Artificial Intelligence in Banking — The Answer to Fraud and Compliance Issues?

- AI integration has become vital to financial institutions

- Fraud detection is strengthened greatly by AI tech

- AI advantages are not limited to large banks

A blog post by Saurabh Singh at AppInventiv.com explores the growing integration of Artificial Intelligence into more and more banking systems.

AI-based systems can help banks reduce costs by increasing productivity and making decisions based on information unfathomable to a human agent. Also, intelligent algorithms are able to spot anomalies and fraudulent information in a matter of seconds.

A report by Business Insider suggests that nearly 80% of banks are aware of the potential benefits that AI presents to their sector. Another report suggests that by 2023, banks are projected to save $447 billion by using AI apps.

These numbers indicate that the banking and finance sector is swiftly moving towards AI to improve efficiency, service, productivity, and RoI and reduce costs.

Clearly, AI has become a critical tool in modern bank infrastructure -- what was once a "bonus" integration is now viewed as a crucial building block. Meanwhile, financial institutions that choose to wait for a "better time" to deploy AI will very likely face consequential costs in excess of the investment needed to get AI in their "tool belt" now.

Artificial Intelligence vs. Fraud

Deployment of AI and ML into payment channels, including image forensics AI capable of detecting counterfeits, alterations, and forgeries from the image of checks, has demonstrably made it possible to more efficiently spot and stop fraud.

This is when artificial intelligence in banking comes to play. AI can help banks improve the security of online finance, track the loopholes in their systems, and minimize risks. AI along with machine learning can easily identify fraudulent activities and alert customers as well as banks.

Mr. Singh highlights a major key for AI in fighting fraud: data collection and analysis. What makes AI and machine learning effective in fighting fraud in banking is the fact that there is a large amount of transactional data points -- hundreds of thousands to millions daily -- that can be fed into the system for training. While it requires enormous effort to tag fraudulent transactions, the effort on the front end is worth the resources as it enables the system to start identifying known fraudulent activities and, as more transactions feed into the system, continuously learns to identify new fraudulent activities.

Artificial Intelligence Enhances Regulatory Compliance

According to an article from The Banker, 176 fines were levied to financial institutions for compliance breaches totaling $5.37B in 2021. While this is down from the previous year, it still represents a massive risk for banks. However, by deploying artificial intelligence and machine learning technologies, banks can mitigate risks and enhance the capabilities of their compliance department.

In most cases, banks maintain an internal compliance team to deal with these problems, but these processes take a lot more time and require huge investment when done manually. The compliance regulations are also subject to frequent change, and banks need to update their processes and workflows following these regulations constantly.

AI uses deep learning and NLP to read new compliance requirements for financial institutions and improve their decision-making process. Even though AI banking can’t replace a compliance analyst, it can make their operations faster and efficient.

Deploying Artificial Intelligence for Check Fraud Detection

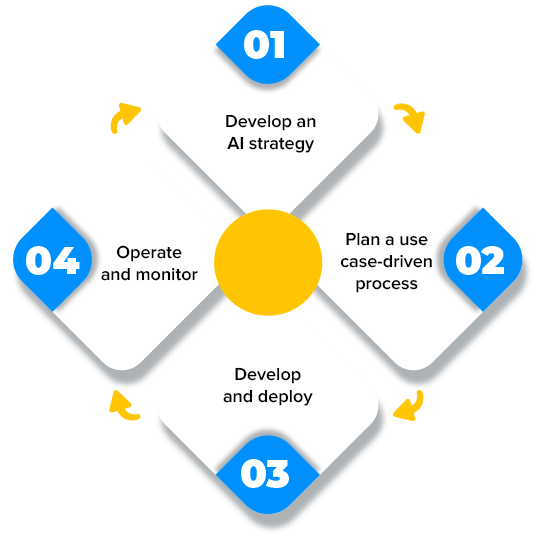

Mr. Singh details his four steps for banks to start deploying artificial intelligence and machine learning:

- Step 1: Develop an AI strategy

- Step 2: Plan a use case-driven process

- Step 3: Develop and deploy

- Step 4: Operate and monitor

Banks have already identified check fraud as a use case for artificial intelligence to solved -- with check fraud accounting for 60% of attempted bank account theft.

Source: AppInventiv

Banks need to take a layered approach using artificial intelligence, deep learning, and image forensics to specifically interrogate the fields of a check image and blend it with transactional data. Deploying image-forensics AI for Check Stock Validation (CSV-AI), Automated Signature Verification (ASV-AI), and Alteration Detection is an effective method for fraud detection, as the technology is able to interrogate the attributes of the check images and -- through hundreds of tests -- identify which checks are suspect and subsequently sent to fraud analysts. The technology is able to quickly process thousands of checks, significantly reducing the number of checks needing review by fraud analysts.

By complementing transactional-analysis technologies with image forensic-based artificial intelligence, banks are able to effectively protecting themselves and their customers from on-us and deposit fraud in 2022 and beyond.