Funds Availability: The Race is On

Modern bank consumers are more and more comfortable interacting with their accounts online, often from a portable device. It’s never been easier to make deposits — using an app on an always-handy phone — and see the “funds available” right in an account, reassuring the user that the money is indeed deposited and… available.

MyBankTracker reports on the race currently occurring as key financial organizations work to shorten the gap between deposit and actual funds availability, which is an extremely important metric in a world where business moves fast and individual depositors find themselves having to cover expenses with funds obtained at the 11th hour.

From MyBankTracker:

Funds availability describes when you can access money you deposit into your bank account. Federal Regulation CC offers a framework for banks to use when setting their funds availability policies. Specifically, Regulation CC covers two things:

• Timing for making deposits available to customers

• Guidelines for disclosing funds availability policies to customers

Under Regulation CC, the timing for when deposited funds will be available is usually based on the type of deposit, when you made it during the course of the business day and, in some cases, the amount deposited.

Banks then can use these guidelines to create and implement funds availability policies. These policies are usually disclosed to you when opening your account initially. Many banks also make their funds availability policies accessible online.

The hold period is designed, of course, to ensure that funds are successfully transferred from the payor’s bank to that of the payee. The balancing act is in making funds available to the depositor as quickly as possible while still allowing for a solid verification that the funds do indeed exist.

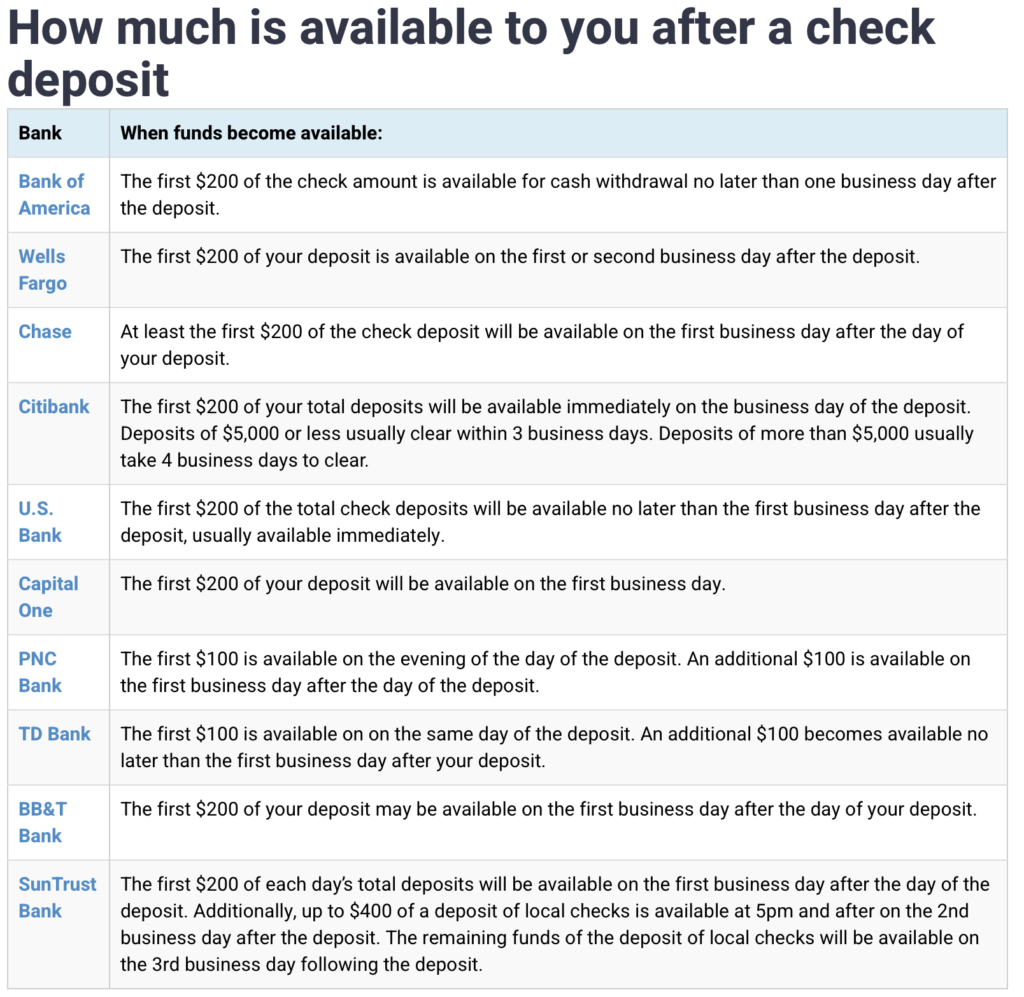

Consequently, this time period varies, as seen in a chart prepared by MyBankTracker:

Another element that varies from bank to bank is cut-off time for deposits. Bank of America, for instance, calls 2pm “the end of the line” for standard deposits to be counted on that day. Chase, on the other hand, goes until the end of the business day – something many businesses may take into account when choosing a bank.

Other Factors

Banks need to look at other elements as well—and this is best served by automation, of course. There’s a “red light” on check deposits totaling more than $5,000 in any one-day period, and a check that’s been redeposited after it’s been returned unpaid will almost certainly cause the funds to be delayed — spotting these characteristics quickly is crucial to timely funds availability.

Delays can also kick in if the account into which the funds are being deposited has issues such as being fairly new (less than 30 days old) or having been overdrawn repeatedly in the past six months. Again, the ability to automate discovery of these factors can make that delay negligable.

The Fraud Connection

As MyBankTracker reports, one of the most common kinds of fraud occurring around the world is the scheme where a payment is offered in the form of a large check – which the “target” can claim if only they use a portion of it to buy a gift card, or wire funds to a third party as part of the “project.” Examples of this tactic appear in the news daily.

This is the key to the deception: The fraudsters hope the target checks their Account Balance and it shows the total amount in the account — including funds that have yet to clear. Unfortunately, they don’t know that it’s the Available Balance that accurately indicates the amount you actually have at your disposal. As we discussed above, that gap varies from bank to bank.

Often fraud targets go ahead and follow instructions to move a portion of the check amount to another party because, to their eyes, the funds are in their account and “available.” As pointed out by the Federal Trade Commission website: By law, banks have to make deposited funds available quickly, usually within two days. When the funds are made available in an account, the bank labels the check “cleared” – and it may say so in the consumer app and in the online account info – but that doesn’t mean it’s a good check. A fake check can take weeks to be discovered; by that time, the scammer has any money the target sent, and the target is stuck paying the “phantom money” back to the bank.

Closing the gap between check deposit and funds availability has become a recognized crucial point of competition between financial institutions. In order for banks to protect their customers, it is important to deploy real-time solutions that utilize both transactional analysis and image analysis to flag suspicious items before funds can be withdrawn from customers banks accounts.

This blog contains forward-looking statements. For more information, click here.