Jack Henry & Associates: 50% Increase in AML Fines Levied in 2022

- 50% increase in anti-money launder fines and penalties levied on FIs in 2022

- 95% of AML execs are prioritizing AI and ML for AML

- Fraudsters "jamming the system" with massive amounts of attempts

A post at Jack Henry Fintalk discusses Anti-Money Laundering strategies -- and how a rising number of financial institutions are being penalized for falling short:

2022 saw a shocking 50% increase in fines and penalties levied against FIs for flaws in their AML systems. The Federal Trade Commission reported that consumers lost $8.8 billion in 2022 (up 30% from 2021), primarily the result of online imposter scams. Institutions like yours find themselves on the hook for most of these losses, due to regulatory and legal obligations to make accountholders whole.

Indeed, the demand and expectation for online services for "virtually everything" has put some banks in an uncomfortable position, to say the least.

Over the last few years, banks and credit unions have found themselves struggling to acclimate to the burgeoning digital demand of today’s consumers. Meanwhile, fraudsters and launderers were expanding into a newly discovered “Wild West,” hastily pioneering new strategies able to evade status quo monitoring efforts.

AI and ML Provide Evolving Fraud Solutions

Part of the problem is that older manual and automated systems are being outpaced by modern fraud techniques. Fortunately, Artificial Intelligence and Machine Learning are stepping up:

One of the most interesting and promising solutions emerging on the financial crimes scene is the development of software solutions featuring artificial intelligence (AI) and machine learning (ML). PYMNTS reports that “95% of AML executives consider it a top priority to use innovative solutions to enhance fraud detection and AML compliance, such as machine learning, artificial intelligence, and cloud-based platforms.”

One of the issues faced by traditional automated solutions leveraging rule-based analysis are false positives, which was once "a reality that financial institutions had to accept." However, today's fraudsters are using tools that allow huge amounts of attempted fraud with very little effort, effectively "jamming the system."

AI and ML, however, are equipped to handle huge amounts of input:

The algorithms and models employed by ML and AI-based applications can analyze extremely high volumes of data almost instantaneously. They can detect anomalies and slight changes within the data that are well beyond the scope of rules-based systems or the human eye. This results in alerts of consistently higher quality, as systems learn what to ignore versus what is truly meaningful.

...The algorithms and models employed by ML and AI-based applications can analyze extremely high volumes of data almost instantaneously. They can detect anomalies and slight changes within the data that are well beyond the scope of rules-based systems or the human eye. This results in alerts of consistently higher quality, as systems learn what to ignore versus what is truly meaningful. Analysts and investigators spend more of their time looking at transactions exhibiting a higher probability of financial misconduct and far less time engaged in the slow and tedious process of separating genuine criminal activity from erroneously flagged items.

Time to Embrace AL and ML to Fight Fraud

Given the sophisticated tools that are made readily -- and inexpensively -- available to fraudsters, it's incredibly important to do whatever is possible to stay one step ahead. Fraudsters will utilize any tactics to their advantage, including basic strategies like flooding the system -- or "jamming the system" -- with thousands of attempts. And, as long as a portion gets through, they will consider the scheme successful and “rinse & repeat” without considerable effort.

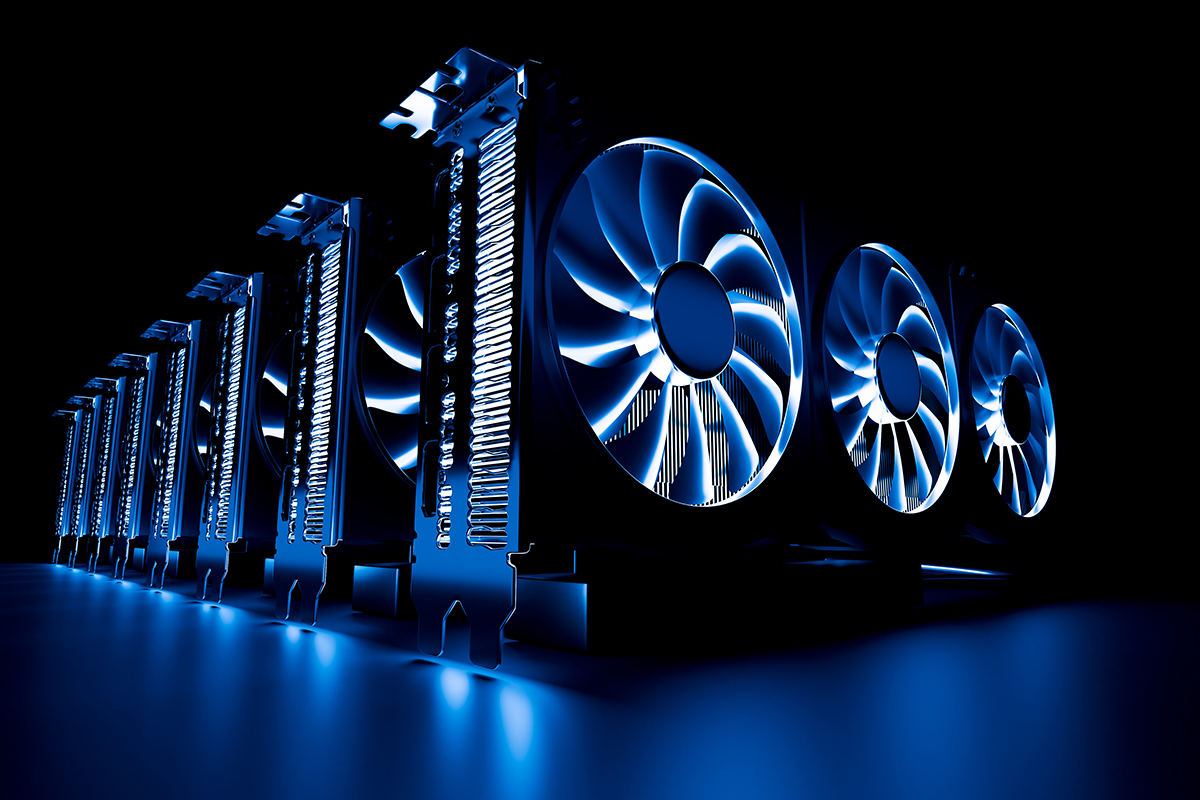

That's why fraud systems that utilize AL and ML technologies are the perfect technology to combat the fraudsters -- whether it's for AML purposes or specific payment channels like checks. AI and ML leverage GPUs to power their systems. GPUs are able to handle larger amounts of data vs a CPU -- enabling financial institutions to reduce latency. And, while many financial institutions are concerned with costs, more affordable GPU options like the NVIDIA A10 Tensor Core GPU have proven effective in handling large workloads -- a GPU that has been successfully utilized for deploying our OrbNet AI for check recognition and OrbNet Forensic AI for check fraud detection.

Whether financial institutions are looking for more accurate results, reducing the number of false positives, or handling large amounts of data, it's critically important to deploy AI and ML technologies to combat the fraudsters.