Fraud Detection

There is no question that fraud is on the rise -- everything from identity theft, COVID Scams, stolen stimulus checks, to even healthcare fraud! Everywhere you look, there is the threat of fraud. Fortunately, we are enjoying a technology renaissance, more equipped than ever to fight fraud.

Artificial Intelligence and deep learning technologies are paving the way to fight the fraudsters and protect your customers -- enabling banks and financial institutions to detect fraudulent attacks and activities before their customers funds are accessed.

With customer expectations at their highest levels, it’s those banks and financial institutions that quickly adopt new technologies that will reap the benefits.

OrboZone Fraud Immersive Video Experience

Experience two versions of the Fraud Detection video, each with its own genre soundtrack. Vote below for the one gets you the most hyped to fight fraud!

Fraud Detection Experience - Version 1

Soundtrack Genre: Instrumental

Fraud Detection Experience - Version 2

Soundtrack Genre: Dubstep

Fraud Detection Experience

AI and Deep Learning -- Powered Fraud Detection in Payments

AI and deep learning technologies are at the forefront of fighting fraud. An article in Forbes.com provides insight:

What’s needed to thwart fraud and stop the exfiltration of valuable transaction data are AI and machine learning platforms capable of combining supervised and unsupervised machine learning that can deliver a weighted score for any digital business’ activity in less than a second. AI is a perfect match for the rapid escalation of nuanced, highly sophisticated fraud attempts. Fraud prevention systems can examine years and in some cases, decades of transaction data in a 250-millisecond response rate to calculate risk scores using AI.

As explained above, one of the most prominent use cases for AI and deep learning for payments fraud is analyzing the past behavior of accounts, training deep learning models with thousands to millions of transactional history. When a new transaction occurs, the technology can analyze this transaction in milliseconds to past transactions to spot suspicious activities. With each new transaction, the artificial intelligence continues to learn. Check out how Visa is leverage AI to fight fraud:

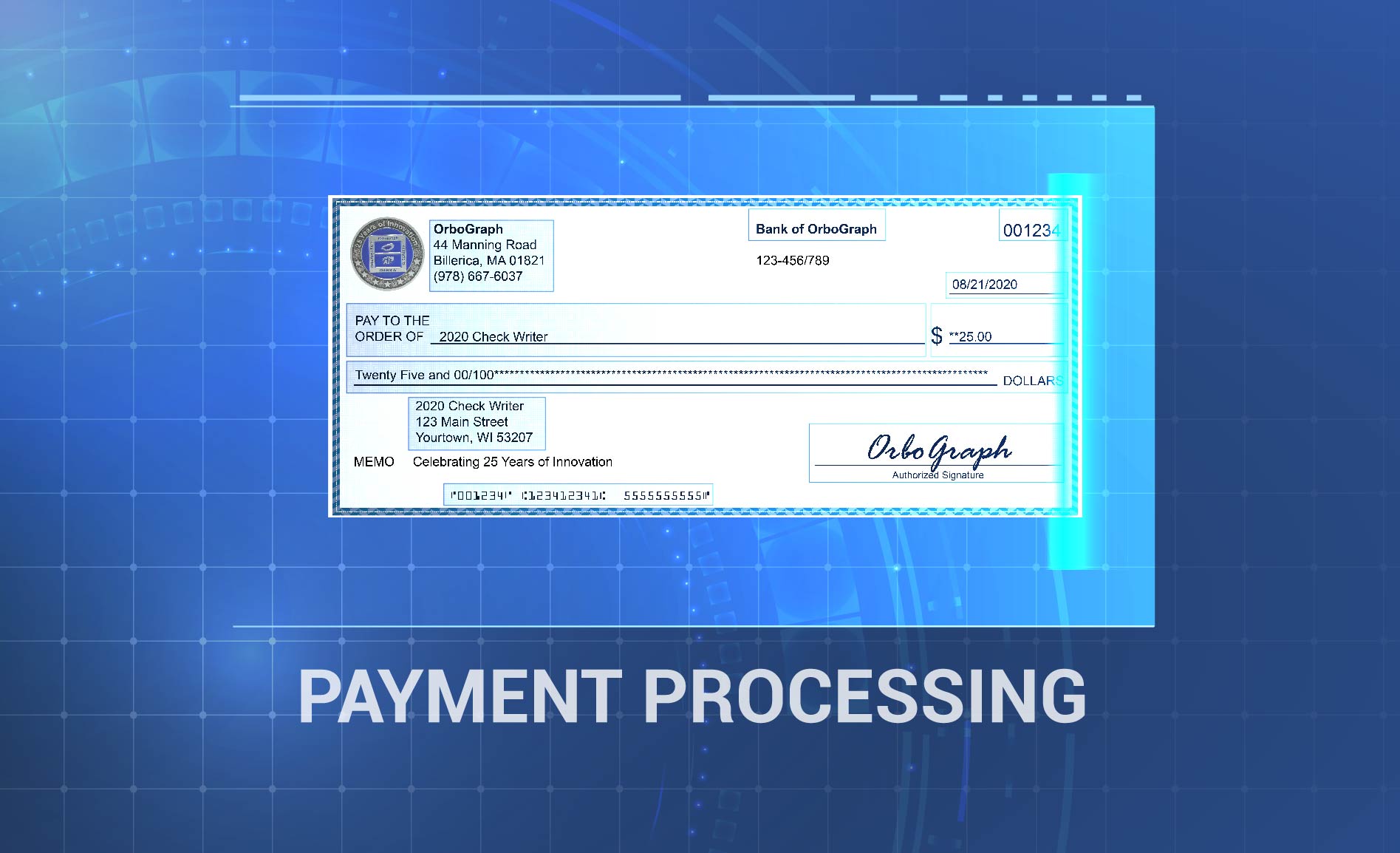

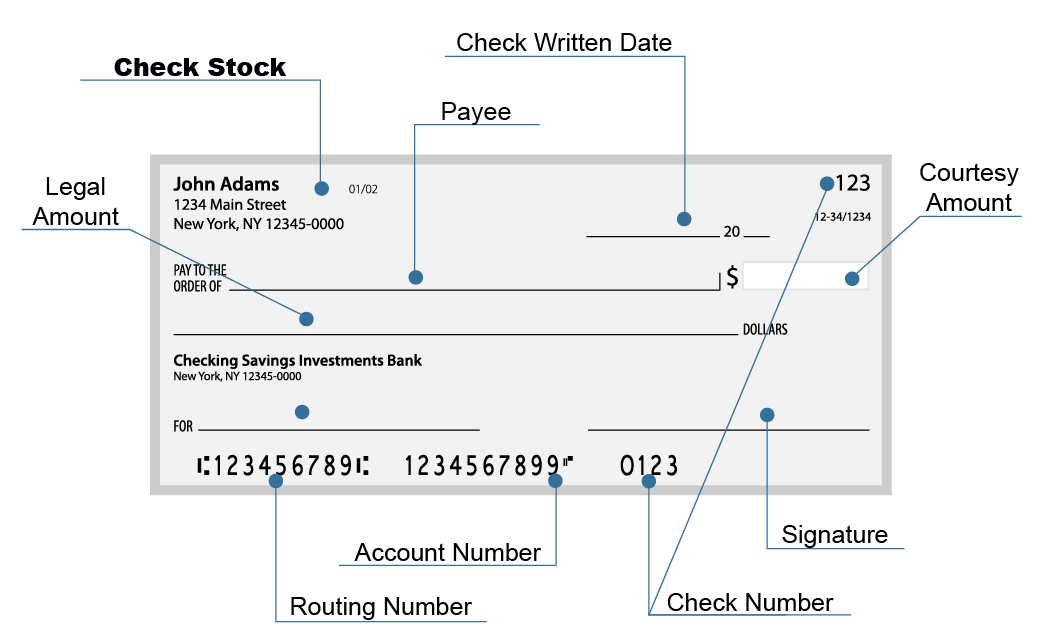

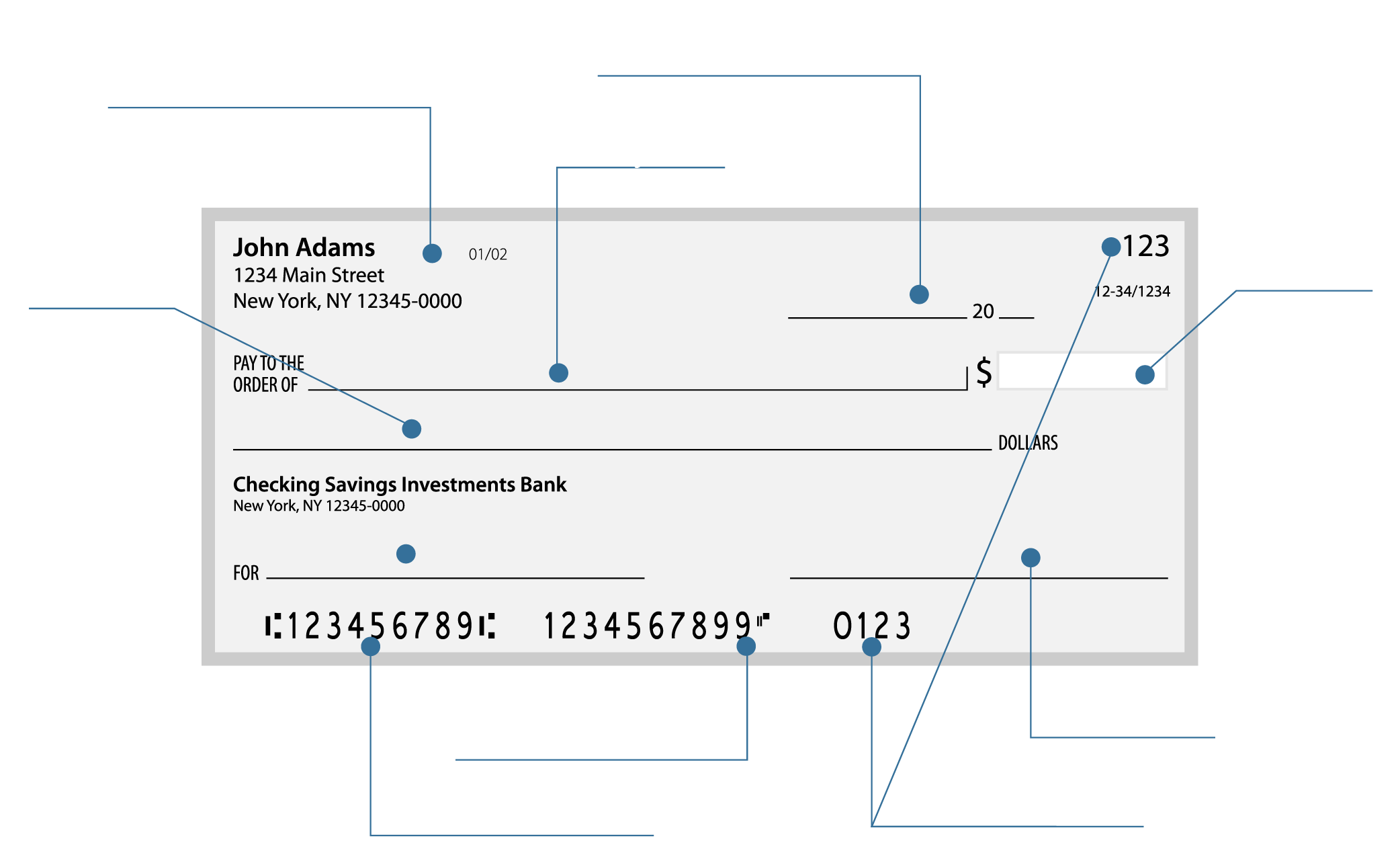

Forensic AI Fraud Detection for Check

It is no secret to the payments industry that check fraud continues to be an issue. Fraudsters will continue to look for vulnerabilities in any payment channel and exploit them for their benefits (check out Modernizing Fraud with AI for news and trends). For banks and financial institutions, new forensic AI is the key to combatting the fraudsters. But what is forensic AI?

Image analysis and recognition technologies are now utilizing AI for check processing -- resulting in 99% recognition rates that eliminates the need for human interaction. This technology has advanced capabilities to not only read, recognize, and extract data from checks, but also allows for enhanced fraud capabilities.

Forensic AI in Action

Let's take a look at the check to the left displaying fields that are typically recognized on a check. Forensic AI will analyze these fields to detect anomalous attributes, providing a risk score to fraud analysts.

Attributes analyzed by Forensic AI include:

- Validating that the Check Stock is consistent with previous transactions

- Identifying alterations to the CAR/LAR fields

- Verifying a signature match to previous checks

And so much more! As the AI technology continues to learn from new transactions, combined with the advancements to the technology, the losses from check fraud will significantly decrease, providing the customers with an unparalleled experience.

Photo Gallery: Fraud Detection

Fraud Detection is represented graphically in many fascinating ways -- check some of them out in our visual gallery! (Hover over the image for description)

The customer experience is enhanced when investing in fraud technologies.

Image analysis with Artificial Intelligence and detect fraud on virtually all fields of the check.

Technology is the key to stopping fraud.

Hackers will stop at nothing to gain access to your customer's accounts and funds.

Word cloud depicting myriad of terms surrounding fraud.

Stimulus checks are the latest avenue for fraudsters.

AI Forensic Fraud is the latest technology for signature verification.

Platform Modernization with new fraud technologies.

AI Forensic Fraud analyzes characteristics of the document.

Securing customer data is key to stopping the fraudsters.

Find the right technologies to fight fraudsters and protect your customers.