Financial Industry

In the spirit of Independence Day, let’s take a look at an article from PaymentsSource.com that explores various attempts to become “independent from checks, cash, and cards.” Their list includes venerable “we’re going all-digital” efforts like Venmo, Green Dot, and even PayPal – – all have sought to declare independence from plastic cards and checks,…

Read MoreAccording to Thomas Skala, chief executive officer and president of telecommunications and payments company Genie Gateway, a mitigated risk of chargebacks makes checks the best path for high-risk sellers. High-risk sellers can include, for example, product repair companies if a customer is unhappy with a repair result; or the travel industry, in which buyers can chargeback travel…

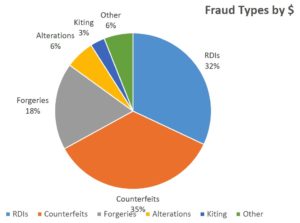

Read MoreContinuing our look at some of the highlights from our 2018 Healthcare and Check Payment Technology Conference in Nashville, TN, this time with information from a presentation entitled “Check Fraud and Payment Risk Industry Update and Technology Advancements,” presented by Joe Gregory, our own VP of Marketing; Yaron Katzir, who is Orbograph’s Director of Product Management for…

Read MoreFor an invigorating Memorial Day drive, we invite you to take 19 minutes to enjoy the OrboGraph Podcast named, “The Foundation and Vision”; a conversation with OrboGraph’s co-president, Barry Cohen, and vice president of marketing, Joe Gregory. Promising to be the best podcast OrboGraph has produced (yes, it is our first), the podcast covers…

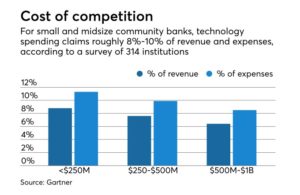

Read MoreSmall banks are at a crossroads: adopt new technologies or face the possibility of shutting the doors. According to Americanbanker.com: For community banks in highly competitive markets, service with a personal touch can be a differentiator to win and keep customers. But when legacy technology hampers the customer experience, all the cups of coffee in…

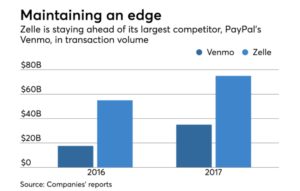

Read MoreAccording to American Banker, the bank-led person-to-person payment network Zelle is making progress, but having growing pains. Banks and consumers have learned a handful of truths — good and bad — about the network as it copes with a number of challenges including fraud threats, growing demand, as well as technical and enrollment issues. Here is…

Read MoreLet’s be frank: paper checks present a challenge to anyone in the accounts payable space. But let’s be equally realistic: checks continue to make up about half of the supplier payments volume. B2B payments disruptors now have a choice when designing and deploying technology: Will they use that tech to make paper checks less friction-filled, or entice…

Read MoreThere is a trend in the wind, according to AmericanBanker.com: Over the past few days, midsize banks — such as Comerica, Commerce Bancshares and M&T Bank — have reported notable declines in total deposits, with M&T, in particular, reporting a 6% drop from a year earlier. Executives have offered a number of reasons why, saying…

Read MoreThe 2018 AFP Payments Fraud Survey, underwritten by J.P. Morgan, has some alarming fraud news for corporate clients and the treasury departments of financial institutions. Overall payments fraud reached a new peak in 2017, after experiencing a downswing earlier in the decade. A record 78% of all organizations were hit by payments fraud last year,…

Read MoreA newly released report reveals that cloud computing advances are a driving force for large enterprises — including, of course, those in the health care and retail banking segments — to modernize their application platforms in spite of large investments they may have made previously in legacy systems. Large enterprises have dedicated in-house IT resources,…

Read More