OrboNation Newsletter: Check Processing and Fraud – February 2024

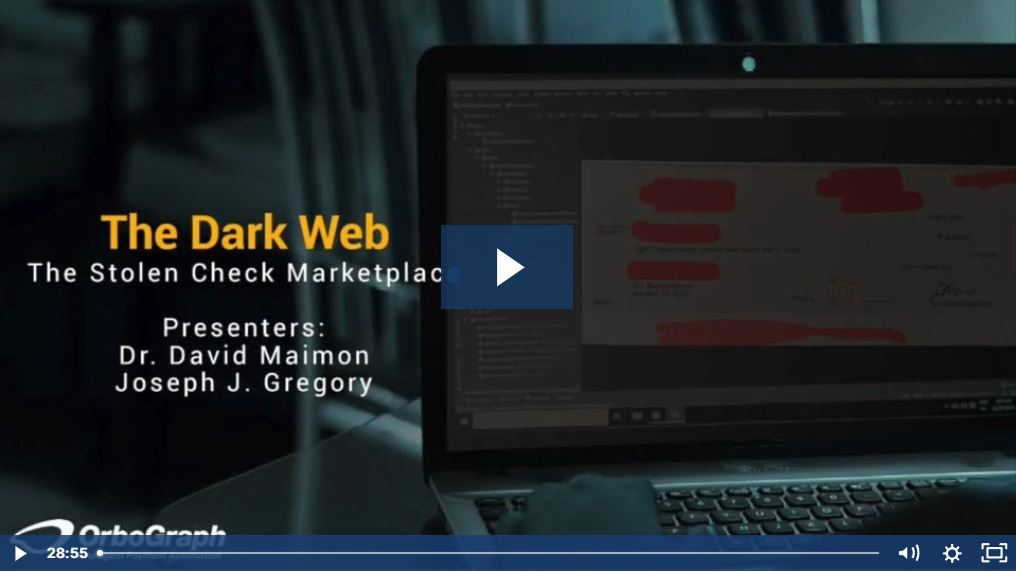

Exploring the Stolen Check Market on the Dark Net with Dr. David Maimon

OrboGraph's Joseph J. Gregory and Dr. David Maimon recently discussed the Dark Web or Dark Net, which is becoming the supermarket for fraudsters looking for raw materials to use as tools in check fraud schemes, specifically images lifted from stolen checks.

It is important to understand that the dark net or dark web is a subsection of the deep web. For most people, we frequent different websites such as social media, news, and sports pages that are common amongst the general public. However, these types are sites only account for 5-10% of websites on the internet. The other 90-95% is known as the deep web -- the part of the internet that is not indexed by search engines such as Google, Bing, etc.

In his research, Dr. Maimon monitors over 80 different channels/markets for check fraud activity, noting the peak of nearly 12,000 in April of 2022..

OrboGraph Announces Second In-Person Check Fraud Roundtable and the OrboGraph Innovation Conference at the Hilton Tampa Downtown

Check Fraud Roundtable will be held on May 14-15, 2024, and OrboGraph Innovation Conference on May 15-16, 2024

OrboGraph is please to announce that we will be hosting both the second, in-person Check Fraud Roundtable (May 14-15, 2024) and the first ever OrboGraph Innovation Conference (May 15-16, 2024).

The Check Fraud Roundtable will include highly engaging discussions on the best and worst cases in check fraud, along with additional analysis of market activity, including SARS. We’ll also be mapping the new capabilities of Version 5.3 to specific fraud use cases and discuss how to optimize detection capabilities in both Day 1 and Day 2... Click here to register →

The OrboGraph Innovation Conference takes inspiration from previous OrboGraph conferences, but a with focus on our check technology. We'll be covering everything from recognition and automation, to deployable technology advancements that tackle the challenges of check fraud. Additionally, we will reveal the roadmap for our OrboAnywhere Suite. Click here to register →

The Seventies Check Fraud Boom… Can We Learn from History

The 1970s were hard times in fraud. The US was going through an economic recession, and inflation was raging. And many people resorted to fraud. Banks reported an explosion of fraud in the mid-70s as more people turned to fraud to get by.

Indeed, check fraud reached $4 billion by 1976 -- equivalent to over $20 billion today, and not far from what banks are now losing...

Over Half of All Banks Express Concern About Legacy Tech Dependency

Over half of bank execs polled are concerned about dependency on legacy technology. The same execs have a positive outlook for 2024. Less than 8% of the execs polled expect to reduce their tech spending in the coming year Monitor Daily reports on a survey of over 100 bank executives...

Inevitably, all technologies will become out-of-date -- this is just how the tech cycle works. However, financial institutions are notorious for taking their time to upgrade to the latest technology -- sometimes to their own detriment. They adhere to the old adage: "If it ain't broke, don't fix it."

Scam Interdiction — “Banks Battle Scams With Tough Love”

The latest Frank on Fraud blog explores Scam Interdiction, a practice that is currently in use all over the world and may be coming to the US. Simply put, Scam Interdiction is the use of AI and other tools to pause or decline suspicious transactions in real-time before any money is lost...

Australian banks don’t think the reimbursement model will work. They call that a “honeypot” for scammers since it will create less onus on the entire ecosystem – including customers to avoid scams.

"Hey, more friction is on the way, but we don't lose half a billion a year. I think it might be worth it."

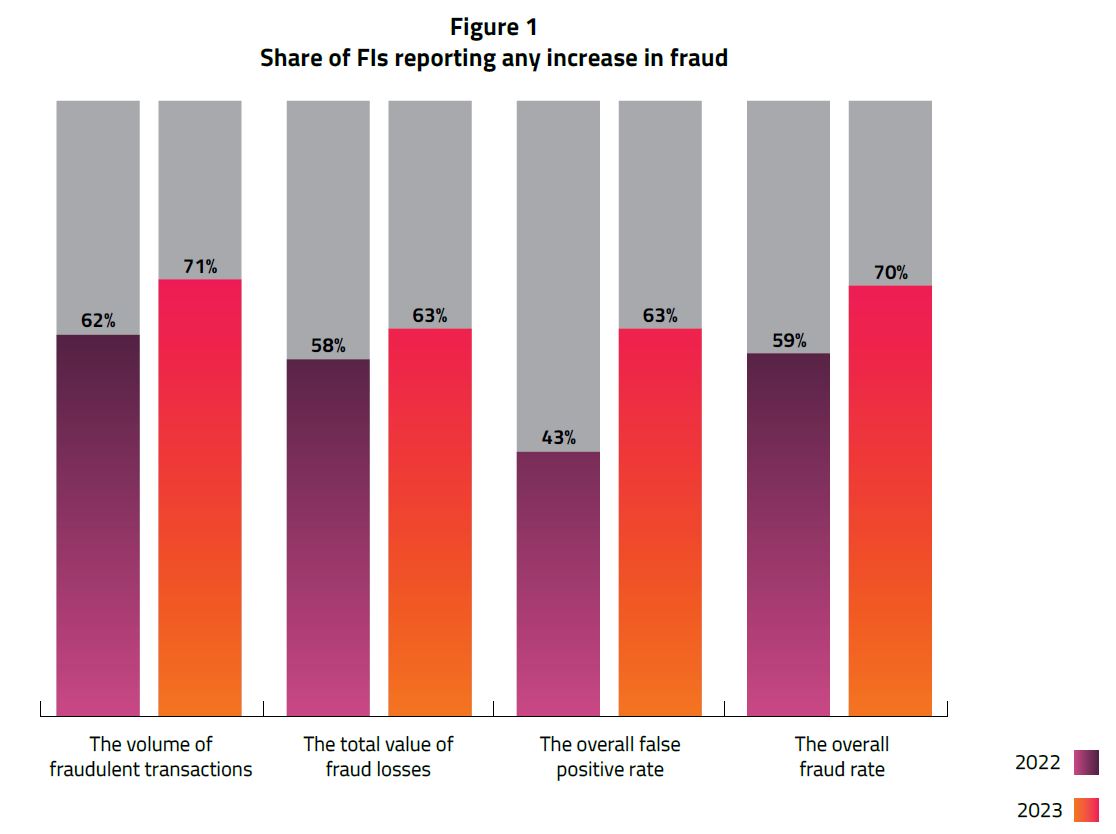

FeatureSpace Report: Check Fraud Increased 70% in 2023 -INCOMPLETE

FeatureSpace -- creator of Adaptive Behavioral Analytics, Automated Deep Behavioral Networks and ARIC Risk Hub, the most powerful and open technology to combat fraud and financial crime -- just released a report entitled The State of Fraud and Financial Crime in North America, which explores "volume, value and false positive benchmarks for financial institutions in North America, 2023."

The findings from the report reveal that "70% of financial institutions (FIs) saw a rise in fraud rates over the past year, marking an 11% increase compared to the previous year."

Compelling evidence also suggests that those currently implementing new fraud prevention strategies – rather than planning to do so in the next two years – are already reaping tangible, positive results.

Are Bank Branches Making a Comeback?

"In-person banking is fading away." Wall Street's biggest bank would beg to disagree. Bankingdive.com reports that banking giant JPMorgan Chase plans to expand its branch network significantly over the next few years, aiming to open over 500 new branches focused on underserved areas.

Some other banks are reducing their physical footprints. However, while JPMorgan also plans to close around 30 locations it acquired from First Republic Bank, the bank sees branches as important for attracting new customers and wants to become people's primary financial partner.

New Alloy Report: Nearly 60% of Banks, Fintechs, and CU’s Absorbed $500K+ in Direct Fraud Losses

Alloy -- a identity risk management platform for financial companies -- has recently published its 2024 State of Fraud Benchmark Report, revealing meaningful losses for financial organizations in 2023:

The direct cost of fraud is significant. 57% of respondents indicated that their organization lost over $500K (EUR/USD) in direct fraud losses over the past twelve months. Over one-quarter of respondents lost over $1 million in direct fraud losses over the past 12 months.

Reverse Positive Pay: Banks Putting Fraud Liability on…Customers?

Jeremy Wiswell said he and his wife, Sarah, had a check written to a vendor for $395 in September. Sarah checked their account the next morning and found that the check had been compromised and written for $27,395.

As it turns out, the Wiswells actually pay a $25-per-month fee in order to get added protection called Reverse Positive Pay -- a program which gives its customers seven hours to approve checks... Unfortunately, the Wiswells "missed their window." That means - you guessed it - they lost $27,395.

This did not sit will with #FraudFighter Thomas O'Malley, as he declared that "this is not a fraud mitigation program; this is a screw the bank customer program."

Visa’s Acquisition of Pismo Banking Platform Continues Trend of Major Companies Entering Banking

Not long after we saw Elon Musk's X (ex-Twitter) make moves into payments, Visa has successfully completed its acquisition of Pismo, a global cloud-native issuer processing and core banking platform, for $1 billion in cash. Earlier reports said Visa was competing with at least one other firm to acquire Pismo.

The acquisition enables Visa to broaden its offerings and better serve the financial institution and FinTech ecosystem, allowing the launch of innovative payments and banking products on a single cloud-native platform. This also expands the geographic footprint of Pismo, which had operations in Latin America, Asia-Pacific, and Europe.

BAI Executive Report Shines Light on Fraud Trends Going Into 2024

The new BAI Executive Report, entitled Safeguarding Against Fraud, offers a look at the current state of fraud and the ways financial institutions can protect themselves and their clients.

One thing is for sure: It's not getting any easier.

Ever faster and smarter technology -- like nearly instantaneous money transfers and the popularization of artificial intelligence -- mean that bad actors are more stealthy with their financial crimes. Phishing emails have given way to voice cloning and more complex deep fake identities that can take over accounts.