Uncategorized

2024 saw a 15% increase in fraud attacks and attempts over the previous year A multi-layer approach to fraud prevention is recommended Also vital are robust email security measures, including two-factor authentication & email scanning Readers of our blog know this simple fact: There is no “single technology” that can detect the majority of counterfeit,…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreTravis Hill is newly appointed acting head of the Federal Deposit Insurance Corporation (FDIC) In 2017 during his first term, Trump issued an Executive Order directing more relaxed regulation We will likely see major changes for the banking industry in the next three years As reported in PYMNTS.com, the newly appointed acting head of the…

Read MoreThere are 10 recommended warning signs that signal check fraud None of the warning signs require special equipment to detect Bank tellers, however, cannot be expected to get through the checklist on a busy day Spotting a fraudulent check is not an easy task. Fraudsters have finely honed their craft, and even the most seasoned…

Read MoreThe business world is tangling with “a startling resurgence in check fraud” Going digital has advantages- but many won’t until they are victimized Implementing Payee Positive Pay service is essential The Bottomline blog pulls no punches with the title of its latest entry, How to Beat Check Fraud: Go Digital, Get Positive Pay, or Get…

Read MoreChecks are seen as a “speed bump” for advancement and innovation Why paper checks are still used FIs need to focus on integration, rather than replacement As we kick off 2025, we see another article selling checks short as a major payment channel. PYMNTS.com notes that paper checks are a “speed bump” slowing the pace…

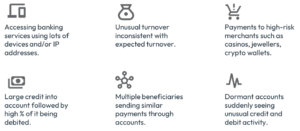

Read MoreScammers are using “mules” to pass bad checks Some “mules” are unaware that they are aiding a scam There are risk factors to look for when detecting mule-aided scams Sarah Cassidy, a senior consultant at FICO specializing in fraud, takes a look via the FICO Blog at money mule fraud, a major and growing problem…

Read MoreCheck fraud looms large for financial institutions Post offices and carriers are targets of check theft A holistic solution is the best approach Yes, you read the title right. In a new podcast from the ABA, Glenn Fratangelo, Director, Product Marketing, NICE Actimize, opens the interview with Patrick Smith, SVP, Fraud Operations, ABA, with the…

Read More1 2 3 Forbes Magazine features a post by Julien Villemonteix, the CEO of UpSlide, a software company that creates documents for investment banking and financial advisory firms. She notes that the banking industry is abuzz with excitement over the potential of artificial intelligence (AI) to transform the sector. With the global AI market projected to…

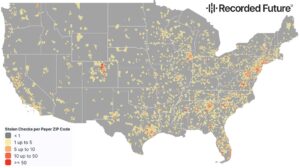

Read MoreRecording Future monitors 700 Telegram Channels for Stolen Checks in H1 2024 85% of stolen checks are likely “reposts” High concentrations of stolen checks are in metropolitan areas Telegram is a major communication channel leveraged by criminals due to its encryption and anonymity. This makes it an attractive method for selling stolen checks. Previously, we…

Read More