Mobile Banking

The US real-time payments network currently reaches about 50% of the population, and was on track, via private sector channels, to provide complete coverage by the end of next year, as noted in an article at Forbes.com by Ike Brannon, a senior fellow at the Jack Kemp Foundation.

Read MoreWant to go deep on financial fraud and crime, and learn the difference between the two while also learning about the role of modern cybersecurity tools in curtailing both? Get comfortable and spend some time with this comprehensive article from McKinsey & Company covering Financial crime and fraud in the age of cybersecurity. Their analysis…

Read MorePaymnts.com reported recent data (from West Monroe Partners) that found 77 percent of banks are already putting AI solutions to use in some way. Count Chase as one of the forefront adopters of Artificial Intelligence solutions and technology. Chase is embracing AI and ML to help customers conduct business while preventing fraudsters from making off with data or financial…

Read MoreA new report by FIS finds that business satisfaction has dipped slightly, but remains high. The FIS research found that 78% of U.S. SMBs report being extremely or very satisfied with their PFIs, down slightly from 81% in the 2018 study. SMBs with $25M-$75M in revenue reported the highest satisfaction in their banking providers (85%).…

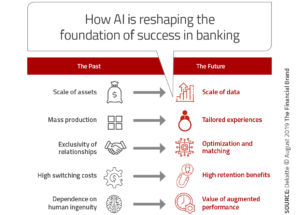

Read MoreLet’s face it: Human beings are indispensable, but we are learning that in order to bring the level of service that is expected in today’s marketplace, machines and analytics have to work together and deliver quicker, more intelligent solutions than we’ve previously seen or experienced. This is the root of Artificial Intelligence and its value…

Read MoreChecks are still ubiquitous across generations. They remain popular, and they are — in spite of repeated premature eulogies — still alive and well in the world of treasury and B2B. Let’s say you have a check payment from a friend, or you’re running a small business on check payments, or you’re still getting a…

Read MoreThe ability of fraudsters to create an image of a check is not necessarily a new technique. What is newsworthy is accessibility.

Read MoreWhen Facebook announced its Libra payment system, reactions were varied, to say the least. Can a gigantic company that cannot be trusted to safeguard our heretofore private information be ready to handle cryptocurrency? PYMNTS.com wonders if another giant company, Walmart, might have a better chance to succeed in the payments field, particularly in light of…

Read MoreIt seems like not so long ago cloud computing was a nifty pie-in-the-sky idea (see what we did there?) that we’d eventually embrace along with personal jet packs and resorts on the moon. While the jet packs and moon lodgings are still off in the future, let’s make one thing clear: cloud computing is not…

Read MorePymnts.com features a podcast with Ingo Money CEO Drew Edwards and Karen Webster discussing the new risk of fraud related to remote mobile check deposits. “Mobile check capture fraud is now escalating so badly that some banks are thinking about shutting it off, because the losses just aren’t worth it,” Edwards states. It’s an interesting…

Read More