NICE Actimize: Attempted Check Fraud Up +171% in 2022

- Check fraud continues to rise

- Check fraud has grown disproportionalty compared to other channels

- Checks haven't changed in decades, making an easy target

The latest NICE Actimize article is available for download, and it's called Check Fraud Running Rampant in 2023.

Talk about getting to the point!

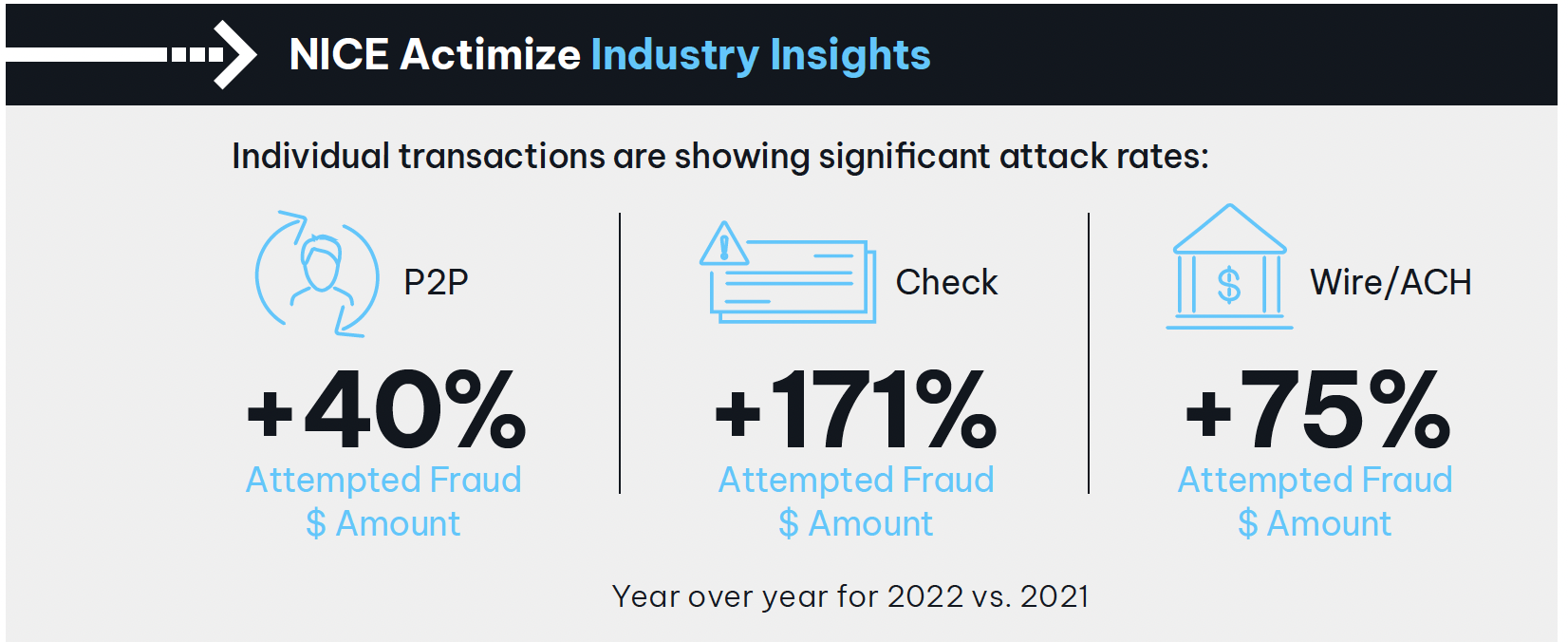

The report is full of valuable information and data, including a rather startling look at where checks stand in the hierarchy of payments fraud increases from 2021 to 2022.

NICE Actimize Image

It's not hard to see the substantial lead checks have over P2P and Wire/ACH.

As summarized by in the report's introduction:

The 2023 NICE Actimize Fraud Insights Report shows a significant spike in check fraud that correlates to first-party deposit fraud. In this scenario, bad actors are opening bogus bank accounts for the sole purpose to defraud the bank. This is done by depositing forged or counterfeit check items into accounts, then depleting the accounts before the funds are reversed.

An even more alarming scenario is consumers falling victim to scams: They receive fraudulent checks from fraudsters, deposit the items into their accounts and are told to keep some, but send a majority to the fraudster. The fraudulent funds are later returned, leaving accounts in overdraft. Typically, these funds are charged off by financial institutions.

Why Checks Lead the Way in Fraud

One of the reasons cited for checks becoming the by-far most popular target is the fact that they really haven't changed or evolved much over time. Computers make check doctoring easy, and the dark web does a brisk business in selling accounts. And, of course, stealing mail has become more and more common and brazen.

As stated in the NICE Actimize report, fraud analytics teams need technology and tools to assess the risk with check items.

This includes:

When taking into account the four technologies recommended by NICE Actimize, these all are components that make up image forensic AI for check fraud. The technology leverages the latest AI and machine learning models -- trained with millions of checks -- to interrogate and analyze images of deposited checks for counterfeits, forgeries, and alterations, referencing profiles of previously cleared good and bad checks.

While there is not a single solution that can fight check fraud alone, image-forensic has all the components to be an effective tool against fraud.