Video Interview with Aite-Novarica Group: Exploring Check Fraud Technologies

- Check fraud is growing ahead of other types of fraud

- Banks using only legacy fraud detection systems are falling behind

- Integration of legacy and image analysis systems brings greater success in fraud detection

In a new video at FraudToday.io, Trace Fooshee, strategic adviser with Aite-Novarica Group, discusses strategies and tools to detect check fraud, and challenges to overcome.

He notes immediately that "unfortunately, check fraud is back," and cites an American Banking Association estimate saying there has been an 84% increase of check fraud in U.S. banks between 2021 and 2022.

Furthermore, Mr. Fooshee notes key findings from a recent survey of 34 fraud executives performed by the Aite-Novarica Group:

- 0 of the 34 fraud executives reported that check fraud losses were decreasing

- 26% reported that losses were flat

- 33% reported that check fraud losses were growing by 10% or less

- 41% said losses were growing by 10% or more

Mr. Fooshee puts the losses in perspective -- he notes that in 2021, only 7% of fraud execs reported losses growing at that scale. Additionally, his organization has heard from FIs experiencing a triple digit increase in check fraud.

Why Checks Are the Fraud Favorite

Mr. Fooshee also notes that check fraud has been the biggest fraud growth area, surpassing even scams.

"Detecting check fraud is really challenging because banks have to differentiate between genuine handwritten documents and falsified handwritten documents," Fooshee says. "It is not something that lends itself easily to automation, and detection tools are usually very costly."

Some causes Mr. Fooshee cites for the substantial uptick in check fraud include:

- Budget cuts in postal security (post office box keys and uniforms are on the black market)

- Social media is being use to amplify the trend and promote methods, particularly using apps like Telegram

- Banks are dealing with competing priorities with limited resources

The legacy, mainframe-based applications that many banks have to "make do" with are not terribly sophisticated, Mr. Fooshee notes.

Addressing Check Fraud with Image Analysis

At the halfway point of the video (6:40), Mr. Fooshee provides key insights on why banks are turning to image analysis technologies to combat check fraud:

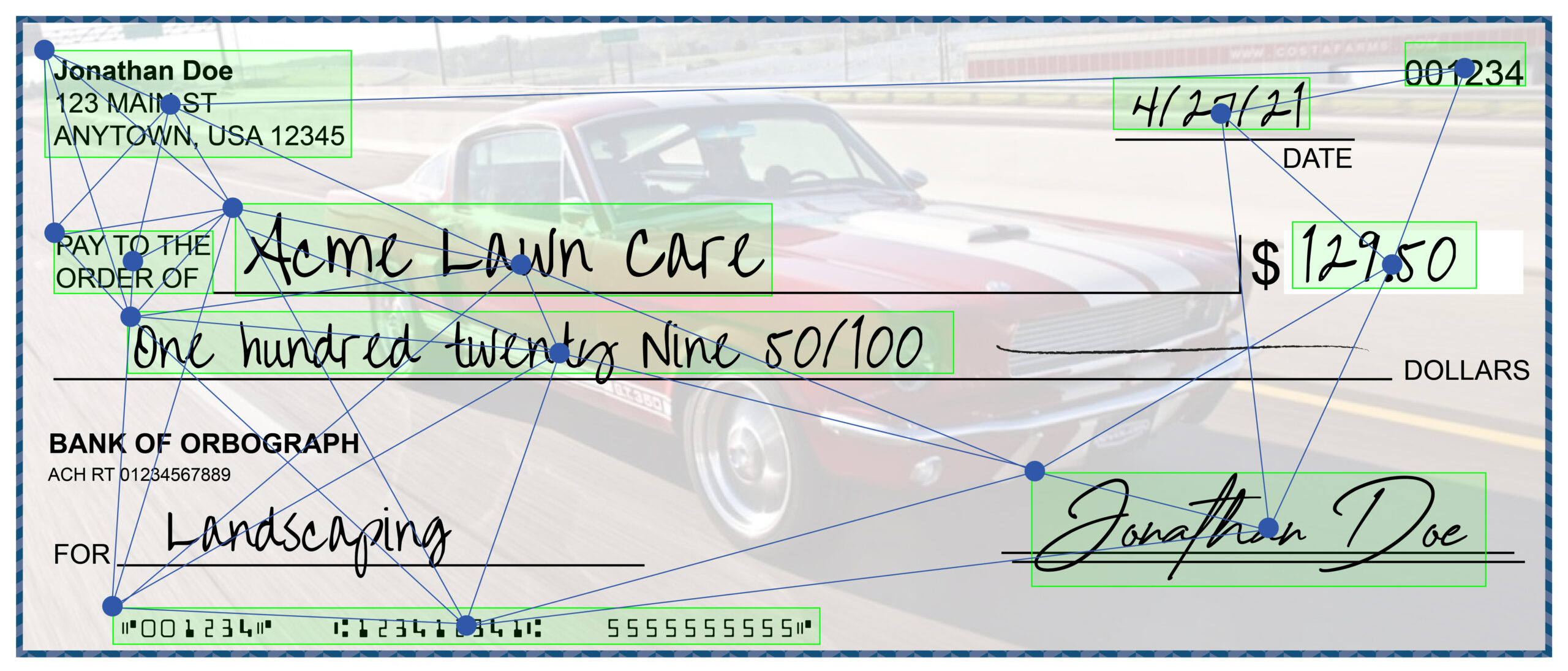

There are a number of vendors that provide what are known as image analysis capabilities. Their systems are designed to compare digitized images of suspect checks to digitized images of known good checks or legitimate checks. The purpose of this [image analysis technology] is to compare two images to analyze the difference between the two to find discrepancies that might indicate alterations or forgeries, or even counterfeits.

Mr Fooshee further notes that image analysis technologies are also useful to reduce the number of false positives. Banks typically face a 100-to-1 false positive rate, but image analysis solutions can make a substantial difference, he explains.

"They are also able to reduce the false positive rate further if they integrate legacy systems and image analysis systems with risk engine platforms."

Innovation: Image Analysis' Evolution to Image Forensics

While we agree with Mr. Fooshee's approach to check fraud detection, innovations in technology has made tremendous strides -- moving from traditional image analysis relying on algorithms and business rules to image forensics which takes a forensic document examination approach, leveraging AI and machine learning technology.

While both take the approach of comparing suspect images to known good check images, image forensic AI provides a more thorough analysis of suspect checks -- improving accuracy to 95%+ detection rates on targeted use cases by performing a deeper analysis of the items.

Image forensic AI leverages a number of analyzers including:

- Check Stock Validation (CSV-AI): Analyzes the attributes, layout, and relative coordinates and dimensions of select preprinted fields as “anchor points” on the check. It does not include aspects of the check that are traditionally completed by the check writer or payor/maker.

- Automated Signature Verification (ASV-AI): Identifies signature variations by comparing the signer on the check presented for payment against the signature in cleared checks drawn on the same account. OrbNet Forensic AI activates 512 feature vectors on every signature to analyze attributes as a “forensic screening” process. See Forensic Document Examination interview for more details.

- Alteration Detection Analysis (check style comparison and amount discrepancy): Detecting alterations is composed of two sub-analyzers: Check Style Analysis and CAR/LAR Discrepancy.

Additionally, OrboGraph has announced the launch of Writer Verification -- end of Q1 -- that is able to analyze the handwriting style of a suspect check and compare it to previously cleared checks. This includes date (i.e. "02/01/2023" vs. "February 2, 2023"), handwriting style (i.e. cursive vs. non-cursive, machine printed vs handwritten), and amount (i.e. $1000.00**** vs, ***$1000.00). After performing the full analysis, the system returns a risk score that details the reasoning behind why an item was flagged, reducing the review time for fraud analysts.

For a visual representation of Image Forensic AI, check out our #OrboIntelligence Check Fraud Detection Challenge, which pits fraud professionals against our OrbNet Forensic AI technology.