Uncategorized

Fraud is rampant, but preventable AI technology is being deployed by fraudsters Fighting fraud will require AI tools There’s no question about it: modern fraud detection systems — including check fraud detection — require the utilization of artificial intelligence to keep up with fraudsters. Why, you may ask? Because AI is used in half of…

Read MoreThe USPS announces elevated efforts to prevent mail theft Postmaster General Louis DeJoy, meanwhile, has announced his resignation USPS efforts will likely fall short, as they face a formidable opponent Over the past few months, we’ve seen a concerted effort by the USPS and the US Government to make drastic changes addressing major challenges within…

Read MoreToday’s digital landscape demands advanced tech for bank customers Data is now a tool for elevated customer service Banks using “data as a customer service tool” have seen revenue increase We’ve made this important point in many earlier posts and news items we’ve shared: In today’s digital landscape, banks must leverage advanced technologies to meet…

Read MoreA new report by NPG reveals check fraud rising even as check usage declines NPG’s survey reveals that 80% of FIs offer Positive Pay FIs have not adopted Positive Pay mainly due to lack of awareness or perceived risk Within the arsenal for financial institutions to fight check fraud, Positive Pay undoubtedly plays a key…

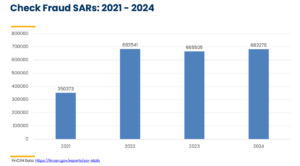

Read MoreOverall SARs reports have declined, but only slightly Check fraud SARs achieve near record-setting levels in 2024 As we seeing the new norm for check fraud levels? According to a recent report from the Thomson Reuters Institute, the total number of Suspicious Activity Reports (SARs) filed by U.S. financial institutions in 2024 declined slightly from…

Read MorePresident Trump Announced “U.S. Crypto Reserve” via his Truth Social platform Ondo Finance unveils “suite of infrastructure products designed to bring capital markets onchain” SWIFT Network adopts Hedera Tech Earlier this week, President Trump made an announcement Via his Truth Social media platform that has sent ripples through the payments industry. It is his intention to…

Read MoreFraud incidents continue to surge Collaborations play a key role in enhancing fraud prevention capabilities Partnerships are vital because there is no single tech that can detect the majority of check fraud As fraud incidents continue to surge, credit unions (CUs) are racing to implement cutting-edge technologies and forge strategic partnerships to safeguard their finances…

Read MoreConsortiums are proving effective in fighting fraud Key to success is a collaborative approach Privacy concerns and regulatory hurdles are among the challenges faced The evolution of banking fraud has drastically changed over the past decade. Most notably, fraudsters are no longer performing their schemes solo. The internet has enabled fraudsters to not only perform…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreThe Trump administration has shut down the Consumer Financial Protection Bureau (CFPB) The freeze of the CFPB makes enforcement unclear There are several reasons why financial institutions should continue their open banking efforts As the new administration continues to make its adjustments, one major change that is affecting the banking industry is the halting of…

Read More