Reasons for the Low Adoption Rates of Positive Pay

- In spite of its effectiveness, Positive Pay is not yet adopted universally

- Adoption of Positive Pay is expected to increase over the next two years

- Positive Pay is an essential tool for check fraud detection, but cannot detect the majority of check fraud alone

Positive Pay is an essential tool for check fraud detection. In fact, according to the NEACH Payments Group (NPG), 77% of businesses report a significant decline in check fraud attempts or losses when using Positive Pay.

However, even though Positive Pay is proven to be effective, adoption remains low.

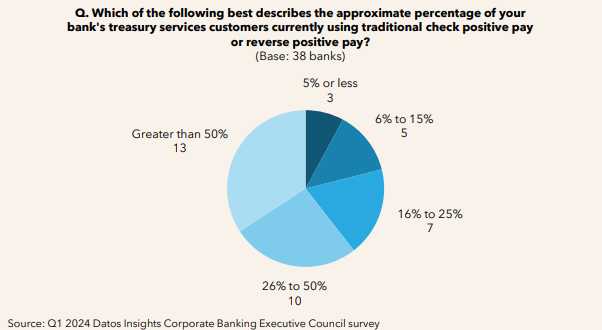

According to research by Alkami in conjunction with Datos Insights, 65% of financial institutions have less than half of their treasury service clients using positive pay, and 39% have less than 25% adoption.

This low adoption is a major reason why only 29% of U.S. financial institutions are satisfied with their current positive pay usage rates.

So, why such low adoption rates?

Factors Leading to Low Adoption of Positive Pay

In a article from Alkami, Kristen Bryce, Senior Product Marketing Manager at Alkami, lists several factors for low adoption:

- FIs are only offering Positive Pay reactively – 42% of banks admit they only promote Positive Pay after fraud occurs.

- Unmotivated Sales Team – Sales teams are not offered bonuses for selling Positive Pay, nor do they have goals or mandates associated with it.

- Usability of the Technology – 35% of banks cite usability issues, making it hard for businesses to integrate Positive Pay into their workflows.

- Small to mid-size businesses (SMBs) don’t even know it exists – 23% of SMBs say their banks never even mentioned Positive Pay.

The Future of Positive Pay Looking Up

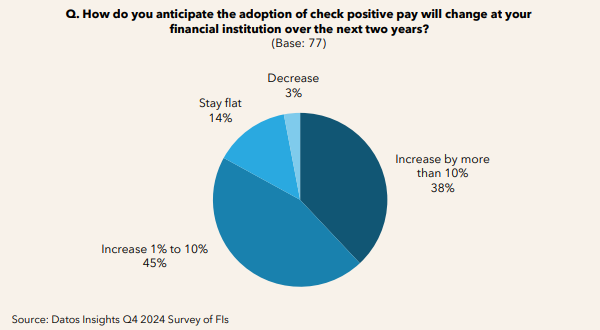

Fortunately, it appears that more financial institutions will be pushing Positive Pay in the near future. According to Alkami's research, over 75% of banks expect check positive pay adoption to rise in the next two years.

Ms. Bryce offered the follow tips to increase adoption:

- Provide education to business clients

- Increase training for sales teams

- Require Positive Pay for high-risk clients

- Incorporate Positive Pay as part of overall fraud tools

Is Positive Pay Enough?

While standard Positive Pay is an essential tool for check fraud detection, it isn't enough to detect the majority of check fraud -- it only matches the check number, dollar amount, and account number of each check presented against a list provided by the business.

As we've noted previously, many FIs are "supercharging" their Positive Pay systems. There are several new technologies able to provide positive pay systems with major boosts, including:

- Payee Positive Pay: Advancements in optical character recognition and payee matching have revolutionized Positive Pay systems, allowing a comprehensive approach that matches the payee name to payee issue file source, building a strong deterrent to payee alterations.

- Field Validation: New technologies enable FIs and their corporate clients to validate additional fields like signature, date, and payor to provide a more robust fraud-detection process.

- Consortium Data: Positive pay systems are receiving a boost from consortium data. As noted in a previous article, technology vendors like AFS are able to take the extracted data and compare it to their consortium data to provide extra protection from check fraud.

- Dark Web Monitoring: Many stolen checks end up on the dark web or other channels like Telegram. Deploying a dark web monitoring solution scours these channels to detect compromised checks or accounts -- putting FIs in a proactive position as they fight check fraud.

By integrating multiple technologies in the fight against check fraud, FIs and their businesses can achieve detection rates high as 95%, significantly reducing losses.