Use Case: How A Stolen Check Led to Identity Theft and Fraud

- Check fraud is on the rise

- Fraudsters require depositor information to pull off scams

- ID theft is growing as a result

Jenna Herron, a columnist at Yahoo Finance, recently found herself on the wrong side of a case of identity theft.

Not long ago, someone posed as me at three bank branches and drained thousands of dollars from my checking account.

Chances are higher now that something similar will happen to you.

This kind of old-fashioned in-person identity theft is on the rise after fraudsters grew more sophisticated during the pandemic, improving their illicit supply chain that makes it easier to pull off these crimes.

In-person identity theft is on the rise, with criminals posing as victims to steal money from bank accounts.

ID theft swelled during the pandemic when the federal government delivered $5 trillion in relief, and criminals "skilled up" at creating fake identities and stealing existing ones to fraudulently claim these benefits.

The Check Connection

Given the success fraudsters were having with using false identities to pilfer funds, stolen checks became another fairly simple way for criminals to obtain the information needed to commit identity theft:

These stolen checks can come from home or car robberies. Another fertile ground for these crimes is the US postal system. Some mail carriers simply steal them from the mail they are supposed to deliver. In other cases, thieves rob the carriers themselves or the iconic blue mailboxes found on public sidewalks.

As we previously noted, stolen checks contain the foundation information for identity theft. Fraudsters are able to gain an individuals full legal name, address, and many times the phone number. With this information, a fraudster can perform a plethora of activities (click here to see a full list).

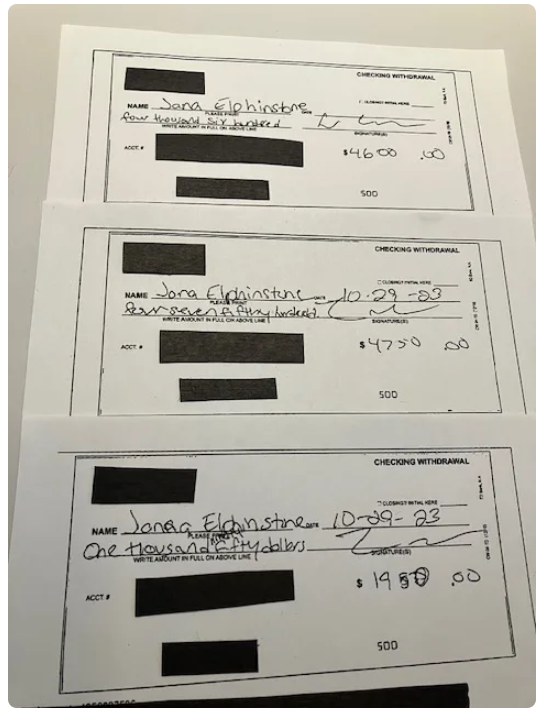

In Ms. Herron's situation, the stolen check was traced back to a missing check that was mailed to her parents years ago. As you can see from the images provided, the fraudster utilized the information from the stolen check -- which was Ms. Herron's maiden name -- and had a fake ID created. The fraudster most likely utilized a mule to then walk into the bank and make the withdrawals from a teller.

Source: Yahoo Finance

As seen in this case, stolen checks can be utilized for a variety of different fraud schemes. While this instance seeming only led to identity theft and withdrawal of funds -- most likely via a mule -- a fraudster could essentially "double dip" by also altering the stolen check or utilizing digital tools to counterfeit the check.

Just as companies offer services to scour the dark web and other channels like Telegram for personal information, there are organizations doing the same for stolen checks. As long as fraudsters can successfully pilfer mail, these stolen checks offer criminals with an easy way to commit check fraud, identity theft, and more. By deploying AI and machine-learning technologies, financial institutions can help protect their customers and their accounts.