mRDC: “Double Presentment” Check Fraud

Mobile remote deposit capture, or mRDC, is wildly popular among banking consumers - and why not? Upon receipt of a paper check, rather than having to travel to a local bank branch to deposit the money into an account, today's bank consumer has only to sign the check and use their smartphone to photograph it front and back.

Once the amount specified is in the recipient's account -- pretty much instantaneously -- the paper check is destroyed.

At least, in theory.

Double Presentment Check Fraud

While alterations are a major topic when dealing with mRDC fraud -- fueled by stolen checks from mailboxes -- there are other methods for fraudsters to get away with consumer funds.

A recent news story in Charlotte, NC, provides a warning for one of the methods of check fraud spurred by mRDC. A bank consumer notices that her account balance is much lower than it should be, and, upon investigating past bank statements, learns that a check written half a year ago had been cashed. Her first thought is that the vendor to whom she'd written the check had simply forgotten to cash or deposit it previously, but a bit of bank statement research revealed that it had indeed been cashed six months ago as well.

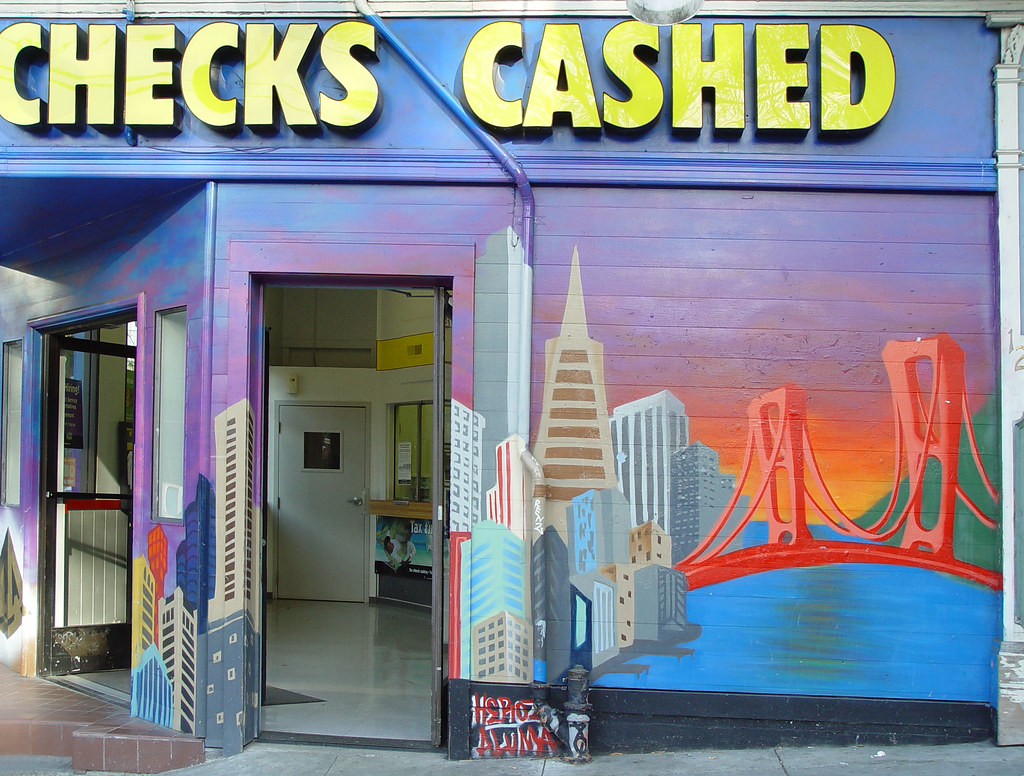

This is a classic case of what banks call double presentment -- simply stated, it's when the same check is deposited twice, first via mRDC and then cashed at a check cashing facility. Instructions for an mRDC deposit include "destroy the check after deposit," but, as you can imagine, there are plenty of fraudsters willing to try their luck with a previously-deposited check (and it can even happen due to depositor error.)

Another common occurrence for double presentment is when an individual deposits a check via mRDC and immediately brings it to a check casher. The fraudster relies on the fact that the check casher is not able to see that the check was already deposited -- enabling the fraudster to get away with the cash, while also transferring the funds out of the account.

By the time the check casher is made aware that the check was already deposited, the fraudster is long gone.

Validating the Negotiability of Checks to Prevent Double Presentment

Double presentment check fraud is difficult to prevent -- the check is legitimate, after all. It's also difficult for check cashers, as verifying whether an item has already been deposited requires due diligence in following up with a financial institution.

However, detection is key to protect the financial institution and their consumers. Deploying AI technology to validate the negotiability of a check -- particular the check number field -- enables banks to see whether the item has already been deposited and stop the payment before funds are released again.

This is accomplished by utilized image forensic AI to analyze the image of the check deposited through mRDC. The check number field is extracted, and the data is transferred to a transactional analytics system. Once the payment is requested from the check casher, the data from the original mRDC-deposited check flags the payment as a double presentment, protecting the funds of the customer.

In a world where mRDC is the expectation, not the exception, it's more important than ever to be vigilant in protecting bank customers against bad actors .