A Texas Bank’s Perspective on Why Check Fraud is Back

Aite Group Also Reports Check Fraud Increase

- As a by-product of EMV, check fraud rebounded.

- Market research provides many insights.

- Majority of fraud professionals cite a need for tech investment to fight fraud.

Texas Citizens Bank’s article, Why Check Fraud Is Regaining Popularity in 2019, states that, “While EMV chips helped reduce card-present fraud, card-not-present fraud and check fraud both increased to fill the void.” These trends are a great example of how fraudsters look for weaknesses across the enterprise.

We found this article very interesting, because it looks into the mind of the fraud perpetrator! How would your financial institution address these examples?

Example 1 (Altered Checks): I receive a birthday check from my grandma for $100. I decide I deserve $1,000 because she made a big fuss at my wedding last year. Out of spite, I add an extra zero to the check amount and alter the written amount to match. I then present the altered check for $1,000 to my bank.

Example 2 (Counterfeit): Using professional design software and my superior print production skills, I create duplicate checks mimicking one I got from my business customer. I print out several phony checks and write myself several checks for small amounts. I endorse and deposit each over time, hoping the customer won’t notice the small withdrawals.

Example 3 (Forgery): When the secretary is out at lunch, I steal a few envelopes off the top of a stack of employee paychecks. I forge the respective employee signatures on the back to endorse. Using fake names and IDs, a friend and I pose as different employees at separate banks.

Many FI’s don’t have the technology in place to detect even these simple scenarios. The article even states that check fraud may be catching back up to debit card fraud.

“They [check fraud criminals] hit everywhere—businesses big and small,” said Texas Citizens Bank Customer Accounts Representative, Cindy Lilly, on common check fraud strategies. “Businesses still use checks, so we’re seeing check fraud more there. It’s often someone with payroll access stealing from their own company—usually the person you’d least expect.”

Aite Research Highlights Challenges of Check Fraud

In a presentation at the 2019 Healthcare and Check Payment Technology Conference hosted by OrboGraph, Shirley Inscoe of Aite Group explored the pervasiveness of check fraud and some of the drivers that keep the threat very much alive, including:

- Organized crime involvement using latest tech and automated systems

- The viewpoint in some countries that fraud against U.S. financial agencies and interests is actually an honorable pursuit

- Outdated technologies should be evaluated

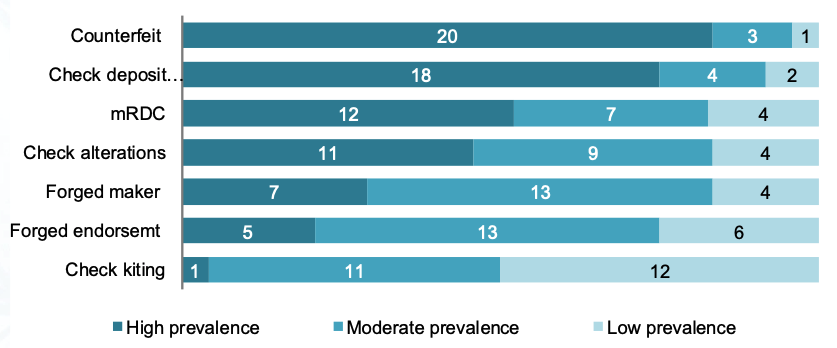

When banks are asked whether they agree with the statement “Check fraud is declining,” 96% mostly or completely disagree. Ms. Inscoe went on to point out that check fraud counterfeit fraud has highest prevalence because it is a low risk/high regard technique that is constantly helped along by advancing, inexpensive technology.

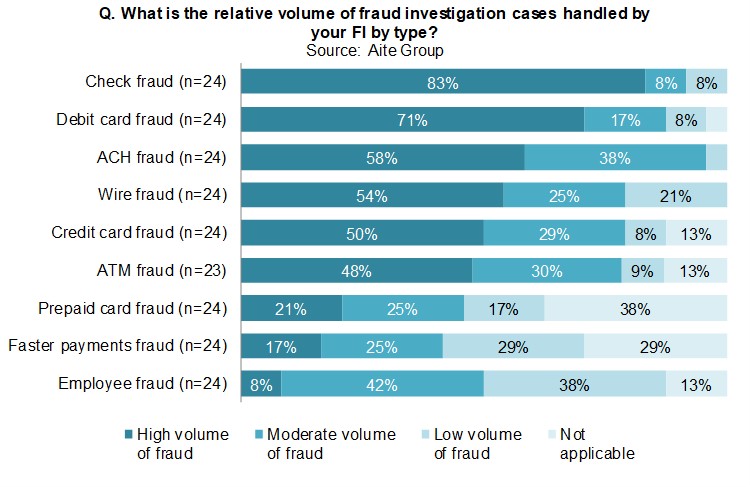

These trends identified in, Financial Institution Investigations: When Fraud Prevention Fails research, found that 91% of FI’s reported check fraud represents high or moderate volume of their investigative cases.

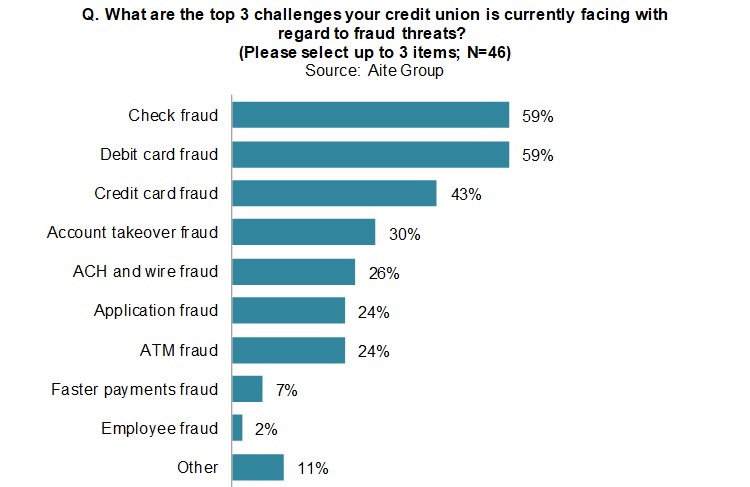

And credit unions are not immune either!

Aite Group found that 71% of 32 fraud professionals they surveyed in late 2018 agreed that their FI needs to make significant technological investments to catch up with the pace of fraud.

Why is this important? Consider this: While the shift to digital is obviously underway, paper checks still represent 47% of the value in 2018, according to Mercator Advisory Group’s report – B2B Payments: More Options Than Ever Before, as reported by PaymentsJournal.