Welcome to OrboNation, the premier industry blog from OrboGraph. In a landscape where financial technology is constantly advancing, OrboNation serves as a centralized hub for professionals to explore the latest innovations in check processing automation.

Our blog provides deep-dive commentary on the most critical topics in the field, ranging from the evolution of omnichannel capture to the transformative power of Artificial Intelligence (AI) and Deep Learning in banking. OrboNation delivers the expert insights, research, and technical updates you need to stay at the forefront of the industry.

The Latest

Platform Modernization Through Fintech/Core Provider Integrations

OrboNation Newsletter: Check Processing and Fraud – Best of 2025

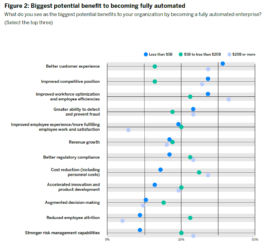

76% of Banks Have Implemented New Automation Technologies

Modernizing the Payments Stack for Operational Efficiencies and Revenue Growth

Why Speed and Latency are Critical in Check Processing

Goldman Sachs CEO: AI Is NOT a Job Killer for Banking

OrboNation Newsletter: Check Processing and Fraud – November 2025

Phyllis Meyerson’s Lasting Legacy: The Blockbuster Story Behind Check 21

US Government Tempering Deadline for Paper Check Disbursements Elimination

Are Interactive Teller Machines (ITMs) The Future of Banking?

OrboNation Newsletter: Check Processing and Fraud – October 2025

Overcoming the Barriers of Adopting Innovative Technologies

The U.S. Treasury Department Publishes Resources Page for Transition to Digital Payments

Government Check Elimination: Will SMBs Follow?

Data Accuracy Concerns for AI — NOT an Issue with Check Processing

OrboNation Newsletter: Check Processing and Fraud – September 2025

Regulatory Roadblocks: Why Agentic AI Faces Unique Challenges in Banking

Quinte Financial Technologies and OrboGraph Partner to Modernize Check Fraud Detection and Case Management for Financial Institutions

Federal Reserve Begins “Technical Research” Into Payment Modernization Technology

OrboNation Newsletter: Check Processing and Fraud – August 2025

Core Banking: Integration, Not Reinvention

Transforming Technology – Legacy or Limitation?

Singapore’s Efforts to Eliminate Corporate Paper Checks — Will Results Mirror Other Countries?

MICR: Do We Need Magnetic Ink Anymore?

OrboNation Newsletter: Check Processing and Fraud – July 2025

Paper Checks: Payment Substitutes are NOT Universally Reliable According to Atlanta FED

Could Cryptocurrency be a Solution for Government Disbursements?

Acquiring and Retaining Small Business Accounts: Time for a Banking Refresh

OrboNation Newsletter: Check Processing and Fraud – June 2025

How Financial Institutions Can Help Push Payment Modernization to Businesses

For 66% of Zillennials, Mobile Phone = Bank Branch

Government Phasing Out Treasury Checks? Well, Not All…

Closing the AI Gap in Banking: Leveraging Low-Code and No-Code Platforms

OrboNation Newsletter: Check Processing and Fraud – May 2025

Evolution from Tellers to Universal Bankers: A Work in Progress

Bank Branch Dynamics: Expanding Physical Foot Print to Enhance Customer Service

7 Key Factors for Successful Banking Platform Modernization

Modernizing Payments Back-Office Crucial for Survival

Product Innovation Briefing: OrboGraph Releases OrboAnywhere Turbo V6.0

Why We Can’t Just “Write Off” Paper Checks

OrboNation Newsletter: Check Processing and Fraud – April 2025

AFP Survey: Despite Fraud Risks, Paper Checks Surged in ’24

Modernizing Banking Technology Through “Composability”

The Future of Open Banking Relies on Today’s Technology

33% of US Consumers View Physical Branches as “Essential”

Review your check processing needs with an OrboGraph expert.

Sign up below for your complimentary assessment or to request

estimated solution pricing from OrboGraph.