2018 Conference Highlights: Check Fraud and Payment Risk

From the “Check Fraud and Payment Risk Industry Update and Technology Advancements” presentation.

Continuing our look at some of the highlights from our 2018 Healthcare and Check Payment Technology Conference in Nashville, TN, this time with information from a presentation entitled “Check Fraud and Payment Risk Industry Update and Technology Advancements,” presented by Joe Gregory, our own VP of Marketing; Yaron Katzir, who is Orbograph’s Director of Product Management for Check Solutions; and Sharon McCullogh, VP of Bank Operations for PNC Bank.

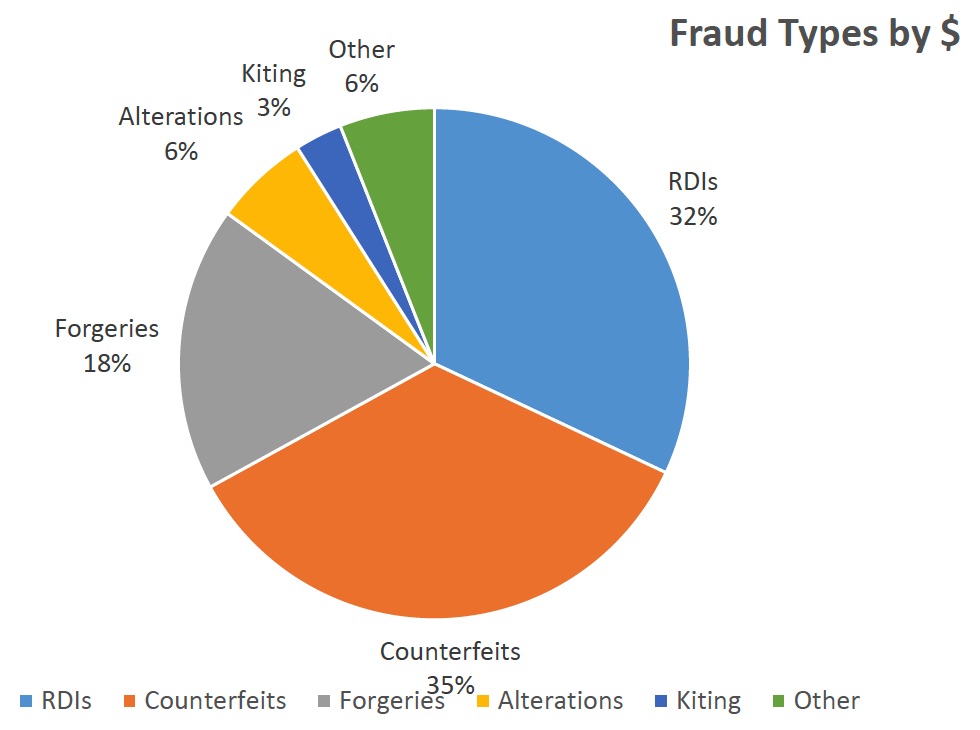

Yaron addressed the check fraud uptrend being observed in the industry. Some of his key data points:

- Cost per transaction account in check fraud losses:

- $0.38 community

- $0.42 large community

- $1.46 regional

- $1.68 super regionals

- Increase in small business account check fraud

- Community/large community for next 12 months

- 32% increase

- 47% stable

- 21% decrease

- 43% money center/regional banks expect check fraud losses to increase in the next 12 months

In addition to the fact that fraud is trending upward, it was noted that, in 2017, 74% of payment fraud was aimed at checks, with wire at 48%, credit cards at 30%, ACH debits at 28%, and ACH credits at 13% — a clear indication that, given the ongoing popularity of checks for individuals and businesses, solutions such as Anywhere Fraud and Anywhere Validate are vital to the health of financial institutions big and small by detecting and preventing counterfeit checks, forgeries and duplicates!