Check Image Quality

Alfredo Alvarez, a principal at Liberty Advisor Group, writes in his article how modernizing legacy technology wins the digital customer: Nimble new entrants and rapidly increasing customer expectations for digital products and services continue to disrupt financial services firms. In response, financial services organizations have made significant investments in agile development and DevOps (development and…

Read MoreLast week, USA TODAY published a consumer-focused article explaining new deposit requirements from a number of banks: Depositors must now include the phrase “For Mobile Deposit Only” underneath their signature on all checks deposited using mobile apps. Some banks are also suggesting you add “For Mobile Deposit Only at (Bank Name)” or “For (BANK NAME) Mobile Deposit…

Read MorePayments 3.0 columnist George Warfel signs off of his last column for the site by noting what he considers deep trends to watch in banking and payments. One particular point he makes is something we’ve seen borne out again and again as cleverly-named payments technology brands appear and then either disappear or team with more established…

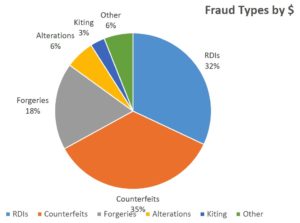

Read MoreAdmit it – you thought everyone knows the basics of check writing, and figured that the younger generation is not using checks. So who cares? Well, you might think this is the case, but there are fresh ideas in this article at the street.com including safeguards against check fraud, which, according to the ABA Deposit Fraud Study, saw…

Read MoreThe National Check Fraud Center has a no-nonsense, word-dense list of 20 UCC Provisions Every Banker Should Know. Go “check” out that link – – looks pretty daunting, doesn’t it? Author Mary Beth Guard manages to keep it light, though, even in some of the longer explanations: Section 4-209: Are you familiar with the encoding warranty? A…

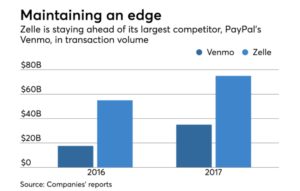

Read MoreIn the spirit of Independence Day, let’s take a look at an article from PaymentsSource.com that explores various attempts to become “independent from checks, cash, and cards.” Their list includes venerable “we’re going all-digital” efforts like Venmo, Green Dot, and even PayPal – – all have sought to declare independence from plastic cards and checks,…

Read MoreAccording to Thomas Skala, chief executive officer and president of telecommunications and payments company Genie Gateway, a mitigated risk of chargebacks makes checks the best path for high-risk sellers. High-risk sellers can include, for example, product repair companies if a customer is unhappy with a repair result; or the travel industry, in which buyers can chargeback travel…

Read MoreContinuing our look at some of the highlights from our 2018 Healthcare and Check Payment Technology Conference in Nashville, TN, this time with information from a presentation entitled “Check Fraud and Payment Risk Industry Update and Technology Advancements,” presented by Joe Gregory, our own VP of Marketing; Yaron Katzir, who is Orbograph’s Director of Product Management for…

Read MoreSmall banks are at a crossroads: adopt new technologies or face the possibility of shutting the doors. According to Americanbanker.com: For community banks in highly competitive markets, service with a personal touch can be a differentiator to win and keep customers. But when legacy technology hampers the customer experience, all the cups of coffee in…

Read MoreLet’s be frank: paper checks present a challenge to anyone in the accounts payable space. But let’s be equally realistic: checks continue to make up about half of the supplier payments volume. B2B payments disruptors now have a choice when designing and deploying technology: Will they use that tech to make paper checks less friction-filled, or entice…

Read More