Financial Industry

The 2018 AFP Payments Fraud Survey, underwritten by J.P. Morgan, has some alarming fraud news for corporate clients and the treasury departments of financial institutions. Overall payments fraud reached a new peak in 2017, after experiencing a downswing earlier in the decade. A record 78% of all organizations were hit by payments fraud last year,…

Read MoreA newly released report reveals that cloud computing advances are a driving force for large enterprises — including, of course, those in the health care and retail banking segments — to modernize their application platforms in spite of large investments they may have made previously in legacy systems. Large enterprises have dedicated in-house IT resources,…

Read MoreRemoteDepositCapture.com creates one featured poll question per month on RDC-related topics. If you’re at all interested in check processing [who wouldn’t be, right?], then we invite you to visit their site and register your input. While you’re there, it’s well worth signing up for their newsletter so you can get poll results regularly. This month’s featured…

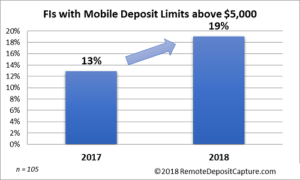

Read MoreA RemoteDepositCapture.com poll reveals that the limits banks and credit unions place on the size of consumer checks eligible for depositing via mobile RDC are rising steadily. In fact, the past year has seen the number of financial institutions with standard per-item deposit limits above $5,000 for consumer mobile deposit customers growing by nearly 50%, according to the…

Read MoreOn July 1st, 2018, Amendments to Federal Reserve Regulation CC take effect. Many financial institutions are taking a passive approach to these very important changes. Others are serious about making changes to their deposit agreements and are changing workflows to modernize their risk and fraud practices. What’s your position on these changes? The amendment creates…

Read MoreThe Wall Street Journal (subscription required) reports that Amazon may be looking at entering the checking account game. Sanvada reports online for those who do not subscribe to the WSJ: A report from the Wall Street Journal has claimed that the retail giant is working on what it calls a “hybrid-type checking account” designed for…

Read MoreIs your financial institution ready for payment innovation? The Innovation Readiness Playbook from PYMNTS.COM surveyed US financial institutions and created a gem for strategic and tactical considerations. Like many surveys, you can take a positive or negative spin on the data and critique the questions. For example: Is this a wake-up call to mid-sized financial institutions that…

Read MoreYou’ve probably seen the headlines: Bank of America ends free checking option, causing customer uproar Bank of America Is Eliminating a Popular Free Checking Account A major bank eliminates free checking – – a blow to the lower income consumer who depends on checks and checking accounts, right? Would it spur industry-wide changes, similar to…

Read MoreLet’s get crazy! OK, maybe a podcast from BAI Banking Strategies isn’t crazy, crazy, but if you are into payments, this could be the best 10-15 minutes of the year! Managing editor Lou Carlozo speaks with Tommy Marshal, FinTech Lead for North America at Accenture about their new payments report entitled Driving the Future of Payments: 10 Mega…

Read MoreThe “death” of the check is still way behind schedule, according to many organizations that predicted the end of paper checks many years ago. We keep reporting that checks are still popular when they were supposed to have been dwindling years ago. (That’s the boring part of the post) The latest installment in PYMNTS’ Kill…

Read More