Check Fraud Today vs. The Past: Reviewing FBI Investigation of a Multi-State Check Counterfeiting Ring

- Jerri Williams writes and podcasts about the FBI to "relive her glory days"

- Tim Gallagher, also a retired FBI agent, discusses "vintage check fraud" techniques

- Sending fraudsters to prison is a bit like sending them to get advanced degrees in fraud

Jerri Williams, a retired FBI agent, author and podcaster who likes to joke that she writes about the FBI to relive her glory days, spoke to retired FBI agent Tim Gallagher, who served for 22 years. They discussed his investigation into a multi-state check counterfeiting ring operating out of Northeast Ohio Banks, where businesses were presented with fake payroll and personal checks, causing hundreds of thousands of dollars in losses.

The case in question -- a "vintage" check fraud case -- first came to Mr. Gallagher's attention way back in 1999, and things got serious right away:

Tim teamed up with a secret service agent and detectives from state and local police agencies to identify and convict the ringleaders the case also resulted in and the recovery of the remains of a cooperating witness suspected of being murdered to stop him from testifying at the time of the investigation.

Highlights from the Podcast

While there are dozens of topics that we could highlight from the podcast, there are several that are pertinent for today's check fraud.

While going to prison is typically seen as a lesson for criminals to learn from their mistakes, there is another side of the coin: In prison, an inmate learns from the experience.

Mr. Gallagher also noted that one of the suspects they were trailing had been caught for bank fraud previously and served time.

They learned from their lessons of their past arrests and convictions, so if you get caught you go to prison you learn from it and they were able to change their techniques and their procedures to insulate themselves and the criminal operation from getting caught. So, instead of learning not to do the crime, they just learned how to do the crime better -- absolutely, they utilized their knowledge and their skills to further a criminal enterprise.

Check Fraud Today

Mr. Gallagher provides an interesting -- though not widely shared -- opinion at the 18:12 mark as to why he believes counterfeit checks are not prevalent today.

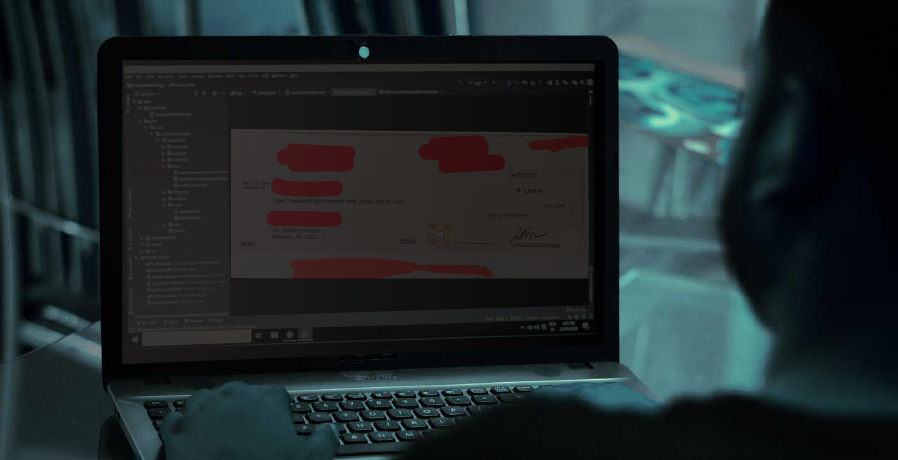

Counterfeit checks are still a major type of check fraud today and, with the mass adoption of mRDC, those physical security features are not something a camera on a phone will capture. Stolen checks via mailbox/mail carrier robberies, or banking information stolen from other means, make it extremely easy for fraudsters to create a counterfeit check in the blink of an eye. We've shared several examples of YouTube tutorials where people share techniques to digitally create counterfeit checks or wash checks.

You don't hear as much about this anymore, obviously, because banks have started putting in more security features onto the checks in order to combat this. And, so probably around 2001, 2002, you're starting to see more and more security features put into the paperwork on the actual checks which started to thwart this as well as some other security measures that were taken by financial institutions that I'm not going to get into because they work really well and they're able to defeat the adversaries of the banks and the financial system and law enforcement.

Ms. Williams appears to accept the statement, which unfortunately is simply not true in today's check fraud ecosystem.

Once these checks are created, a fraudster can print them out on a simple, inexpensive desktop printer, use a mobile device to deposit the check into a newly created account -- and, in a matter of minutes, that fraudster is able to extract funds.

However, technology is playing a key role in stopping fraudsters. Behavioral analytics systems analyze all transactions to identify anomalous payments, while image forensic AI is analyzing the images of the checks for key fraud identifiers such as check stock issues, amount discrepancies, writer style on the check, and signature verification. All these tools combined provide a strong detection defense against fraudsters.