“I Got Over $5000 in Fake Checks from Craigslist Scammers!”

- Craigslist is a popular "hunting ground" among fraudsters

- Fraudulent checks come in various levels of detail and realism

- Fraudsters mail dozens of fakes checks knowing only one or two will convince their "mark"

Craigslist can be a handy resource for buying and selling goods and services -- and it is also a very popular vehicle for scammers deploying simple check fraud tactics.

Detailing the Scam

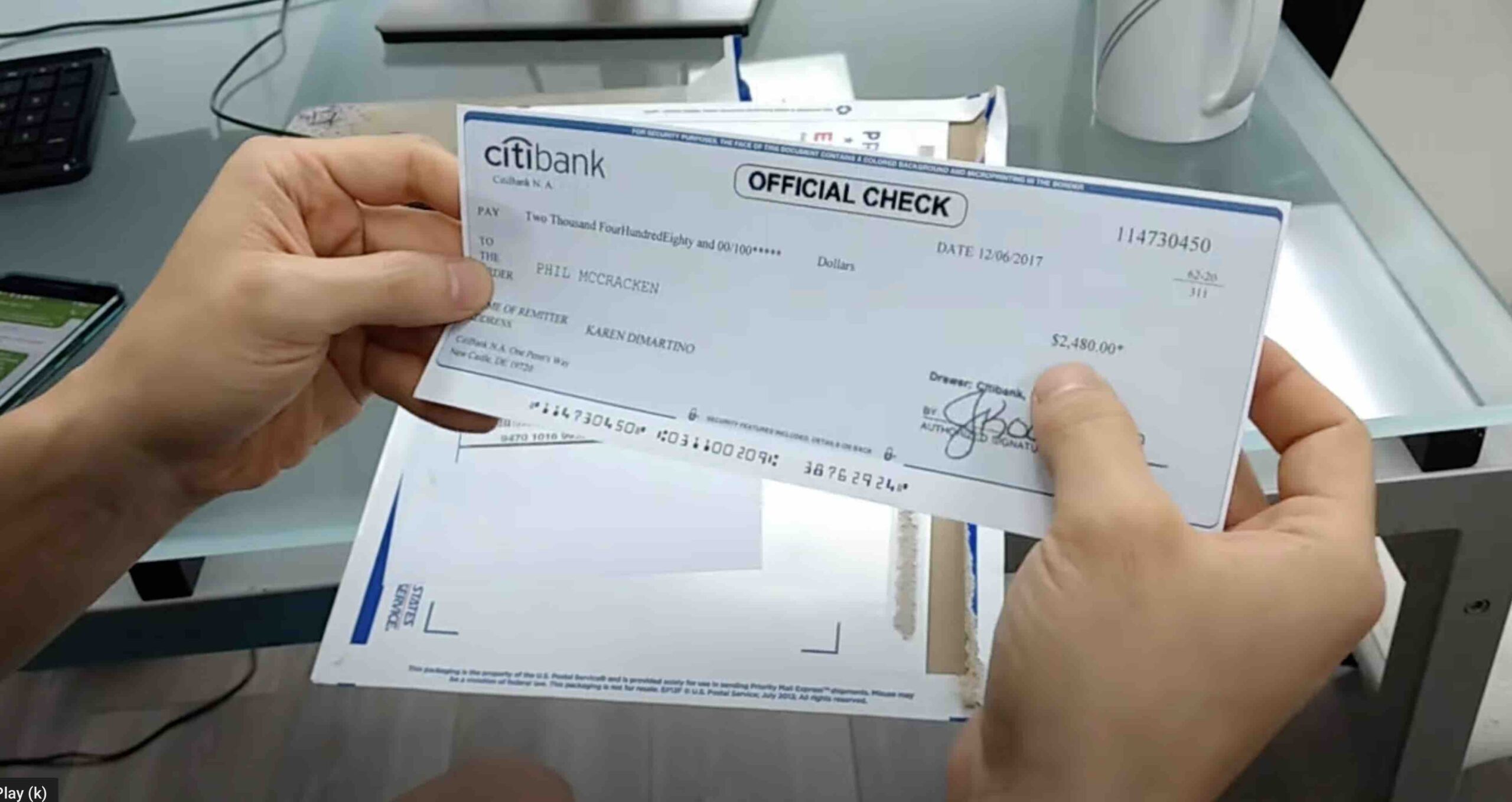

On YouTube, Traveling Director demonstrated a common Craigslist scam by offering some furniture for sale. His asking price was $300, but he had "buyers" consistently send checks for much, much larger amounts of money. It's interesting to see the range of quality in the forgeries -- a couple of the checks he received are downright amateurish.

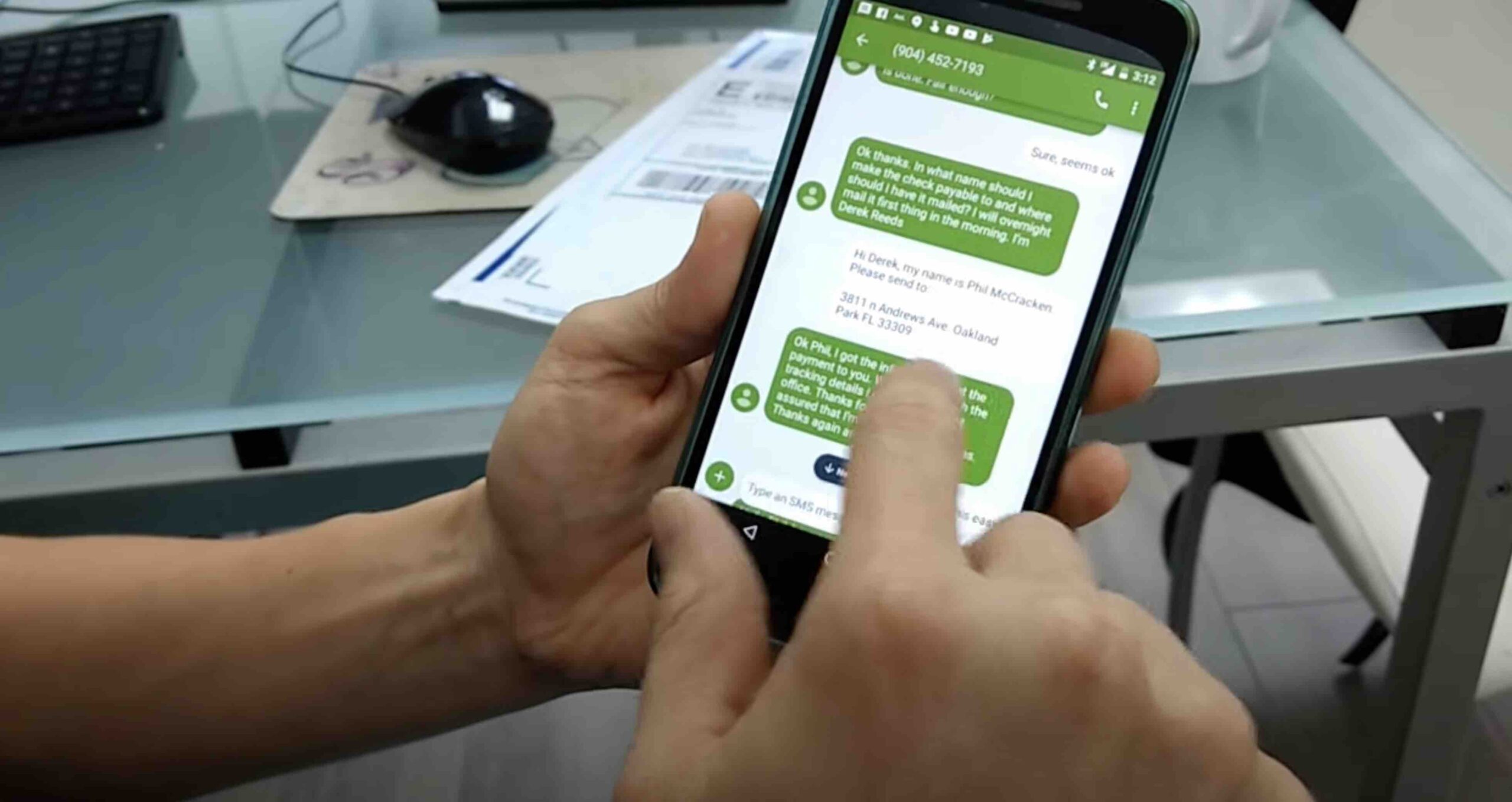

Texting the scammers

Some fraudulent checks look more authentic than others.

The scam is common: A "buyer" sends a check for a much larger amount than is asked for in the ad. The seller deposits the check, and mistakenly feels secure when he or she sees their account balance change to reflect the amount written on the check. The buyer asks for a portion of the money back -- and is willing to pay a bit more than the original asking price to cover the "error."

The seller assumes that once the check is deposited, they have the money; they return a portion of the funds back to the buyer -- in this case, the scammer.

Keys to the Scam

Scammers don't mind sending out dozens of these fake checks in hopes of hitting the jackpot with just one. There are a couple of keys for the scam:

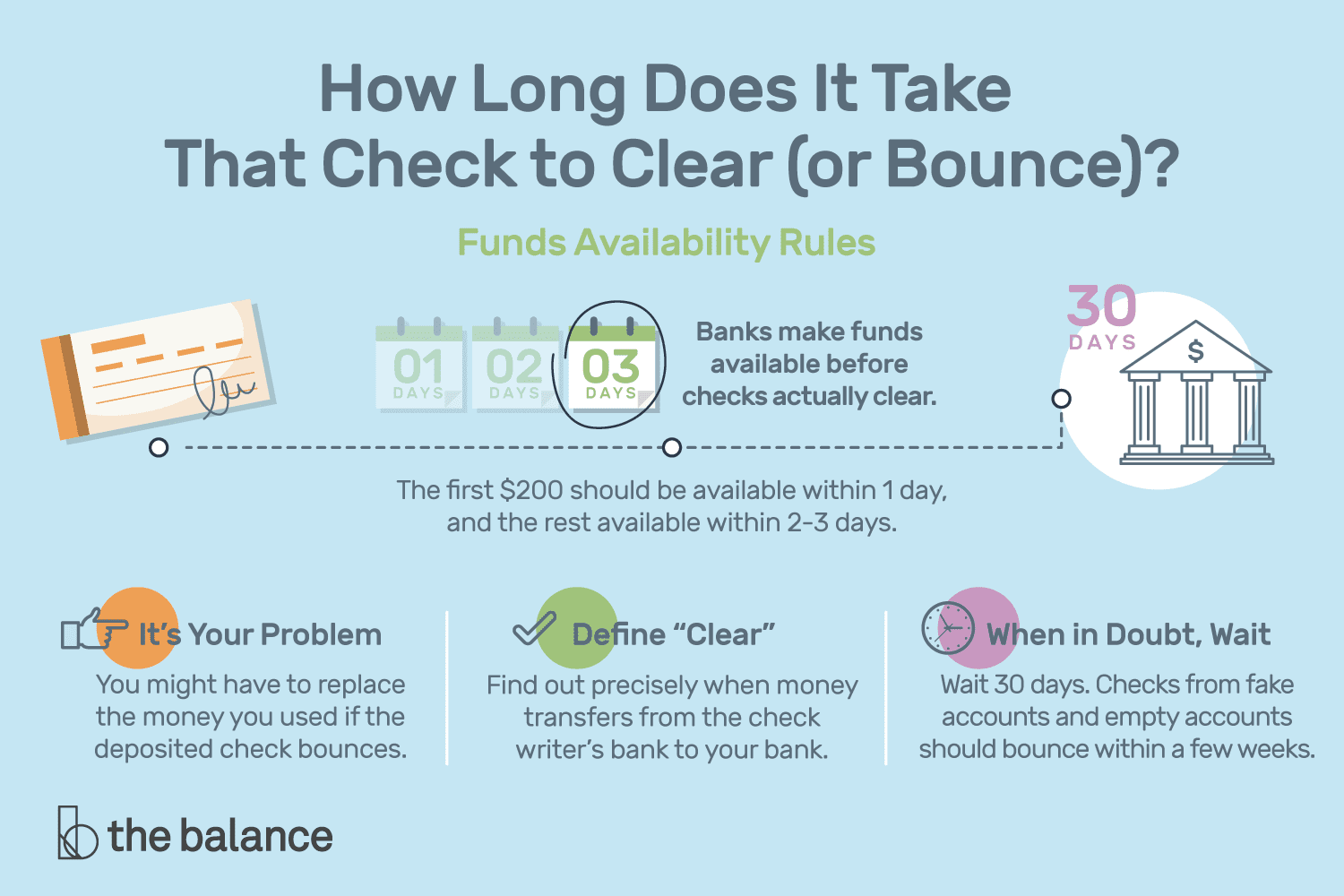

1. The seller is unaware of the rules around funds availability policy for banks

It turns out that the average bank customer is unaware of the funds availability policy, and that, by law, a bank must make a certain amount of funds available for withdrawal shortly after the check is deposited. This becomes a real issue for the account holder as they are responsible for all of the funds until the check actually clears, which, as we know, can take up to three days.

The Balance provides a nifty infographic that provides valuable details your customer should be aware of. Click the image to the right to enlarge.

Theresa Chiechi © The Balance 2019

As long as there is a gap between "available" and "cleared," scammers will use the "please send me back a portion of my overpayment - and keep some for yourself!" gambit.

2. Scammers will reply to thousands of ads, utilizing "money mules"

As you can see from the video, the YouTuber receives a handful of responses to his advertisement to sell his couch and the envelopes are sent from all different locations. As we detailed last week in our "What’s It Like to be the Personal Assistant to a Fraudster?," the scammers leverage "money mules" to send out the checks from a various locations, enabling the checks to be delivered quickly to increase chances of success.

Click the image above to watch the video.

3. Scammers Will Push the Victims to Use Mobile RDC to deposit and Return Funds through Electronic Transfer

While this is not detailed in the video above, this may be the most important part of the scam in order for it to be successful. As we see from the video, some of the checks were poorly created, to say the least. That's why scammers will likely push the victims to use their bank's mobile app (mRDC) to deposit, as a teller will almost assuredly inform their customer that the check appears to be fake.

The scammers will then instruct the victim to transfer the money through a variety of electronic means -- Venmo, Cash App, Cryptocurrency, etc. -- in order to secure the funds before the victim is aware that the check has bounced. If the victim returns a personal check of their own, there is a likely chance the victim is able to put a stop on the check before the scammer is able to obtain the funds.

These YouTube videos are great at keeping the general public aware of scams that are being committed today. Banks are doing their part by creating dedicated web pages on their site to provide additional information to their customer base -- but is it enough?

To thwart the scammers, banks need to invest in image analysis technologies leveraging AI and Machine Learning to protect their customers. Even though some of the checks are poorly made -- and most likely printed using a $35 printer -- if the victim deposits the check through mRDC, the scam will likely be successful without technology closely analyzing the attributes of the check image to detect signs of fraud.

Click the image above to watch the video.

This just happened to my roommate. He will give the cashier’s check to his bank so they are aware he was almost taken in. Thankfully I sensed something wasn’t right about the transaction before any financial damage was done.

Be very careful people. If you try to deposit these checks in person some tellers will call the police and you may end up being charged as an accomplice! Usually, it’s very embarrassing either way as the police question you at the bank in front of everyone! You may be let go if innocent, or may get a ticket, or worse locked up if the police think you’re part of the bad checks scam to steal from banks and people. Years ago my friend was selling furniture on CL and got send a very authentic looking cashiers check. She took it to the bank and the teller alerted police secretly. They showed up sirens blaring and grilled her on trying to steal from the bank. She was lucky to tell the truth and have them believer her that it was sent by mail, or carrier. I cannot remember which method they used to get her the check, but it was one scary and a bit embarrassing situation as people thought a bank robbery was going on! LaterI heard about another friend who received the check, deposited it and it appeared to clear! They took the funds out in cash immediately and then the scammers tried to have them send it all to them. This friend immediately knew something was very wrong. Why would they ask for ALL of the money back when paying for their for sale items? That’s clearly a greedy scammer trying to get all the money from the fake check, persons account, or bank. The bank closed this persons account 2 days later and they’ve been flagged for fraud ever since not being able to open another business bank account with that bank. When reporting to the police and FBI they allegedly take the reports and look into things, but there’s so many cases that you often won’t even hear back from them after that. It’s buyer and seller beware and a civil matter unless the bank is stolen from. Then the investigation is taken mor seriously. Of course the public doesn’t get the enforcement like the wealthy banks do. After all the banks are part of the system that controls the police in most nations, so they get top notch enforcement while the public is “blown off” most often when they lose money. The banks use police. FBI and private investigators / insurance investigators to get people actually arrested and locked up to attempt to get the money back. Now you know, so be careful!