Reuters: Over 185K Check Fraud Related SARs Reported in 2023

- 2022 saw a huge increase in SARS reports

- Check fraud led the way in 2022

- The check fraud trend so far in 2023 indicates that it will surpass 2022

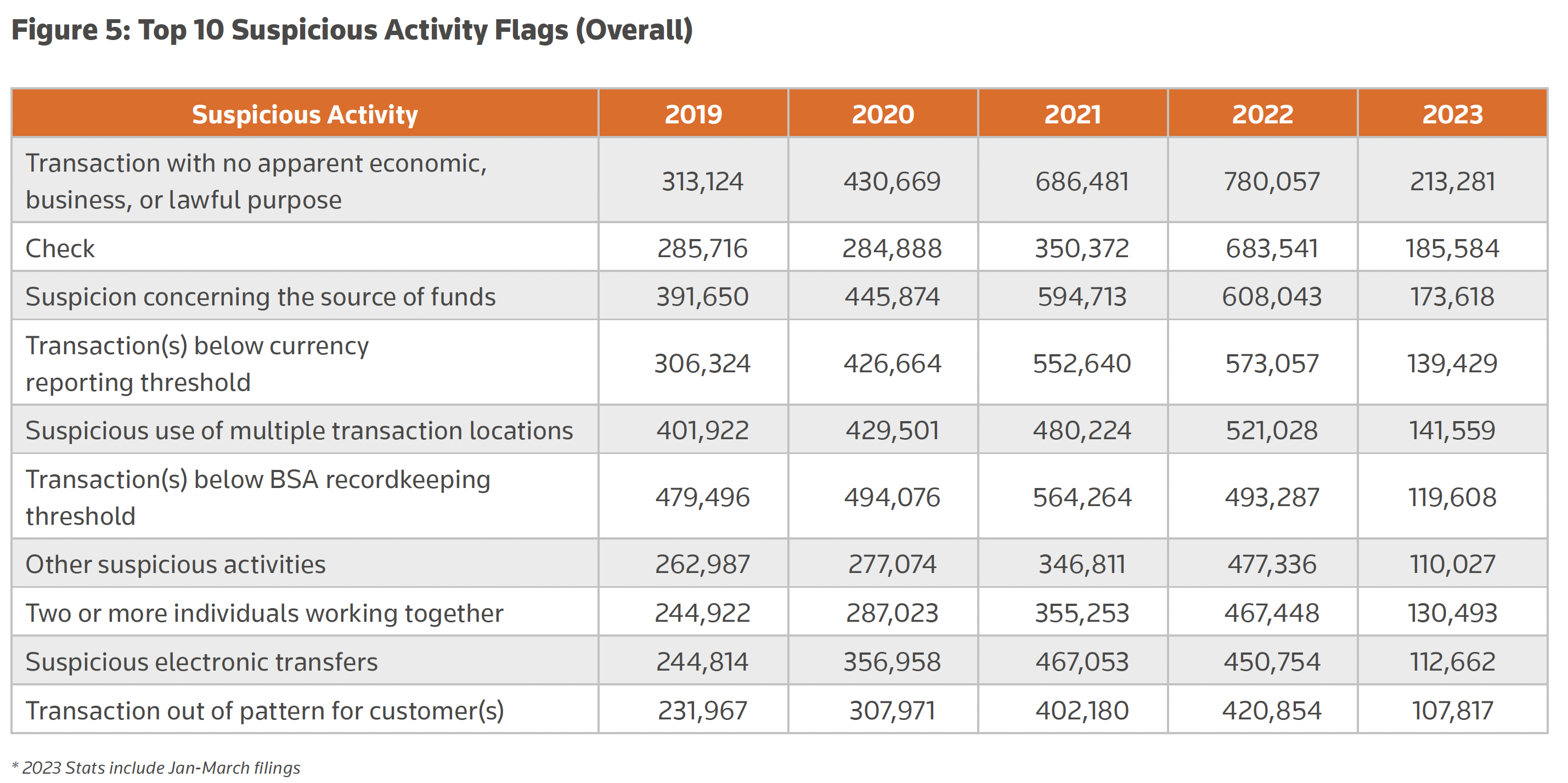

According to the Thomson Reuters Regulatory Intelligence special report based on analysis of public data released by the U.S. Treasury Department’s anti-money laundering (AML) unit, FinCEN, there has been a significant increase in SARs (Suspicious Activity Reports) recorded in 2022.

The report shows that SARs filings soared in virtually all categories -- with particularly massive spikes in human exploitation, elder fraud, and government-related benefit scams are noteworthy. Such vulnerable populations have grown in both size and susceptibility, especially among migrants and the elderly.

As noted on page 23 of the report:

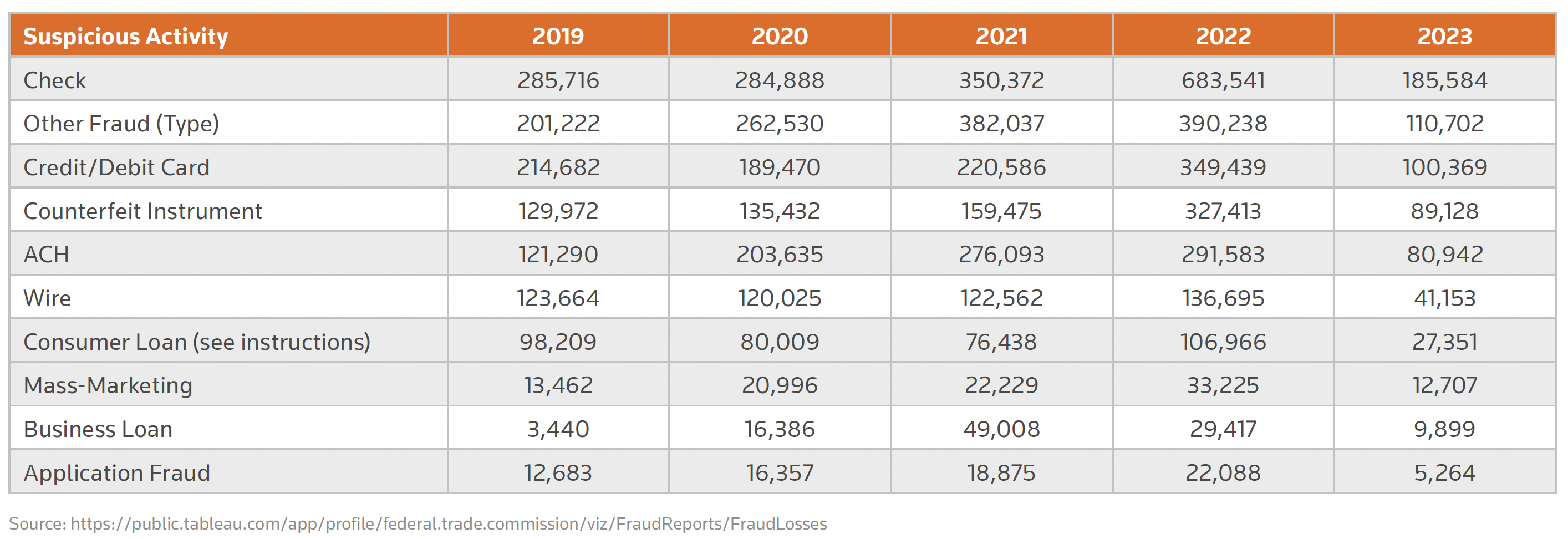

"Check fraud, was by far the most prevalent fraud type reported in 2022, with over 680,000 SAR filings. It was the second largest of all SAR categories that year. While firms have responded by reinforcing their anti-fraud organizations overall, they have focused particular attention on check fraud. While firms have responded by reinforcing their anti-fraud organizations overall, they have focused particular attention on check fraud."

Check Fraud Continues to Surge in 2023

According to Reuters, we're seeing a continued surge in Q1 of 2023:

If the trend stays constant, check fraud will hit 800K for the year -- yet another "growth spurt" for check SARS filings.

Reuters provides indicators for check fraud, including:

- Uncharacteristically large withdrawals from a customer’s account via check to a new payee.

- Customer complaints about checks stolen from the mail and deposited into unknown accounts.

- Complaints about mailed checks never reaching intended recipients.

- Checks used to withdraw funds appear to be made of a noticeably different paper stock than that used by the issuing bank or other stock used for known, legitimate transactions.

- Existing customer with no history of check deposits has new, sudden check deposits and withdrawals or transfers.

- Non-characteristic, sudden, abnormal deposit of checks, often electronically, followed by rapid withdrawal or transfer.

- Examination of suspect checks reveals faded handwriting underneath darker handwriting, suggesting that the original handwriting was overwritten.

- Suspect accounts may exhibit indicators of other suspicious activity, such as pandemic-related fraud.

- New customer opens an account that is seemingly used only for the deposit of checks followed by frequent withdrawals and transfers.

- A non-customer who attempts to cash a large check or multiple large checks in person and, when questioned by the financial institution, provides an explanation that is suspicious or potentially indicative of money mule activity.

How to Reverse the Trend

Reuters offers this piece of advice to financial institutions to combat fraud, particularly when it comes to checks:

Institutions should also be working to reduce unproductive alerts and working to leverage technology to combat fraud proactively. Additionally, there is a growing need for qualified subject-matter experts to examine trending fraud practices.

When it comes to technology, financial institutions need to look at complementary technologies that effectively leverage AI and machine learning to combat check fraud. This includes transactional analytics to monitor account behaviors and image forensic AI to analyze the images of checks.

Furthermore, banks are investing in dark web monitoring technologies to scour the underground marketplace for account information, account holder information, and images of checks to proactively take action before funds are lost.

There is no "silver bullet" or single solution that is able to eliminate check fraud. Combining multiple technologies that complement one another, however, will provide the best detection strategy possible.