Navigating “Waves of Regulations” Through Tech and Training

Most -- if not all -- individuals and organizations in the banking industry are at least familiar with the Federal Register, the Daily Journal of the United States Government. This is an important resource for banks, particularly for the Chief Compliance Officer, the BSA Officer, and their departments, as it provides banks with new regulations that are coming from the government.

PaymentsJournal.com has recently published an article to help banks and financial institutions navigate the new "waves of regulations."

Waves of new regulations have rolled through during the past few administrations and swept through the financial services industry since the financial crisis. This should not come as a surprise given that banking is one of the most highly regulated industries. Every day, a Chief Compliance Officer must review and react to about 200 new regulatory changes, according to a Boston Consulting Group report. In the United States, that velocity of change continues to rise, putting organizations increasingly on edge.

Automation and Artificial Intelligence

Their first bit of advice is what we concentrate on in this space: Find ways to eliminate manual tasks and create automation wherever possible.

It’s time to banish manual processes and replace them with automation. The use of manual processes and tools have a greater margin for error and are not efficient. It’s also expensive to engage expert resources in tedious tasks. In contrast, automated tools, including the implementation of AI and ML technology, allows for the monitoring and controlling of compliance issues with greater ease and accuracy than ever before.

Tools that enable you to proactively identify regulatory changes and assess their impact on business processes, policies, risks, and controls are key to moving from the manual state to automated. This includes a centralized framework that aggregates regulatory content from multiple trusted sources, including both subscription and publicly available data sources.

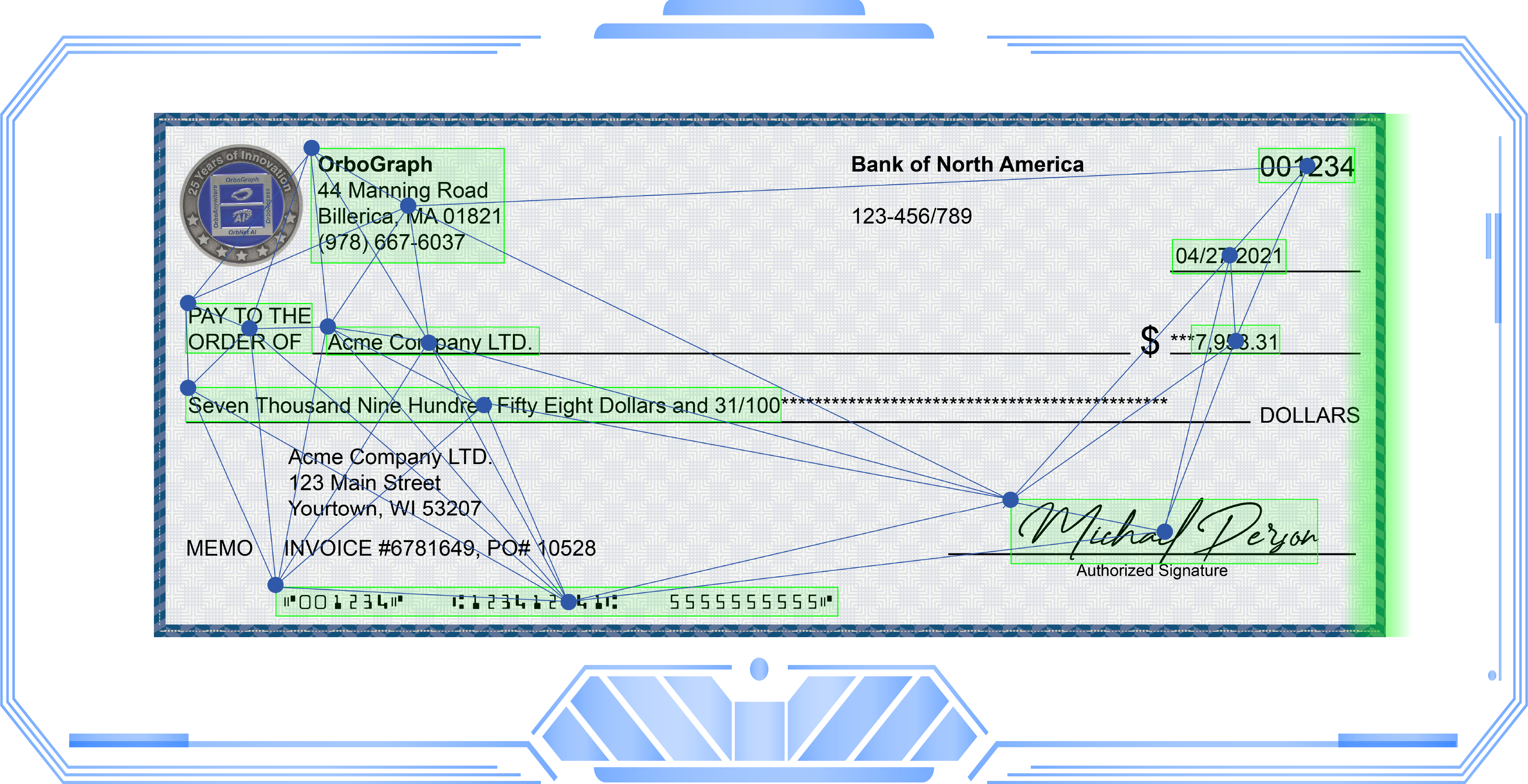

Banks have already deployed artificial intelligence with remarkable success -- from digital assistants to check recognition and check fraud detection. These technologies are also being utilized for compliance by extracting data from all the fields of checks and using the data for AML/BSA/OFAC/KYC. It only makes sense to concentrate on these technologies to further assist banks in improving and smoothing their compliance and BSA departments.

Keep the Human Factor Engaged

Deploying AI and automation doesn't mean "forget the flesh-and-blood talent":

It’s also important to strike the right balance between the roles of employees and the use of technology. People are primarily needed for the “smart decisions” – the choices that require judgement. On the other hand, smart tools, whether AI or advanced software, are better suited to handle more remedial, repetitive tasks.

This particularly topic draws comparisons to healthcare revenue cycle management, where employees feared that technology would replace them. This is certainly NOT the case as artificial intelligence and machine learning technologies should be seen as enhancing employee's abilities -- perhaps giving them superpowers! If human analysts can spend their time developing the best strategy to resolve issues -- rather than just doing mechanistic tasks better accomplished by AI-powered tools -- the mix of automation and personnel can be best perfected.

The "Front Line"

Also crucial to staying current and compliant is to ensure that the day-to-day "flesh and blood" talent is up to speed on what to look for and how to report it.

In essence, frontline workers are the eyes and ears of an organization. They are the first to deal with others outside the business, and they are the first to interact with internal co-workers and contractors. This unique position enables frontline workers to be an ideal source of intelligence.

As mentioned earlier, banks should be checking the Federal Register regularly, and it is upon the compliance and BSA departments to update policies and procedures, while also providing educational training for their front line employees to minimize risk. Remember, it takes many persons and departments to maintain compliance with regulations, but it only takes one mistake to cause major harm and fines to a bank.