Investing in Check Fraud Tech — The Need and The Cost

- Check fraud is growing

- We are on track to see another increase in '23

- Fortunately, investing in newer tech to combat fraud is affordable

Check fraud continues to be a growing and significant problem for US banks.

S&P Global reports that, between 2018 and 2022, suspicious activity reports for check fraud at banks increased over 200%. Check fraud now makes up over one-third of all reported fraud at banks.

With 447,525 SAR check fraud reports in 2023 through October, this year is on track to beat the 2022 surge. Check fraud SARs have increased more for personal or business checks than for any other financial instrument.

Some key points addressed by S&P Global include::

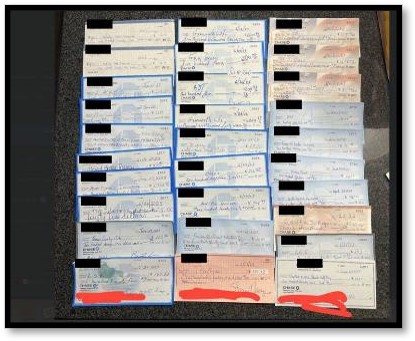

- Criminal networks are exploiting checks -- which are easy to alter or counterfeit -- after stealing checks from mailboxes and postal workers.

- Fraud schemes are becoming highly sophisticated, using tools like Photoshop and stolen personal information to replicate checks and signatures.

- Banks like Regions Financial lost over $100 million to check fraud this year. Others, like ServisFirst and Truist, also reported increased losses.

Increase Investment in Tech

Point Predictive Chief Fraud Strategist Frank McKenna notes that much of the tech that banks currently rely upon for check fraud prevention dates back to the 1990s, and the cost of investing in newer -- and more effective -- tech is affordable, even for community banks.

"It's a fraction of the cost of the fraud," McKenna said. "AI, pattern recognition and machine learning, all that has come a long way."

As we've noted in our blog, there are several complementary technologies that financial institutions can marry together to create a strong defense against check fraud. Many of these technologies are now boosted by the integration of AI and machine learning technologies, including image analysis. Previous iterations used algorithms and outdated OCR technologies to analyze the images of checks.

Now, financial institutions are leveraging image forensic AI technology. Based on the principles of forensic document examination, this tech is able to prevent over 95% of targeted use cases, while driving a high level of accuracy -- reducing false positives.

The technology is readily available to financial institutions -- and affordable. Those who wait to invest later will be the ones suffering most.