Uncategorized

Frank Albergo, National President of the Postal Police Officers Association, recently reposted via LinkedIn an item found by David Maimon, Professor at Georgia State University and Head of Fraud Insights at SentiLink. As Mr. Albergo relates: Crime evolves and criminals adapt. Obviously mail thieves want to avoid detection and arrest. A United States Postal Service letter…

Read MoreCNN reports that the US Treasury Department has begun using artificial intelligence — or AI — to detect fraud and recover funds, adopting techniques already widely used in the private sector. Starting around late 2022, the Treasury Department began using enhanced fraud-detection methods powered by AI to spot fraud, CNN has learned. The strategy mirrors…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read More“Check cooking” is on the rise Florida’s Attorney General has issued a warning Initial investment for deposit fraud is surprisingly low Florida’s Attorney General, Ashley Moody, recently issued a warning about a digital check manipulation or “check cooking” scheme where fraudsters alter stolen checks to change the payee and payment amount. The warning comes in…

Read MoreLike many clubs or societies, fraudsters have a language all their own Some slang terms are obvious, while others are very oblique A valuable online Fraud Glossary resource is growing by the day People who share a common hobby or vocation often have a “lingo” of their own that they use to streamline communication and…

Read MoreOver half of bank execs polled are concerned about dependency on legacy technology The same execs have a positive outlook for 2024 Less than 8% of the execs polled expect to reduce their tech spending in the coming year Monitor Daily reports on a survey of over 100 bank executives which found concerns about dependency…

Read MoreThe latest Frank on Fraud blog explores Scam Interdiction, a practice that is currently in use all over the world and may be coming to the US. Simply put, Scam Interdiction is the use of AI and other tools to pause or decline suspicious transactions in real-time before any money is lost. Frank on Fraud…

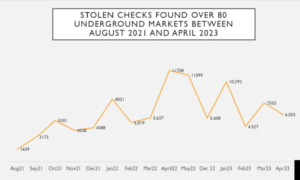

Read MoreThe Dark Net is emerging as a supplier for fraudsters Dr. David Maimon shares his insights into the Dark Net ecosystem A proactive approach to rising fraud cases is recommended OrboGraph’s Joseph J. Gregory and Dr. David Maimon recently discussed the Dark Web or Dark Net, which is becoming the supermarket for fraudsters looking for…

Read More“In-person banking is fading away.” Wall Street’s biggest bank would beg to disagree. Bankingdive.com reports that banking giant JPMorgan Chase plans to expand its branch network significantly over the next few years, aiming to open over 500 new branches focused on underserved areas, according to a statement seen by Reuters and The Wall Street Journal. Some other banks…

Read MoreCheck fraud is not new — it boomed in the 1970s By 1977, banks responded with multiple anti-fraud tactics Are there lessons modern financial institutions can learn from the ’70s? FrankonFraud takes us back to the days of cable TV, eight-track tapes, and leisure suits – the 1970s. The 1970s were hard times in fraud.…

Read More