What if Michael Cohen was Paid by ACH?

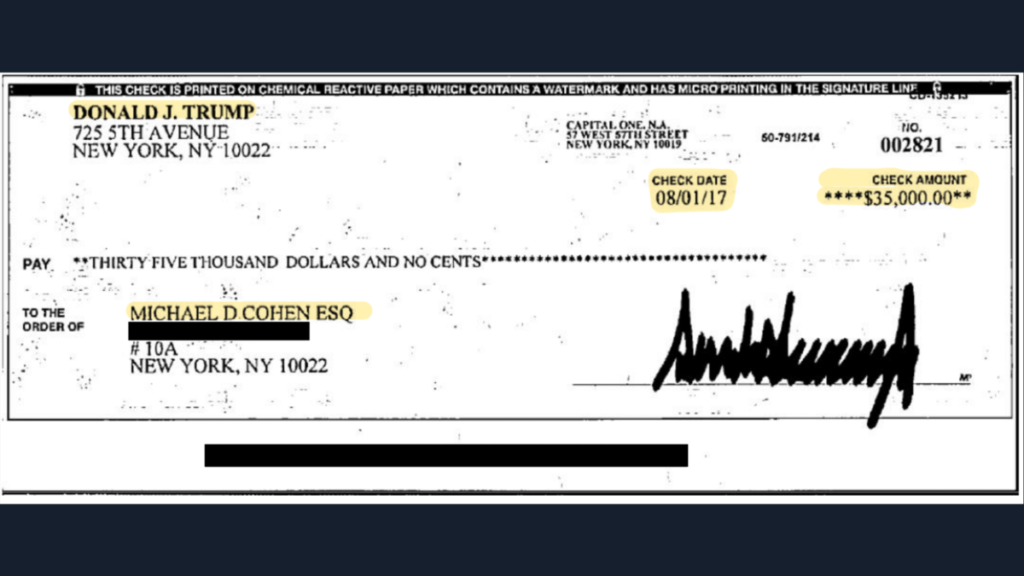

By now, images of the checks submitted into evidence by Michael Cohen as he testified before Congress have become ubiquitous.

One of the checks, shown below, illustrates the power of data that is generated on a check. You see the courtesy and legal amounts, the date issued, maker/payer, payee and payee address, check number, and, of course, signature — signed by Trump himself as stated in the hearing.

When a check is paid by the paying bank, the option exists to validate and analyze many or all of these fields. For example, using advanced self-learning algorithms, a database of history is built using image analysis tools like automated signature verification (ASV). ASV can actually compare previously cleared checks to images presented for payment so that forgeries can be limited. Same with check stock verification (CSV), which is used to identify counterfeit items. And when amounts are altered or incorrect, there’s a test for that, too.

Now, what if the payment would have been executed via electronic ACH?

The payment data would have certainly been a lot less impressive on Mr. Cohen’s bank statement:

- Net credit amount of $35,000

- Payer information would have probably been related to a company name, potentially truncated due to limited characters

- Date received

- ACH payment format/type along with tracking number

The image and transaction data behind this story is underutilized in today’s market. Banks have the potential to use this paper trail, convert it to image, and extract data for fraud prevention, compliance adherence, reduce errors, and understand customer behaviors regarding who they are doing business with.

This blog contains forward-looking statements. For more information, click here.