Uncategorized

Bank infrastructure has changed For modern banks, customers are more important than money The Cloud has become more and more integral Michael Haney, head of product strategy at Galileo Financial Technologies, recently spent time with Hal Levey, senior writer at PYMNTS, discussing the fact that banking infrastructure has undergone a significant evolution over the past few…

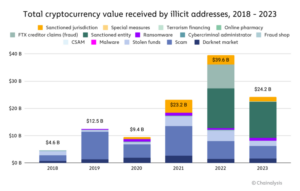

Read MoreFinCEN issues warning on cryptocurrency being used by Mexican Drug Cartels 2%-5% of the worlds GDP — or $2.22 to $5.53T — is laundered Cryptocurrency makes up only .47%, or one-half of one percent, of money laundered On June 20, 2024, the US Financial Crimes Enforcement Network (FinCEN) issued an updated advisory to US financial…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreOpen Banking is popular worldwide United States financial institutions are “late to the party” Collaboration, innovation, and interoperability are keys to success A few weeks ago we explored Open Banking and its impact. Open Banking is a system that allows consumers to share their financial data with third-party providers and enables access to a wider…

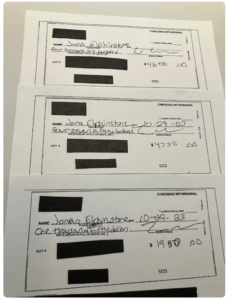

Read MoreCheck fraud is on the rise Fraudsters require depositor information to pull off scams ID theft is growing as a result Jenna Herron, a columnist at Yahoo Finance, recently found herself on the wrong side of a case of identity theft. Not long ago, someone posed as me at three bank branches and drained thousands of…

Read MoreOverall banking fraud is climbing Account takeover fraud is now surpassed by authorized payments scams While check deposits are down, check fraud is up 33% NICE Actimize has gathered and published some in-depth research that clearly shows a precipitous rise in banking fraud, which is understandably a growing concern for Financial Institutions (FIs) and consumers…

Read MoreWhile thought of as “old school,” there are still advantages to using checks For many, checks still offer respite from carrying physical money At the same time, growing fraud makes caution necessary Alternative Payments offers a comprehensive look at the advantages and disadvantages to paying with checks, along with a bit of history and key…

Read MoreMany parts of the U.S. have been on the blunt end of some “interesting” weather of late. Whether it’s flooding rains, high winds, or excessive heat, it’s been important to be “weather aware.” Effective weather prediction — the kind that helps you postpone that camping trip when storms are ahead, or make sure the snowblower…

Read MoreCheck fraud is on the increase and touching more and more depositors Over half of financial institutions report checks as the payment method most impacted by fraud Technology currently exists to combat the threat Detecting check fraud is — to say the least — complex. There are many variables that need to be considered, along…

Read MoreAI has emerged as a powerful protective tool for banks and their depositors Consumers are becoming more aware of AI services in other areas of their lives What was once a feature will soon be an expectation BizTech Magazine examines AI and the three primary ways banks are deploying this new tool. Consumers, too, are…

Read More