Ex-US Secret Service Member Recounts the History of Check Fraud Investigations

- The United State Secret Service also investigates financial crimes

- Check fraud detection used much different methods in the 90s

- Check fraud is on the rise, but so is the effectiveness of AI tech designed to detect and prevent it

Some may be surprised to see the Secret Service mentioned in conjunction with financial crimes. Don't they wear dark glasses and guard the President and other government figures?

For those who are unaware of the history of the USSS, the agency was founded in 1865 in the U.S. Department of the Treasury in order to combat a massive amount of counterfeit currency circulating in the country at the close of the U.S. Civil War. It wasn’t until 1901, after the murders of three U.S. Presidents that the USSS was given the responsibility of protecting the President of the United States. When the USSS was founded, the only other Federal law enforcement agencies in existence were the U.S. Marshal Service and the U.S. Postal Inspection Service (USPIS).

Indeed, the original purpose of the USSS was to handle the challenge of counterfeited currency. And, as explained by Secret Service website, as the financial system has evolved, so too, has the USSS.

Today, Secret Service agents, professionals, and specialists work in field offices around the world to fight the 21st century’s financial crimes, which are increasingly conducted through cyberspace. These investigations continue to address counterfeit, which still undermines confidence in the U.S. dollar, but it is credit card fraud, wire and bank fraud, computer network breaches, ransomware, and other cyber-enabled financial crimes, that have become the focus of much of the Secret Service investigative work.

The "Good Old Days" of Check Fraud Detection

The Secret Service has a long history of investigating financial crimes like counterfeiting and check fraud. In the 1990s, check fraud was rampant, with many cases involving stolen, forged, or altered checks. Investigating these cases used to involve labor-intensive techniques like analyzing fingerprints, handwriting samples, and surveillance footage.

Check cases were either stolen checks that were forged and cashed, counterfeit corporate checks, altered checks in which the dollar amounts were changed, or what we called deceased payee check cases. The latter referred to government checks issued, typically monthly, to someone receiving some form of government assistance but the “payee” died and the family didn’t notify the government so as to continue receiving and cashing those monthly checks. Check fraud was so rampant in the 90s that USSS Field Offices had entire squads of agents assigned to investigate these types of cases. Those squads were called, to nobody’s surprise, check fraud squads.

More recently, criminals have turned to new techniques and technologies like stealing checks en masse from mailboxes and depositing altered checks remotely using mobile apps. This has made traditional investigation methods less effective.

A few years ago, check fraud came back with a reckless abandon. Criminals realized they could steal checks en mass right out of the mail due to some vulnerabilities in the system such as a generic key, called an arrow key, that can open up those blue mailboxes on the street corner and clustered mailboxes all over the country. Steal one arrow key and the mail system is your oyster. So now its easier to get stolen checks and cheap software makes it very easy to alter them without much effort. And finally and most importantly, they can deposit those checks right from their burner phone without fear of getting physically caught on surveillance cameras or leaving fingerprints on the checks. No bueno for the good guys in law enforcement and the banking sector.

Adapting Old Tactics with New Technologies

Mr. O'Neil comments on the new landscape of check fraud, and how the old "investigative techniques" are no longer viable in this new day and age of check fraud. However, new technologies utilized by the bad guys also mean new tech for the good guys.

This includes a new technology for handwriting analysis -- or what OrboGraph calls "Writer Verification." The technology analyzes the handwriting style of a deposited check and compares it to that of previously cleared items -- both hand written and machine printed. Consequently, the AI model is trained and continuously learns from good items, and the technology can identify variances in the hand writing or machine printed items.

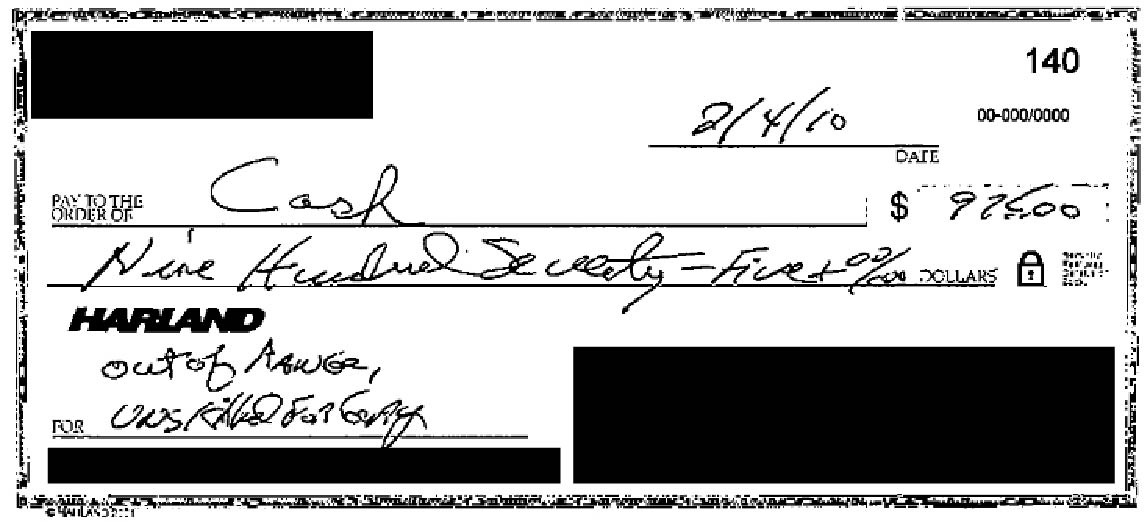

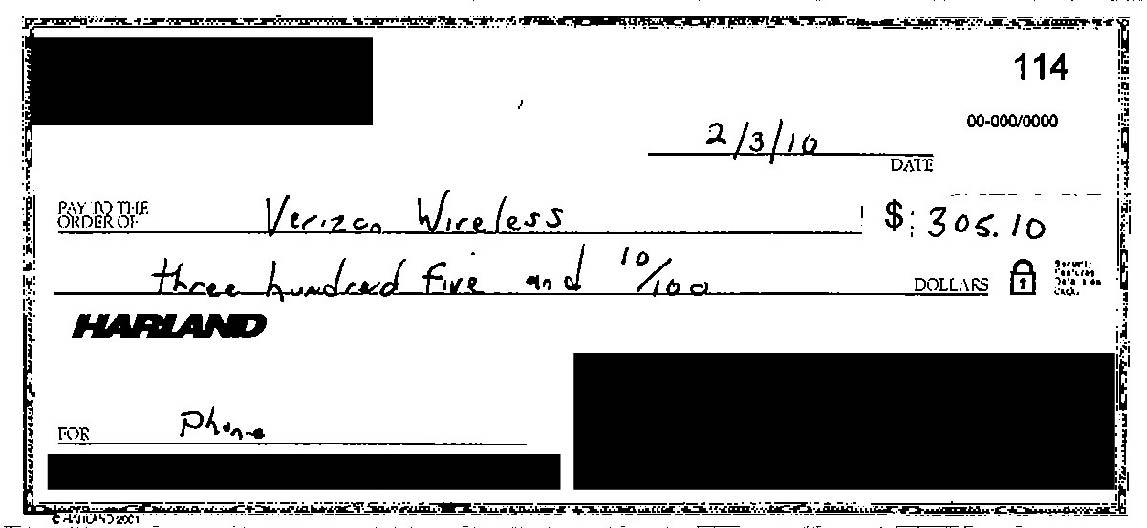

As seen in the redacted examples below, the check at the top has different handwriting than previously cleared items in the profile -- and the system will flag the item.

The analysis can also be performed on machine printed checks, where a variance in fonts can be detected.

This technology, along with other AI analyzers like check stock validation, signature verification, and amount verification, are powerful tools that FIs can leverage to combat check fraud. Deploying these technologies -- while collaborating with other FIs and federal agencies -- will continue to be the best path for the indsutry.