Check Processing

There are many reasons for the resilience of checks (including the small- and mid-sized businesses that rely on the paper check’s “float” for accounting purposes), but one important factor has been fear of fraud and security risks in newer digital transactions. Digital transactions are indeed growing at a rapid rate — particularly among millennials, many…

Read MoreAlfredo Alvarez, a principal at Liberty Advisor Group, writes in his article how modernizing legacy technology wins the digital customer: Nimble new entrants and rapidly increasing customer expectations for digital products and services continue to disrupt financial services firms. In response, financial services organizations have made significant investments in agile development and DevOps (development and…

Read MoreLast week, USA TODAY published a consumer-focused article explaining new deposit requirements from a number of banks: Depositors must now include the phrase “For Mobile Deposit Only” underneath their signature on all checks deposited using mobile apps. Some banks are also suggesting you add “For Mobile Deposit Only at (Bank Name)” or “For (BANK NAME) Mobile Deposit…

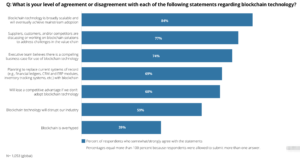

Read MoreVarious applications of blockchain technologies have been hyped and praised, and nearly everywhere you look, there is a company or start-up touting the benefits of the tech. Auditing and tax-services firm Deloitte conducted a survey called Breaking Blockchain Open wherein several aspects of blockchain were covered. In their analysis, Ambcrypto.com points out that, while 84% of…

Read MoreWe’ve talked recently about how banks are, to a greater and greater extent, making significant investments in technology to make transactions both more convenient and more secure for their customers/members. But another path to maintaining and, indeed, growing a loyal customer base in the age of remote deposit capture via mobile device — and an…

Read MorePayments 3.0 columnist George Warfel signs off of his last column for the site by noting what he considers deep trends to watch in banking and payments. One particular point he makes is something we’ve seen borne out again and again as cleverly-named payments technology brands appear and then either disappear or team with more established…

Read MoreHats off to Wells Fargo for taking a position which protects themselves and their clients against fraud losses…even if there are bumps along the way. Sometimes risk mitigation has a price in terms of review processes, funds availability or customer service for a select few. In an effort to protect itself and clients in light of…

Read MoreIf you already know the difference between “indorsement” and “endorsement,” you’re the kind of professional who will benefit from the newly-released RemoteDepositCapture.com’s Guide to Restrictive Indorsements, available to purchase at their website. The report is authored by John Leekley, founder and CEO of RemoteDepositCapture.com, who is widely regarded as the leading authority on all things…

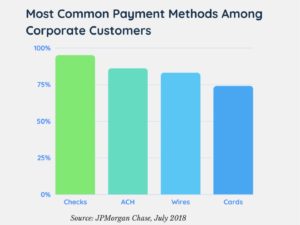

Read MoreA survey released last week by JPMorgan Chase revealed that, while a majority of U.S. business leaders (owners, managers, and executives) prefer using digital banking, less than half of them have plans to increase their use of online banking products and services! The reason? Cybersecurity concerns! While checks are certainly not immune from fraud and hacking,…

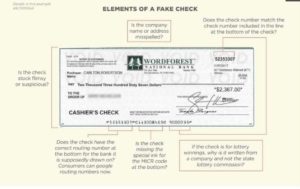

Read MoreAdmit it – you thought everyone knows the basics of check writing, and figured that the younger generation is not using checks. So who cares? Well, you might think this is the case, but there are fresh ideas in this article at the street.com including safeguards against check fraud, which, according to the ABA Deposit Fraud Study, saw…

Read More