interesting is that a check deposited at the bank of first deposit (BoFD), can create a charge-off at either the BofD or at the paying bank. FI’s are incentivized to have strong fraud defenses in both deposit processing and paying bank functions to minimize losses. As an example, an FI with poor deposit fraud defenses can allow for many fraudulent checks to enter the banking system! A bank with poor inclearing fraud detection exposes their clients to additional fraud risk and a poor customer experience.

Two New Major Entry Points: mRDC and ATM Deposits

During the pandemic, mobile banking usage increased by up by 200 percent, leaving FIs vulnerable to risk since fraudsters no longer had to personally risk entering physical branches. Additionally, ATM fraud has spiked as well.

According to a recent interview with PYMNTS.com, Bill Roese, Chief Risk Officer of Ingo Money noted the following:

“People think that checks are nearly extinct, but the fact is that there are billions of dollars still being deposited through checks,” Pickering noted. “The other factor that has really changed the game is remote deposit capture. A lot of banks didn’t make remote deposit capture available until the last two years, or they throttled it and prevented access to their customers or restricted access.”

Remote capture is an incredibly convenient means of depositing funds, but also a boon to fraudsters who may not be all that experienced or willing to "go the extra mile" to pull off a scam. In fact, persons not previously predisposed to criminal activity may be tempted by the ease with which fraud can be executed.

Required Technologies at the Paying Bank

With these new entry points vulnerable to fraud attacks, the paying bank must be more diligent in their defenses. Fraudsters are becoming smarter, and they create fake and altered checks in many ways targeting FIs with weaker customer defenses.

So, what is needed for the paying bank to deter these attacks? The detection approach MUST include two pieces: image forensics and transactional analysis.

Image forensics refers to the use of image analysis technologies based on AI with deep learning models. There are several primary image forensic analyzers which must be deployed at the paying bank.

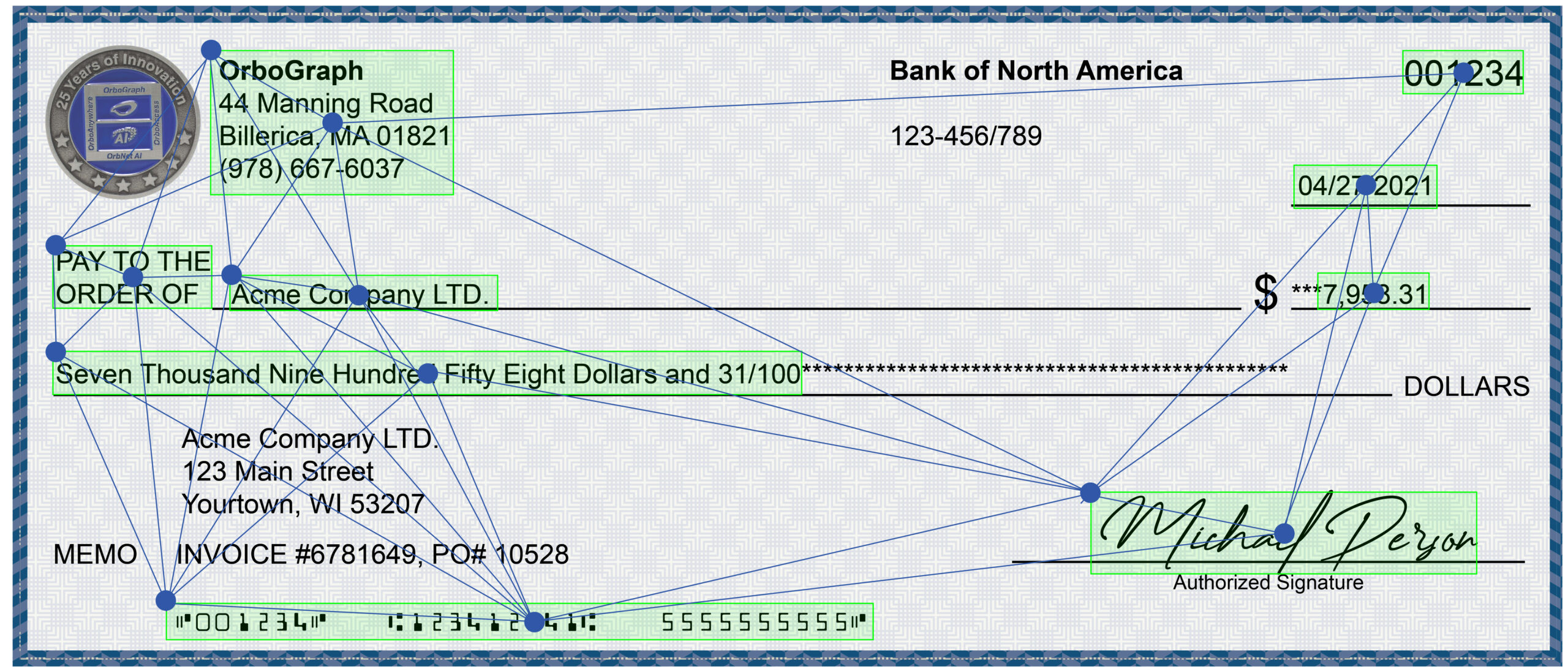

Check Stock Validation (CSV-AI)

Check stock validation is a specific analyzer which compares the image of a newly presented check to historical check images to authenticate the check stock. The solution helps institutions more effectively identify counterfeit in-clearing checks with greater speed, accuracy, and reliability than visual inspections. CSV-AI leverages technology to spot aberrations that cannot be detected by the human eye. It also reduces the number of manual verifications and decreases false positives through digital check image analysis.

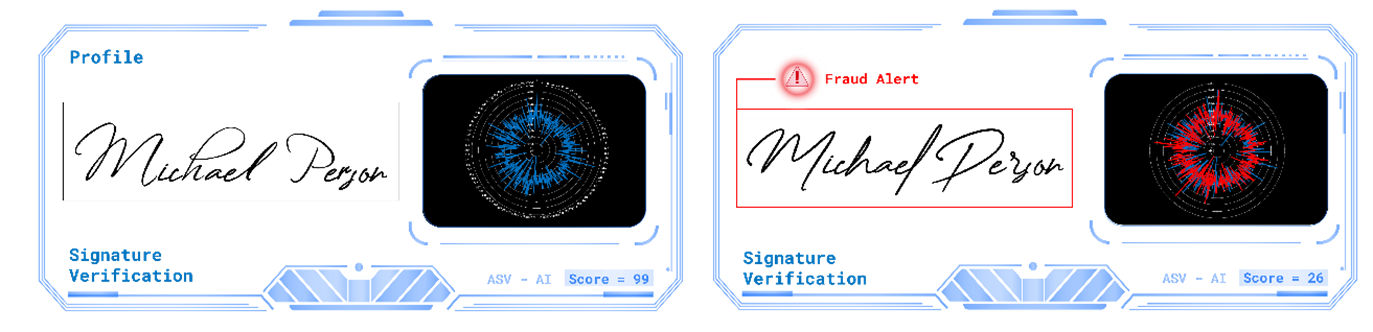

Automated Signature Verification (ASV-AI)

This solution uses a different form of deep learning technology which looks at 512 features of each signature. This results in a very efficient inspection of every check presented for payment, like a forensic analyst.

ASV-AI compares digitized signatures to referenced images, manages multiple signatories on the same account, and monitors items requiring dual signatures to validate check signatures on personal and business accounts. ASV-AI analyzes dynamic aspects of signature fragments, handwriting trajectories, and geometric analytics, producing confidence scoring based on these elements when comparing newly presented check signatures with previously saved images.

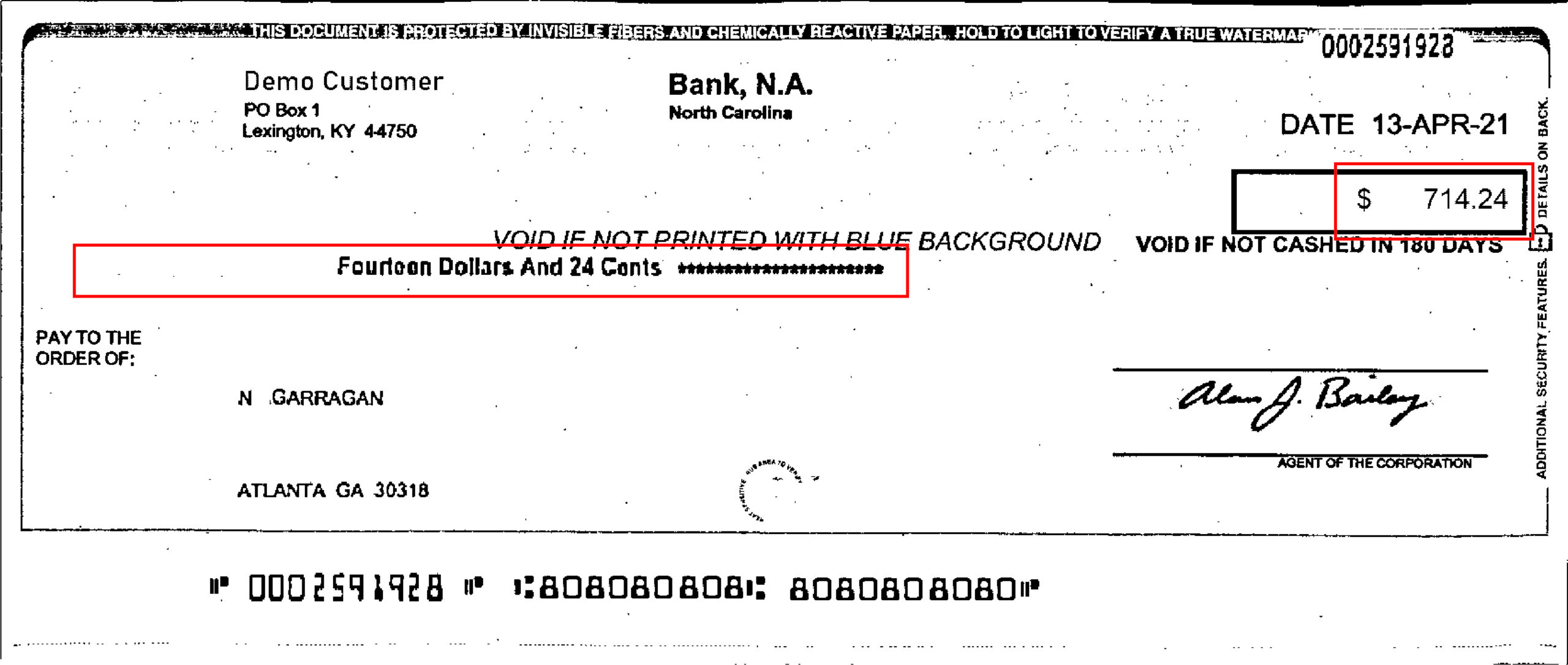

Alteration Detection

Alterations to checks typically occur in the amount fields (CAR/LAR) or the payee field, but can extend beyond these fields as well, including the date. In many cases, alterations also include washing the check and recreating these new fields for a fraudulent transaction.

When an altered check hits the paying bank’s inclearing file, it can be difficult to detect when a skilled alteration is created. However, new technologies analyzing multiple fields of the check as well as new payee recognition and matching can help identify this kind of fraud use case.

For example, related to an altered payee field, a positive pay system can use new AI technology to read the payee field and match the result to a payee issue file provided by the business. Additionally, running a check style analysis for inconsistencies on the check -- such as different fonts, along with CAR/LAR discrepancy -- is very effective as well.

Transaction & Account Analysis

Transaction analysis is the process of examining bank transactions to look for unusual and suspicious activity or other issues. This key component for the paying bank scrutinizes check numbers and check amounts as well as duplicate check numbers to identify suspicious items out-of-range. It also applies tests at the account level, measuring deviations from the norm.

These transaction results are then merged into an intelligent voting scheme along with image forensic scores in order to optimize the detection process.

Conclusion:

Fraudsters have expanded their check fraud operations. Five years ago, a paying bank could afford to rely on humans to essentially skim their inclearing work. Not today. A blended technology approach using image forensics has become a necessity for not only large national banks, but regional and community banks as well. To learn more about image-forensic AI technology for check fraud detection, click the button below.

About OrboGraph

OrboGraph LLC and OrboGraph LTD (www.OrboGraph.com) -- an independent company of Revenue Management Solutions (RMS) and part of the Thompson Street Capital Partners (www.tscp.com) portfolio of companies -- are based in Burlington, Massachusetts, Rehovot, Israel, and remote payments industries. Established in 1995, OrboGraph assists over 4,000 financial institutions and corporations in automating the process of depositing paper-originated negotiable items (checks, money orders, preauthorized drafts, etc.) and increasing check fraud detection capabilities for deposit and on-us fraud.

OrboGraph is focused on the optimization and automation payments and fraud detection for financial institutions. OrboGraph continues its investment and research & development on traditional payment channels such as checks -- the channel most in need. Through our OrbNet AI and OrbNet Forensic AI technologies, banks are able to achieve straight-through processing -- achieving over 99%+ read rates -- and increase check fraud detection capabilities.

Our software processes billions of checks and internal tickets per year across a wide range of Omnichannel workflows, including: centralized proof of deposit, teller capture, branch capture, regional processing centers, retail remittance, wholesale lockbox, service bureaus, image exchange, remote deposit devices, Mobile RDC, ATMs, check cashers, and point of sale devices.