Judge Judy Takes On Check Fraud

- Check fraud visits Judge Judy's courtroom

- The plaintiff was actually confronted with two unrelated check fraud attempts

- Judge Judy has no time for dilly-dallying

The Honorable Judith Susan Sheindlin, most recognizably known as "Judge Judy," is a former prosecutor and Manhattan family court judge turned TV personality. Many people know her from the daytime TV show aptly named "Judge Judy," where she takes on a variety of cases. It is no surprise that she is taking on one of the most common cases of fraud these days: Check Fraud.

Before we dive into this case, it is important to understand that these cases are real and have already been resolved in the court of law -- the claimants and defendants are REAL people. When they appear on the show, these individuals are able to provide their testimony and evidence, but the case has already been resolved and being "reenacted," so to speak, in Judge Judy's court -- where Judge Judy relies on the courtroom briefs to pass down her final verdict.

With that said, let's dive into the drama!

In the case, a woman is suing a former "boyfriend" for, among other things, check fraud. Judge Judy shrugs off additional accusations of parking ticket and license plate-related crimes; she wants to get right to the check fraud.

The scam turns out to be a fairly common one: after dating for about a month, the defendant explained to his accuser that his bank account was in "negative," meaning that if he were to deposit two checks he had in his possession, they would not get him out of deficit and free up money for him. This money, he further explained, was needed for his daughter.

Account Holder Liable for the Deposited Fake Checks

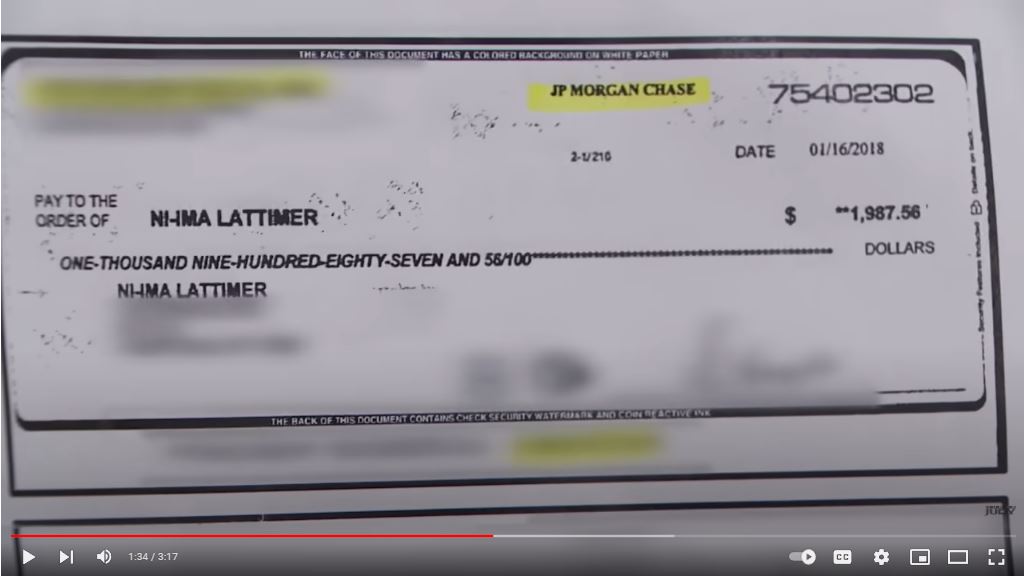

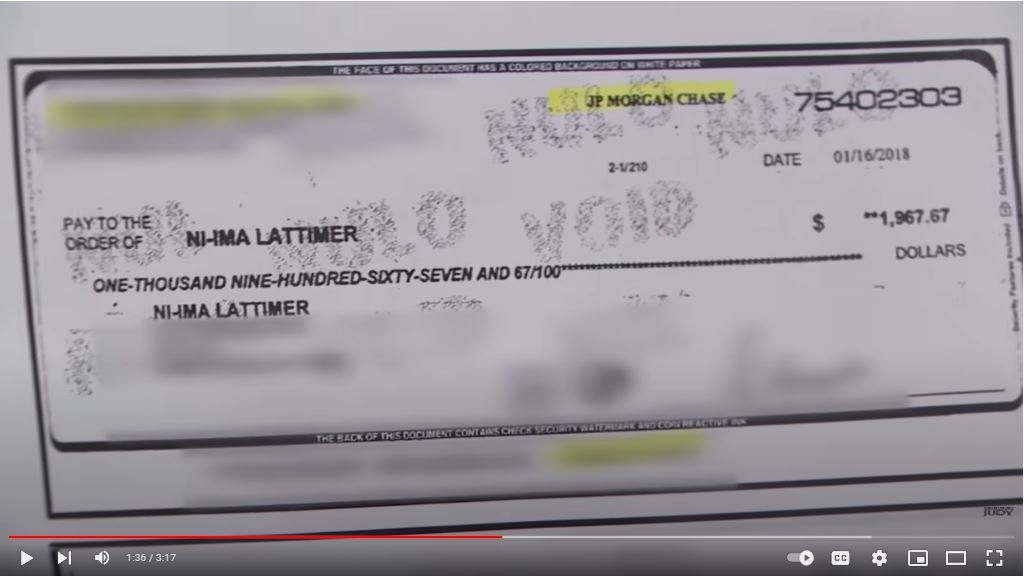

As you can see from the images below, the check images deposited appear to be legitimate checks. The accuser gave the defendant her bank information so he could make the deposit; once cleared, she withdrew funds and gave him the money he requested.

The bank learned -- after funds were disbursed -- that the checks were fake. This, of course, made the woman a victim of check fraud theft, as she was liable to return the funds.

The accuser then provides evidence and details about the police report filed; however, because the police were not able to corroborate that the defendant created or deposited the fake checks, there was nothing they could do. This was verified in the evidence presented, which can be assumed is a copy of police report, stating "Compl[ete] reports an unknown deposited checks into her Nefcu account and withdrew funds. For bank purposes."

When confronted with the evidence, the defendant claims he had nothing to do with them. However, the text messages submitted as evidence told a different story.

Additional Check Fraud?

What is interesting -- and fairly telling about the prevalence of this sort of fraud -- is that the accuser also brings up as an aside a check she received in the mail where she is invited to deposit a large amount and take some out to send back to the scammer. It has little or nothing to do with the case being discussed, but illustrates how common and varied check fraud can be.

Judge Judy takes on a case similar to this, where a daughter puts her trust in a fellow student, had a check deposited into a joint account with her mother, and withdrew the funds believing that she would receive half the money. Unfortunately, this was a bad check and her mother ended up suing her daughter for the lost funds. You can check out part 1 and part 2 on YouTube.

Entertainment, or an All-Too-Common Scam?

While the cases are presented for entertainment purposes, these are all too common check fraud scams that victimize innocent people everyday. Financial institutions need to continue to educate and warn their customers to watch for these types of scams and protect their accounts.

On the back end, financial institutions are able to protect themselves and their customers by deploying different technologies leveraging AI and machine learning to stop fraudsters in their tracks. If the depositing banks utilized transactional analysis and image forensic AI, it's likely that these checks would have been flagged and payment stopped before the funds were made available.

Check fraud isn't going away overnight, and it incumbent on all parties -- account holders, their financial institutions, law enforcement, and even Judge Judy -- to spread awareness and protect society from these types of scams.